Kodak 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

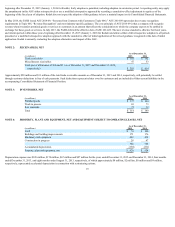

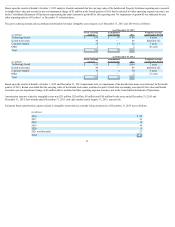

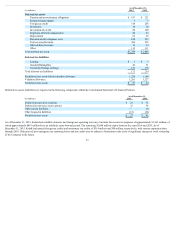

NOTE 8: SHORT-TERM BORROWINGS AND LONG-TERM DEBT

Debt and related maturities and interest rates were as follows at December 31, 2015 and 2014:

As of December 31,

(in millions) 2015 2014

Type Maturity

Weighted-Average

Effective Interest Rate Carrying Value Carrying Value

Current portion:

Term note 2016 7.56% $ 4 $ 4

Credit line 2015 2.42% — 1

Other 2016 3.12% - 6.07% 1 —

5 5

Non-current portion:

Term note 2019 7.56% 400 403

Term note 2020 11.04% 270 269

Other Various 3.12% - 6.07% 5 —

675 672

$ 680 $ 677

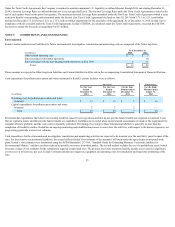

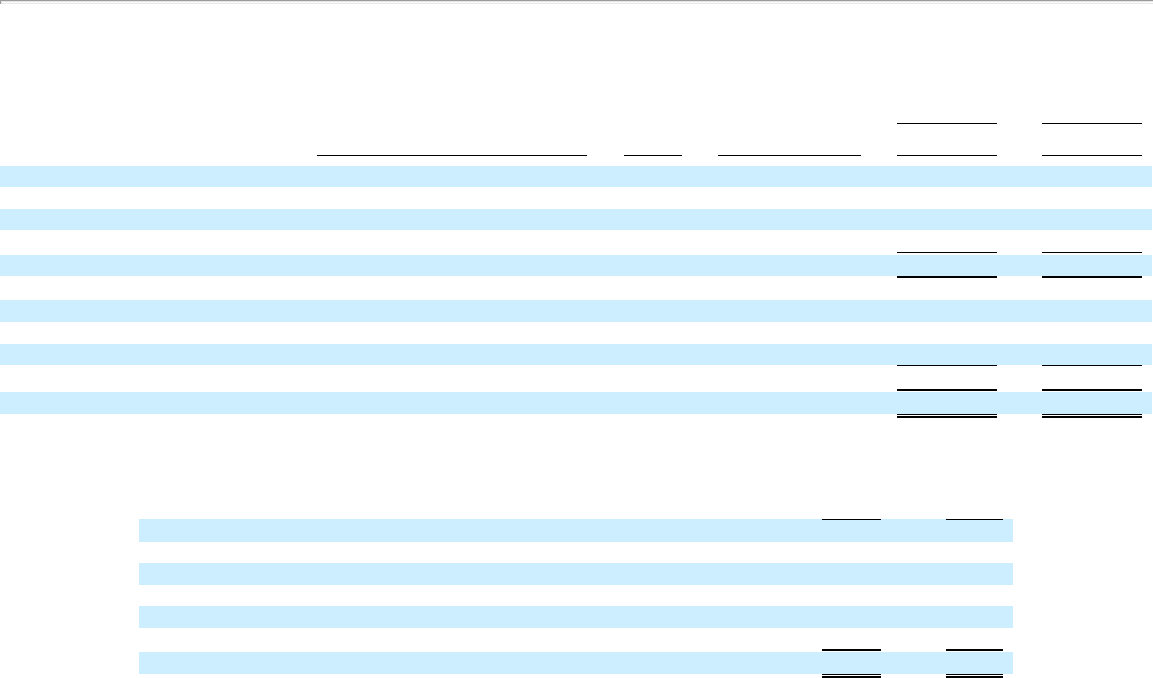

Annual maturities of debt outstanding at December 31, 2015, were as follows:

(in millions)

Carrying

Value

Maturity

Value

2016 $ 5 $ 5

2017 4 4

2018 5 5

2019 392 397

2020 271 276

2021 and thereafter 3 3

Total $ 680 $ 690

On September 3, 2013, the Company entered into (i) a Senior Secured First Lien Term Credit Agreement (the “First Lien Term Credit Agreement”) with the

lenders party thereto (the “First Lien Lenders”), JPMorgan Chase Bank, N.A. as administrative agent, and J.P. Morgan Securities LLC, Barclays Bank PLC, and

Merrill Lynch, Pierce, Fenner & Smith Inc. as joint lead arrangers and joint bookrunners, and (ii) a Senior Secured Second Lien Term Credit Agreement (the

“Second Lien Term Credit Agreement,” and together with the First Lien Term Credit Agreement, the “Term Credit Agreements”), with the lenders party thereto

(the “Second Lien Lenders,” and together with the First Lien Lenders, the “Term Credit Lenders”), Barclays Bank PLC as administrative agent, and J.P. Morgan

Securities LLC, Barclays Bank PLC and Merrill Lynch, Pierce, Fenner & Smith Inc. as joint lead arrangers and joint bookrunners. Additionally, the Company and

its U.S. subsidiaries (the “Subsidiary Guarantors”) entered into an Asset Based Revolving Credit Agreement (the “ABL Credit Agreement” and together with the

Term Credit Agreements, the “Credit Agreements”) with the lenders party thereto (the “ABL Lenders” and together with the First Lien Lenders and the Second

Lien Lenders, the “Lenders”) and Bank of America N.A. as administrative agent and collateral agent, Barclays Bank PLC as syndication agent and Merrill Lynch,

Pierce, Fenner & Smith Inc., Barclays Bank PLC and J.P. Morgan Securities LLC as joint lead arrangers and joint bookrunners. Pursuant to the terms of the Credit

Agreements, the Term Credit Lenders provided the Company with term loan facilities in an aggregate principal amount of $695 million, consisting of $420 million

of first-lien term loans (the “First Lien Loans”) and $275 million of second-lien term loans (the “Second Lien Loans”). Net proceeds from the Term Credit

Agreements were $664 million ($695 million aggregate principal less $15 million stated discount and $16 million in debt transaction costs). The ABL Lenders will

make available asset-based revolving loans in an amount of up to $200 million (the “ABL Loans”). The maturity date of the loans made under the Term Credit

Agreements is the earlier to occur of (i) September 3, 2019 (in case of First Lien Loans) or September 3, 2020 (in case of Second Lien Loans) and (ii) the

acceleration of such loans due to an event of default (as defined in the Term Credit Agreements). The maturity date of the loans made under the ABL Credit

Agreement is the earlier to occur of (i) September 3, 2018 and (ii) the date of termination of the commitments in accordance with the terms of the ABL Credit

Agreement. The ABL Credit Agreement also provides for the issuance of letters of credit of up to a sublimit of $150 million. The Company has issued

approximately $118 million of letters of credit under the ABL Credit Agreement as of December 31,

23