Kodak 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

maintains reserves for potential credit losses and such losses, in the aggregate, have not exceeded management’s expectations. Counterparties to the derivative

instrument contracts are major financial institutions. Kodak has not experienced non-performance by any of its derivative instruments counterparties.

CASH EQUIVALENTS

All highly liquid investments with a remaining maturity of three months or less at date of purchase are considered to be cash equivalents.

INVENTORIES

Inventories are stated at the lower of cost or market. The cost of all of Kodak’s inventories is determined by the average cost method, which approximates current

cost. Kodak provides inventory reserves for excess, obsolete or slow-moving inventory based on changes in customer demand, technology developments or other

economic factors.

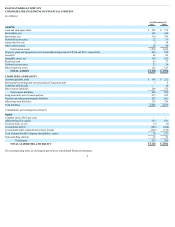

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are recorded at cost, net of accumulated depreciation with the exception of property, plant and equipment owned as of the

application of fresh start accounting. Kodak capitalizes additions and improvements while maintenance and repairs are charged to expense as incurred. Upon sale

or other disposition, the applicable amounts of asset cost and accumulated depreciation are removed from the accounts and the net amount, less proceeds from

disposal, is charged or credited to net (loss) earnings. In connection with fresh start accounting, property, plant and equipment were adjusted to their estimated fair

value and depreciable lives were revised as of September 1, 2013. Refer to Note 25, “Fresh Start Accounting.”

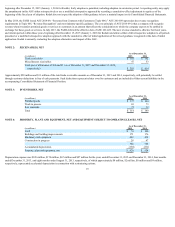

Kodak calculates depreciation expense using the straight-line method over the assets’ estimated useful lives, which are as follows:

Successor

Company

As of September 1,

2013

Buildings and building improvements 5-40 1-38

Land improvements 20 1-20

Leasehold improvements 3-20 1-10

Equipment 3-15 1-20

Tooling 1-3 1-3

Furniture and fixtures 5-10 1-10

Kodak depreciates leasehold improvements over the shorter of the lease term or the asset’s estimated useful life.

Equipment subject to operating leases is included in Property, plant and equipment, net in the Consolidated Statement of Financial Position. Equipment subject to

operating leases consists of equipment rented to customers and is depreciated to estimated salvage value over its expected useful life. Equipment operating lease

terms and depreciable lives generally vary from 3 to 7 years.

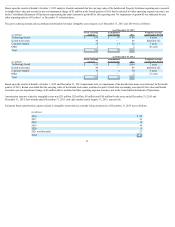

GOODWILL

Goodwill reported in the Successor period represents the reorganizational value of assets in excess of amounts allocated to identified tangible and intangible assets.

Refer to Note 25, “Fresh Start Accounting.” Goodwill is not amortized, but is required to be assessed for impairment at least annually and whenever events or

changes in circumstances occur that would more likely than not reduce the fair value of the reporting unit below its carrying amount. Kodak performed the annual

test of impairment as of October 1, 2015 for all its reporting units and updated its analysis as of December 31, 2015 due to the change in the annual goodwill

impairment test date from October 1 to December 31.

When testing goodwill for impairment, Kodak may assess qualitative factors for some or all of its reporting units to determine whether it is more likely than not

(that is, a likelihood of more than 50 percent) that the fair value of a reporting unit is less than its carrying amount, including goodwill. If Kodak determines based

on this qualitative test of impairment that it is more likely than not that a reporting unit’s fair value is less than its carrying amount, or elects to bypass the

qualitative assessment for some or all of its

15