Kodak 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

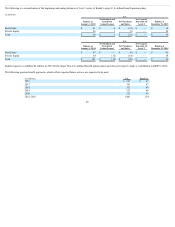

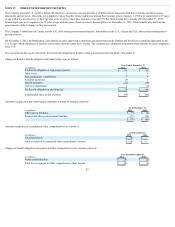

During each of the years ended December 31, 2015 and December 31, 2014, the Company repurchased shares of common stock for approximately $1 million to

satisfy tax withholding obligations in connection with the issuance of stock to employees under the 2013 Plan. Treasury stock consisted of approximately

0.3 million shares and 0.2 million shares at December 31, 2015 and December 31, 2014, respectively.

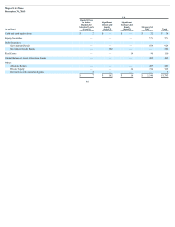

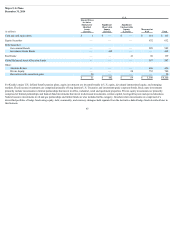

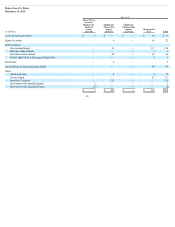

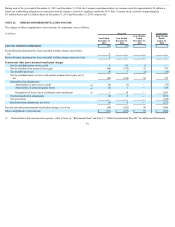

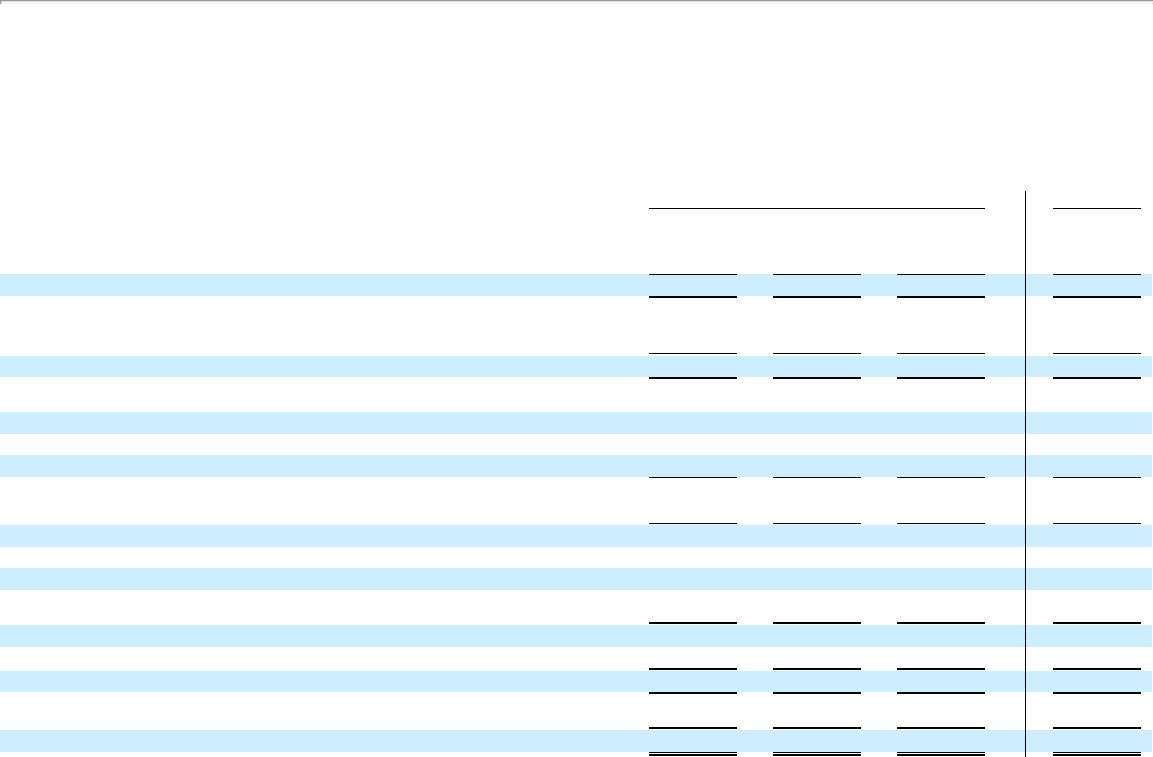

NOTE 21: OTHER COMPREHENSIVE (LOSS) INCOME

The changes in Other comprehensive (loss) income, by component, were as follows:

(in millions) Successor Predecessor

Year Ended

December 31,

2015

Year Ended

December 31,

2014

Four Months

Ended

December 31,

2013

Eight Months

Ended

August 31,

2013

Currency translation adjustments $ (35) $ (33) $ 1 $ 4

Reclassification adjustment for losses included in Other charges (net), before

tax 2 — — —

Reclassification adjustment for losses included in Other charges (net), net of tax 2 — — —

Pension and other postretirement benefit plan changes

Newly established prior service credit 4 61 6 —

Newly established net actuarial (loss) gain (88) (278) 95 393

Tax (benefit) provision (5) 7 (3) (14)

Newly established prior service credit and net actuarial (loss) gain, net of

tax (89) (210) 98 379

Reclassification adjustments:

Amortization of prior service credit (a) (8) (3) — (75)

Amortization of actuarial (gains) losses (a) (2) 1 — 185

Recognition of losses due to settlements and curtailments (a) 1 10 — 1,563

Total reclassification adjustments (9) 8 — 1,673

Tax (provision) — — — (448)

Reclassification adjustments, net of tax (9) 8 — 1,225

Pension and other postretirement benefit plan changes, net of tax (98) (202) 98 1,604

Other comprehensive (loss) income $ (131) $ (235) $ 99 $ 1,608

(a) Reclassified to Pension (income) expense - refer to Note 16, “Retirement Plans” and Note 17, “Other Postretirement Benefits” for additional information.

54