Kodak 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

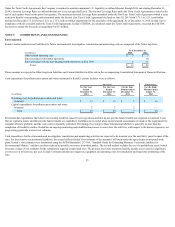

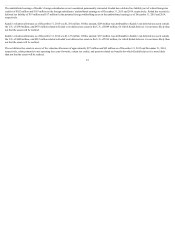

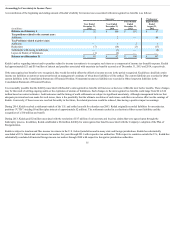

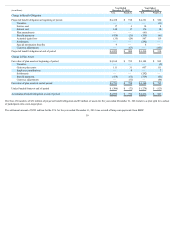

The undistributed earnings of Kodak’s foreign subsidiaries are not considered permanently reinvested. Kodak has a deferred tax liability (net of related foreign tax

credits) of $102 million and $159 million on the foreign subsidiaries’ undistributed earnings as of December 31, 2015 and 2014, respectively. Kodak has recorded a

deferred tax liability of $19 million and $17 million for the potential foreign withholding taxes on the undistributed earnings as of December 31, 2015 and 2014,

respectively.

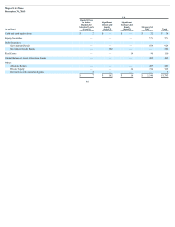

Kodak’s valuation allowance as of December 31, 2015 was $1,201 million. Of this amount, $266 million was attributable to Kodak’s net deferred tax assets outside

the U.S. of $344 million, and $935 million related to Kodak’s net deferred tax assets in the U.S. of $884 million, for which Kodak believes it is not more likely than

not that the assets will be realized.

Kodak’s valuation allowance as of December 31, 2014 was $1,127 million. Of this amount, $315 million was attributable to Kodak’s net deferred tax assets outside

the U.S. of $400 million, and $812 million related to Kodak’s net deferred tax assets in the U.S. of $769 million, for which Kodak believes it is not more likely than

not that the assets will be realized.

The net deferred tax assets in excess of the valuation allowance of approximately $27 million and $42 million as of December 31, 2015 and December 31, 2014,

respectively, relate primarily to net operating loss carry-forwards, certain tax credits, and pension related tax benefits for which Kodak believes it is more likely

than not that the assets will be realized.

34