Kodak 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

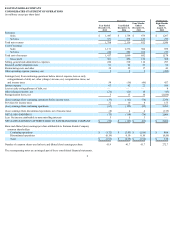

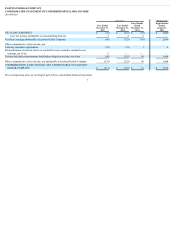

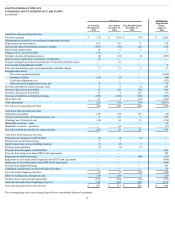

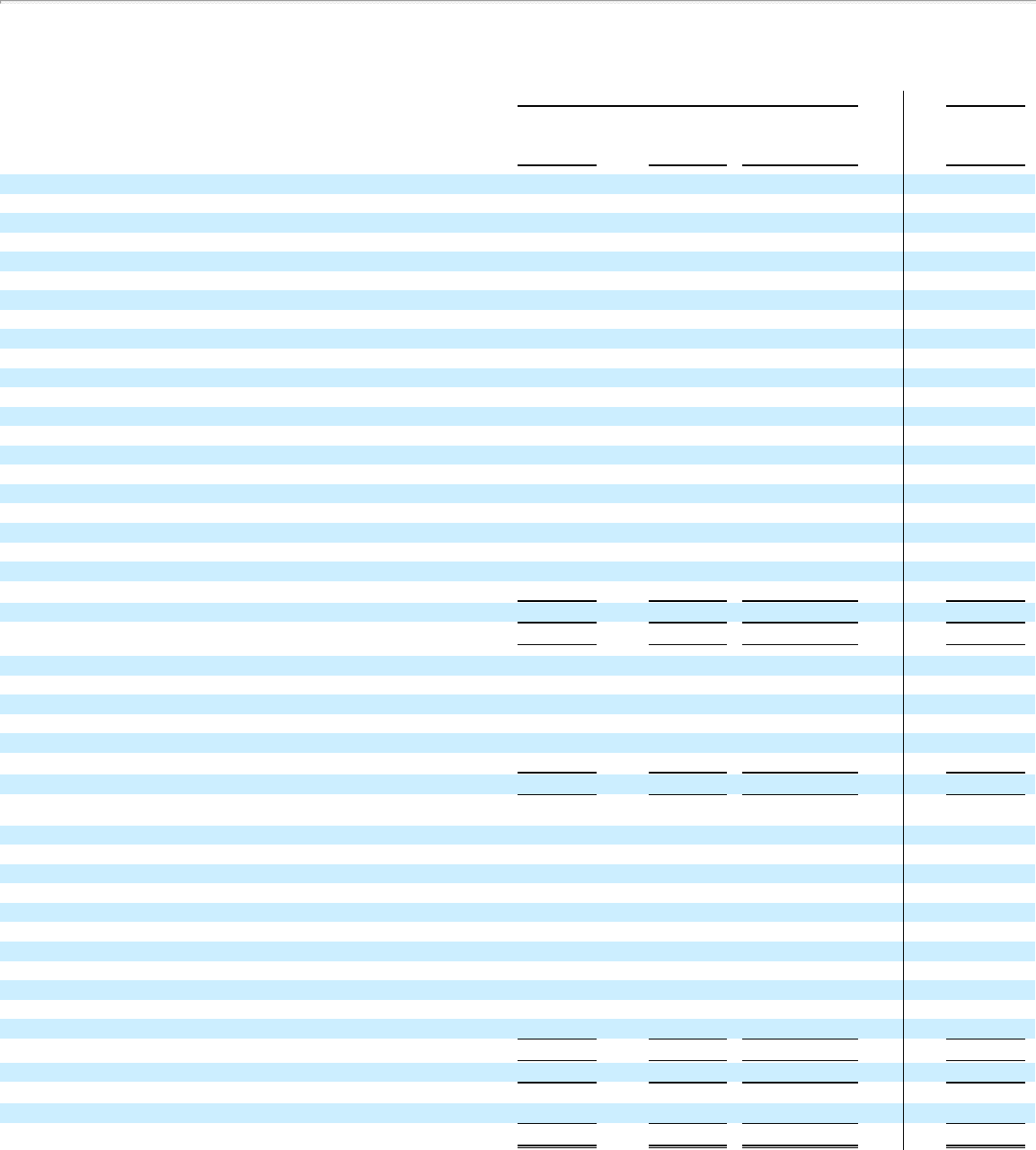

EASTMAN KODAK COMPANY

CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions)

Successor Predecessor

Year Ended

December 31,

2015

Year Ended

December 31,

2014

Four Months Ended

December 31,

2013

Eight Months

Ended

August 31,

2013

Cash flows from operating activities:

Net (loss) earnings $ (75) $ (118) $ (78) $ 2,066

Adjustments to reconcile to net cash used in operating activities:

Depreciation and amortization 145 199 75 118

Pension and other postretirement (income) expense (107) (78) (61) 145

Stock based compensation 18 8 1 3

Change in U.S. vacation benefits (17) — — —

Net gains on sales of businesses/assets (4) (23) (6) (407)

Gain on assets acquired for no monetary consideration (3) — — —

Foreign exchange loss from remeasurement of Venezuela monetary assets — 16 — —

Loss on early extinguishment of debt — — — 8

Non-cash restructuring costs, asset impairments and other charges 9 13 9 81

Reorganization items:

Non-cash reorganization gain — — — (1,964)

Payment of claims (10) (2) — (94)

Fresh start adjustments, net — — — (302)

Other non-cash reorganization items, net 4 8 3 119

Provision (benefit) for deferred income taxes 6 5 (2) 448

Decrease (increase) in receivables 15 143 (72) 105

Decrease (increase) in inventories 12 4 147 (27)

Decrease in liabilities excluding borrowings (109) (307) (105) (595)

Other items, net 21 4 (13) (269)

Total adjustments (20) (10) (24) (2,631)

Net cash used in operating activities (95) (128) (102) (565)

Cash flows from investing activities:

Additions to properties (43) (43) (21) (18)

Net proceeds from sales of businesses/assets , net 2 18 9 827

(Funding) use of restricted cash (10) 68 93 (134)

Marketable securities – sales — — — 21

Marketable securities – purchases — (2) — (17)

Net cash (used in) provided by investing activities (51) 41 81 679

Cash flows from financing activities:

Repayment of emergence credit facilities (4) (4) (2) —

Net proceeds of other borrowings 5 1 — —

Equity transactions of noncontrolling interests (1) (3) 7 —

Treasury stock purchases (1) (1) (3) —

Proceeds from Emergence credit facilities — — — 664

Proceeds from Senior and Junior DIP Credit Agreements — — — 450

Repayment of other borrowings — (40) (375)

Repayment of term loans under Original Senior DIP Credit Agreement — — — (664)

Repayment of term loans under Junior DIP Credit Agreement — — — (844)

Proceeds from Rights Offerings — — — 406

Contingent consideration received with sale of business — — — 35

Net cash used in financing activities (1) (7) (38) (328)

Effect of exchange rate changes on cash (18) (38) 5 (23)

Net decrease in cash and cash equivalents (165) (132) (54) (237)

Cash and cash equivalents, beginning of period 712 844 898 1,135

Cash and cash equivalents, end of period $ 547 $ 712 $ 844 $ 898

The accompanying notes are an integral part of these consolidated financial statements.

11