Kodak 2015 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

beginning after December 15, 2015 (January 1, 2016 for Kodak). Early adoption is permitted, including adoption in an interim period. A reporting entity may apply

the amendments in this ASU either retrospectively or use a modified retrospective approach by recording a cumulative-effect adjustment to equity as of the

beginning of the fiscal year of adoption. Kodak does not expect the adoption of this guidance to have a material impact on its Consolidated Financial Statements.

In May 2014, the FASB issued ASU 2014-09, “Revenue from Contracts with Customers (Topic 606).” ASU 2014-09 supersedes the revenue recognition

requirements in Topic 605, “Revenue Recognition” and most industry-specific guidance. The core principle of ASU 2014-09 is that a company will recognize

revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in

exchange for those goods or services. In July 2015, the FASB deferred the effective date of ASU 2014-09. The new revenue standard is effective for fiscal years,

and interim periods within those years, beginning after December 15, 2017 (January 1, 2018 for Kodak) and allows either a full retrospective adoption to all periods

presented or a modified retrospective adoption approach with the cumulative effect of initial application of the revised guidance recognized at the date of initial

application. Kodak is currently evaluating the adoption alternatives and impact of this ASU.

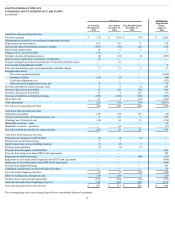

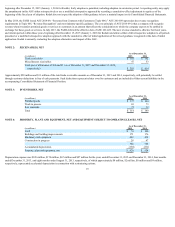

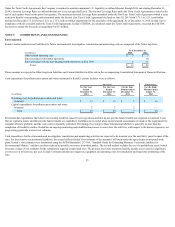

NOTE 2: RECEIVABLES, NET

As of December 31,

(in millions) 2015 2014

Trade receivables $ 318 $ 361

Miscellaneous receivables 47 53

Total (net of allowances of $10 and $11 as of December 31, 2015 and December 31, 2014,

respectively) $ 365 $ 414

Approximately $28 million and $31 million of the total trade receivable amounts as of December 31, 2015 and 2014, respectively, will potentially be settled

through customer deductions in lieu of cash payments. Such deductions represent rebates owed to customers and are included in Other current liabilities in the

accompanying Consolidated Statement of Financial Position.

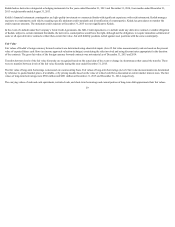

NOTE 3: INVENTORIES, NET

As of December 31,

(in millions) 2015 2014

Finished goods $ 177 $ 204

Work in process 65 73

Raw materials 72 72

Total $ 314 $ 349

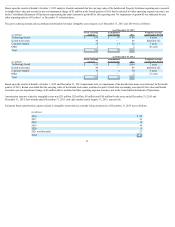

NOTE 4: PROPERTY, PLANT AND EQUIPMENT, NET AND EQUIPMENT SUBJECT TO OPERATING LEASES, NET

As of December 31,

(in millions) 2015 2014

Land $ 74 $ 100

Buildings and building improvements 171 176

Machinery and equipment 483 432

Construction in progress 28 47

756 755

Accumulated depreciation (330) (231)

Property, plant and equipment, net $ 426 $ 524

Depreciation expense was $120 million, $174 million, $67 million and $87 million for the years ended December 31, 2015 and December 31, 2014, four months

ended December 31, 2013, and eight months ended August 31, 2013, respectively, of which approximately $8 million, $2 million, $0 million and $4 million,

respectively, represented accelerated depreciation in connection with restructuring actions.

19