Kodak 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

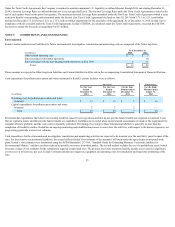

Based upon the results of Kodak’s October 1, 2015 analysis, Kodak concluded that the carrying value of the Intellectual Property Solutions reporting unit exceeded

its implied fair value and recorded a pre-tax impairment charge of $2 million in the fourth quarter of 2015 that is included in Other operating expense (income), net

in the Consolidated Statement of Operations representing the entire amount of goodwill for this reporting unit. No impairment of goodwill was indicated for any

other reporting units as of October 1 or December 31 valuation dates .

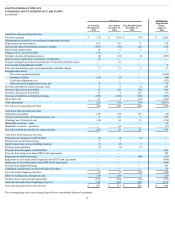

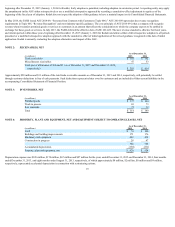

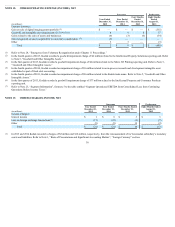

The gross carrying amount and accumulated amortization by major intangible asset category as of December 31, 2015 and 2014 were as follows:

As of December 31, 2015

(in millions)

Gross Carrying

Amount

Accumulated

Amortization Net

Weighted-Average

Amortization Period

Technology-based $ 131 $ 47 $ 84 6 years

Kodak trade name 46 — 46 Indefinite life

Customer-related 37 11 26 7 years

Other 2 — 2 20 years

Total $ 216 $ 58 $158

As of December 31, 2014

(in millions)

Gross Carrying

Amount

Accumulated

Amortization Net

Weighted-Average

Amortization Period

Technology-based $ 131 $ 27 $104 7 years

Kodak trade name 46 — 46 Indefinite life

Customer-related 36 6 30 8 years

Other 2 — 2 21 years

Total $ 215 $ 33 $182

Based upon the results of Kodak’s October 1, 2015 and December 31, 2015 impairment tests, no impairment of the Kodak trade name was indicated. In the fourth

quarter of 2013, Kodak concluded that the carrying value of the Kodak trade name, estimated as part of fresh start accounting, exceeded its fair value and Kodak

recorded a pre-tax impairment charge of $8 million that is included in Other operating expense (income), net in the Consolidated Statement of Operations.

Amortization expense related to intangible assets was $25 million, $25 million, $8 million and $10 million for the years ended December 31, 2015 and

December 31, 2014, four months ended December 31, 2013, and eight months ended August 31, 2013, respectively.

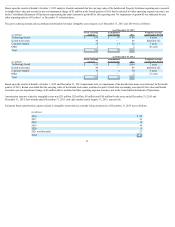

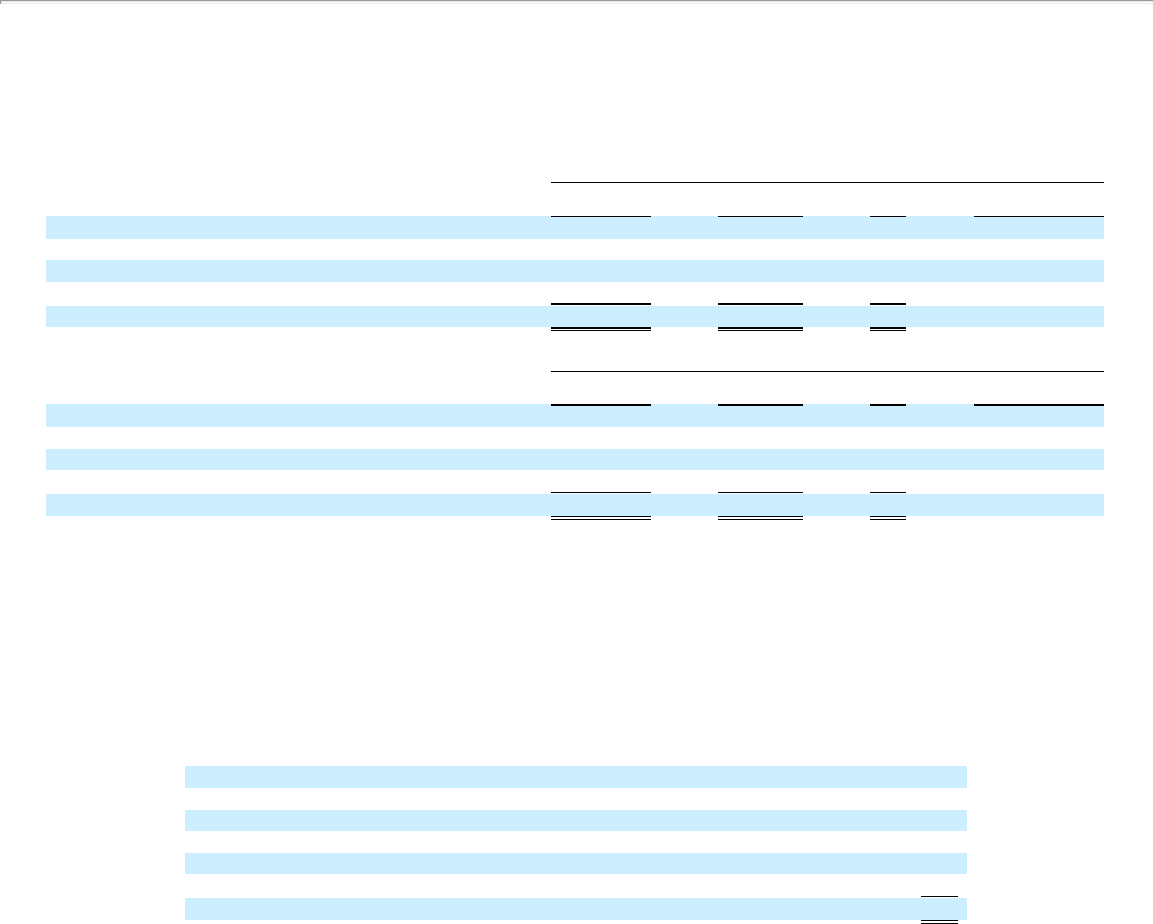

Estimated future amortization expense related to intangible assets that are currently being amortized as of December 31, 2015 was as follows:

(in millions)

2016 $ 25

2017 23

2018 18

2019 10

2020 9

2021 and thereafter 27

Total $112

21