Kodak 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

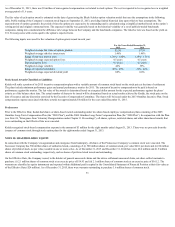

To estimate fair value utilizing the guideline public company method, Kodak applied valuation multiples, derived from the operating data of publicly-traded

benchmark companies, to the same operating data of Kodak. The comparable public company analysis identified a group of comparable companies giving

consideration to lines of business and markets served, size and geography. The valuation multiples were derived based on projected financial measures of revenue

and earnings before interest, taxes, depreciation and amortization (“EBITDA”) and applied to projected operating data of Kodak. The range of multiples for the

comparable companies was between .2x-.9x of revenue and 2.5x-8.0x of EBITDA.

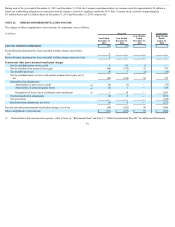

To estimate fair value utilizing the discounted cash flow method, Kodak established an estimate of future cash flows for the period ranging from September 1, 2013

to December 31, 2022 and discounted the estimated future cash flows to present value. The expected cash flows for the period September 1, 2013 to December 31,

2017 were based on the financial projections and assumptions utilized in the disclosure statement. The expected cash flows for the period January 1, 2018 to

December 31, 2022 were derived from earnings forecasts and assumptions regarding growth and margin projections, as applicable. A terminal value was included,

calculated using the constant growth method, based on the cash flows of the final year of the forecast period.

The discount rate of 29% was estimated based on an after-tax weighted average cost of capital (“WACC”) reflecting the rate of return that would be expected by a

market participant. The WACC also takes into consideration a company specific risk premium reflecting the risk associated with the overall uncertainty of the

financial projections used to estimate future cash flows.

As the valuation approaches produced comparable ranges of enterprise value, Kodak selected equal weighting of the guideline public company method and

discounted cash flow method to estimate the enterprise value.

63