Kodak 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

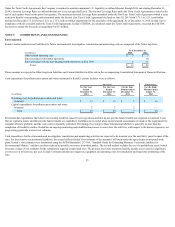

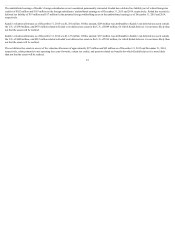

During 2013, a substantial portion of the Company’s pre-petition debt securities, revolving credit facility and other obligations were extinguished. Absent an

exception, a debtor recognizes cancellation of indebtedness income (“CODI”) upon discharge of its outstanding indebtedness for an amount of consideration that is

less than its adjusted issue price. The Internal Revenue Code of 1986, as amended (“IRC”), provides that a debtor in a bankruptcy case may exclude CODI from

taxable income but must reduce certain of its tax attributes by the amount of any CODI realized as a result of the consummation of a plan of reorganization. The

amount of CODI realized by a taxpayer is the adjusted issue price of any indebtedness discharged less the sum of (i) the amount of cash paid, (ii) the issue price of

any new indebtedness issued and (iii) the fair market value of any other consideration, including equity, issued. As a result of the market value of equity upon

emergence from chapter 11 bankruptcy proceedings, the estimated amount of U.S. CODI was approximately $705 million, which reduced the value of Kodak’s

U.S. net operating losses that had a value of $2,495 million. The actual reduction in tax attributes occurred on the first day of the Company’s tax year subsequent to

the date of emergence, or January 1, 2014.

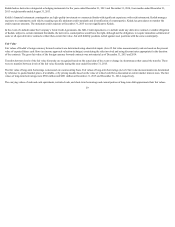

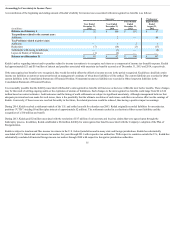

IRC Sections 382 and 383 provide an annual limitation with respect to the ability of a corporation to utilize its tax attributes, as well as certain built-in-losses,

against future U.S. taxable income in the event of a change in ownership. The Debtors’ emergence from chapter 11 bankruptcy proceedings was considered a

change in ownership for purposes of IRC Section 382. The limitation under the IRC is based on the value of the corporation as of the emergence date. However, the

ownership changes and resulting annual limitation will result in the expiration of approximately $711 million of net operating losses, $567 million of foreign tax

credits and $21 million of research and expenditure credits generated prior to the emergence date. The expiration of these tax attributes was fully offset by a

corresponding decrease in Kodak’s U.S. valuation allowance, which results in no net tax provision.

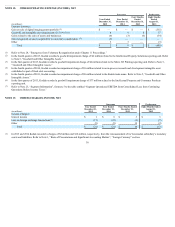

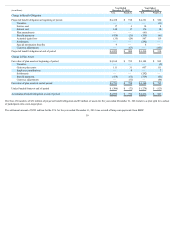

During 2013, the KPP Global Settlement provided for the acquisition by the KPP of certain assets, and the assumption by the KPP of certain liabilities of Kodak’s

Personalized Imaging and Document Imaging businesses (the “Business”). The underfunded position of the U.K. Pension Plan was approximately $1.5 billion.

Kodak Limited held a deferred tax asset related to the pension liability of $329 million. As a result of the KPP Global Settlement in the period ended December 31,

2013 and the release from the pension liability to the KPP, Kodak Limited reversed the corresponding deferred tax asset.

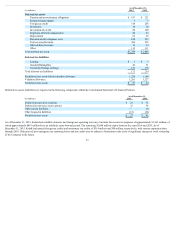

During the eight months ended August 31, 2013, Kodak determined that it was more likely than not that a portion of its deferred tax assets outside the U.S. would

not be realized due to changes in the business resulting from the KPP Global Settlement and the related sale of the Business. As a result, Kodak recorded a tax

provision of $100 million associated with the establishment of a valuation allowance on those deferred tax assets.

Additionally, during the eight months ended August 31, 2013, Kodak determined that it was more likely than not that a portion of the deferred tax assets outside the

U.S. would not be realized due to the change in Kodak’s business as a result of restructuring associated with the emergence from bankruptcy and accordingly,

recorded a tax provision of $46 million associated with the establishment of a valuation allowance on those deferred tax assets.

32