Kodak 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

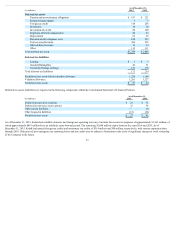

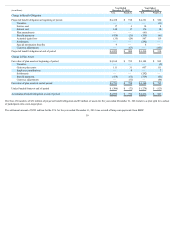

As of December 31,

(in millions) 2015 2014

Deferred tax assets

Pension and postretirement obligations $ 187 $ 221

Restructuring programs 3 5

Foreign tax credit 314 258

Inventories 14 20

Investment tax credit 80 100

Employee deferred compensation 46 43

Depreciation 62 45

Research and development costs 188 232

Tax loss carryforwards 380 355

Other deferred revenue 13 13

Other 112 111

Total deferred tax assets $ 1,399 $ 1,403

Deferred tax liabilities

Leasing $ 1 $ 7

Goodwill/Intangibles 49 51

Unremitted foreign earnings 121 176

Total deferred tax liabilities 171 234

Net deferred tax assets before valuation allowance 1,228 1,169

Valuation allowance 1,201 1,127

Net deferred tax assets $ 27 $ 42

Deferred tax assets (liabilities) are reported in the following components within the Consolidated Statement of Financial Position:

As of December 31,

(in millions) 2015 2014

Deferred income taxes (current) $ 22 $ 31

Deferred income taxes (non-current) 23 38

Other current liabilities — (1)

Other long-term liabilities (18) (26)

Net deferred tax assets $ 27 $ 42

As of December 31, 2015, Kodak had available domestic and foreign net operating loss carry-forwards for income tax purposes of approximately $1,565 million, of

which approximately $481 million have an indefinite carry-forward period. The remaining $1,084 million expire between the years 2016 and 2035. As of

December 31, 2015, Kodak had unused foreign tax credits and investment tax credits of $314 million and $80 million, respectively, with various expiration dates

through 2030. Utilization of post-emergence net operating losses and tax credits may be subject to limitations in the event of significant changes in stock ownership

of the Company in the future.

33