Kodak 2015 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company provided an indemnity as part of the 1994 sale of Sterling Corporation (now “STWB”), which covered a number of environmental sites including the

Lower Passaic River Study Area (“LPRSA”) portion of the Diamond Alkali Superfund Site. STWB, now owned by Bayer Corporation, is a potentially responsible

party at the LPRSA site based on alleged releases from facilities formerly owned by subsidiaries of Sterling. On February 29, 2012, the Company notified STWB

and Bayer that, under the voluntary petition for bankruptcy by the Company and its U.S. subsidiaries, it elected to discontinue funding and participation in remedial

investigations of the LPRSA. STWB and its parent, Bayer, filed proofs of claim against the Company and its U.S. subsidiaries. These claims have been discharged

pursuant to the First Amended Joint Chapter 11 Plan of Reorganization. Environmental matters at three sites owned by the Company and one site for which the

Company was not the owner but was responsible for the remediation were not resolved by the discharge. On March 17, 2015, the Company entered into an

agreement with STWB related to these four sites. The agreement calls for the Company to retain ownership and environmental responsibility of one of the sites.

Ownership and environmental responsibility for one site and environmental responsibility for the unowned site transferred to STWB in the second quarter of 2015.

Ownership of the remaining site is expected to pass to an unrelated party by 2018 at which point the Company’s environmental responsibility will pass to STWB. If

the ownership for the fourth site does not transfer to that unrelated party prior to January 1, 2020, the Company and STWB will share approximately equally in the

ongoing costs of the site. As a result of this agreement, the Company reduced its environmental liabilities by approximately $5 million and recognized a gain in the

first quarter of 2015 of the same amount.

On January 14, 2015, the Company sold its property in Middleway, West Virginia and transferred the related environmental liability to Commercial Liability

Partners WV, LLC (CLP). As part of the transaction, the Company withdrew from its Voluntary Remediation Agreement with the West Virginia Department of

Environmental Protection, received an indemnity from CLP regarding any environmental obligations, and was named insured in an environmental insurance policy

for a period of ten years in the case of breach by CLP. As of December 31, 2014, the $2 million net book value of the Middleway property was classified in Current

assets held for sale and the environmental liability of approximately $9 million was classified as Current liabilities held for sale. The Company released the

environmental liability associated with the site and recognized a gain of approximately $5 million on the transaction in 2015.

Estimates of the amount and timing of future costs of environmental remediation requirements are by their nature imprecise because of the continuing evolution of

environmental laws and regulatory requirements, the availability and application of technology, the identification of presently unknown remediation sites and the

allocation of costs among the potentially responsible parties. Based on information presently available, Kodak does not believe it is reasonably possible that losses

for known exposures could exceed current accruals by material amounts, although costs could be material to a particular quarter or year.

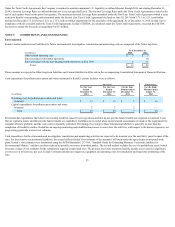

Asset Retirement Obligations

Kodak’s asset retirement obligations primarily relate to asbestos contained in buildings that Kodak owns. In many of the countries in which Kodak operates,

environmental regulations exist that require Kodak to handle and dispose of asbestos in a special manner if a building undergoes major renovations or is

demolished. Otherwise, Kodak is not required to remove the asbestos from its buildings. Kodak records a liability equal to the estimated fair value of its obligation

to perform asset retirement activities related to the asbestos, computed using an expected present value technique, when sufficient information exists to calculate

the fair value. Kodak does not have a liability recorded related to every building that contains asbestos because Kodak cannot estimate the fair value of its

obligation for certain buildings due to a lack of sufficient information about the range of time over which the obligation may be settled through demolition,

renovation or sale of the building.

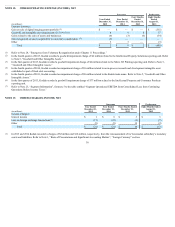

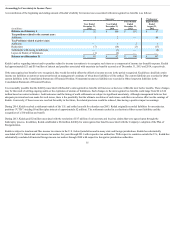

The following table provides asset retirement obligation activity:

For the Year Ended December 31,

(in millions) 2015 2014

Asset Retirement Obligations at start of period $ 53 $ 52

Liabilities incurred in the current period 1 3

Liabilities settled in the current period (3) (1)

Accretion expense 2 2

Revision in estimated cash flows (6) (2)

Foreign exchange impact — (1)

Asset Retirement Obligations at end of period $ 47 $ 53

26