Kodak 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

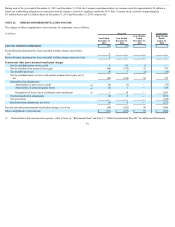

NOTE 17: OTHER POSTRETIREMENT BENEFITS

The Company provided U.S. medical, dental, life insurance, and survivor income benefits to eligible retirees, long-term disability recipients and their spouses,

dependents and survivors. Generally, to be eligible for these benefits, former employees leaving the Company prior to January 1, 1996 were required to be 55 years

of age with ten years of service or their age plus years of service must have equaled or exceeded 75. For those leaving the Company after December 31, 1995,

former employees were required to be 55 years of age with ten years of service or have been eligible as of December 31, 1995. These benefits are paid from the

general assets of the Company as they are incurred.

The Company’s subsidiaries in Canada and the U.K. offer similar postretirement benefits. Information on the U.S., Canada and U.K. other postretirement plans is

presented below.

On November 7, 2012, the Bankruptcy Court entered an order approving a settlement agreement between the Debtors and the Retiree Committee appointed by the

U.S. Trustee which eliminated or reduced certain retiree benefits under the U.S. plan. The Company also eliminated all postretirement benefits for active employees

in the U.S.

The measurement date used to determine the net benefit obligation for Kodak’s other postretirement benefit plans is December 31.

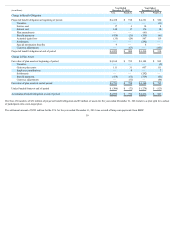

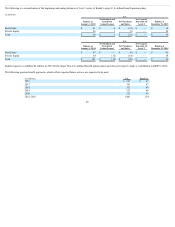

Changes in Kodak’s benefit obligation and funded status were as follows:

Year Ended December 31,

(in millions) 2015 2014

Net benefit obligation at beginning of period $ 86 $ 95

Interest cost 3 4

Plan participants’ contributions 7 9

Actuarial (gain) loss (8) 2

Benefit payments (12) (18)

Currency adjustments 2 (6)

Net benefit obligation at end of period $ 78 $ 86

Underfunded status at end of period $ (78) $ (86)

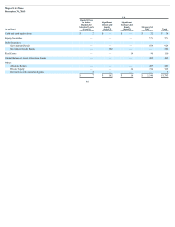

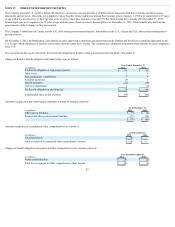

Amounts recognized in the Consolidated Statement of Financial Position consist of:

As of December 31,

(in millions) 2015 2014

Other current liabilities $ (5) $ (8)

Pension and other postretirement liabilities (73) (78)

$ (78) $ (86)

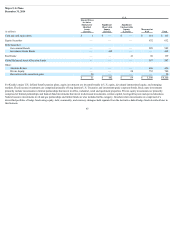

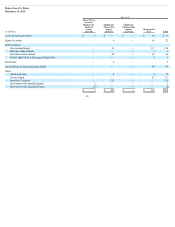

Amounts recognized in Accumulated other comprehensive loss consist of:

As of December 31,

(in millions) 2015 2014

Net actuarial gain $ (8) $ —

Total recorded in Accumulated other comprehensive income $ (8) $ —

Changes in benefit obligations recognized in Other comprehensive (loss) income consist of:

Year Ended December 31,

(in millions) 2015 2014

Newly established loss $ (8) $ (2)

Total loss recognized in Other comprehensive (loss) income $ (8) $ (2)

49