Kodak 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

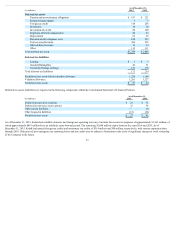

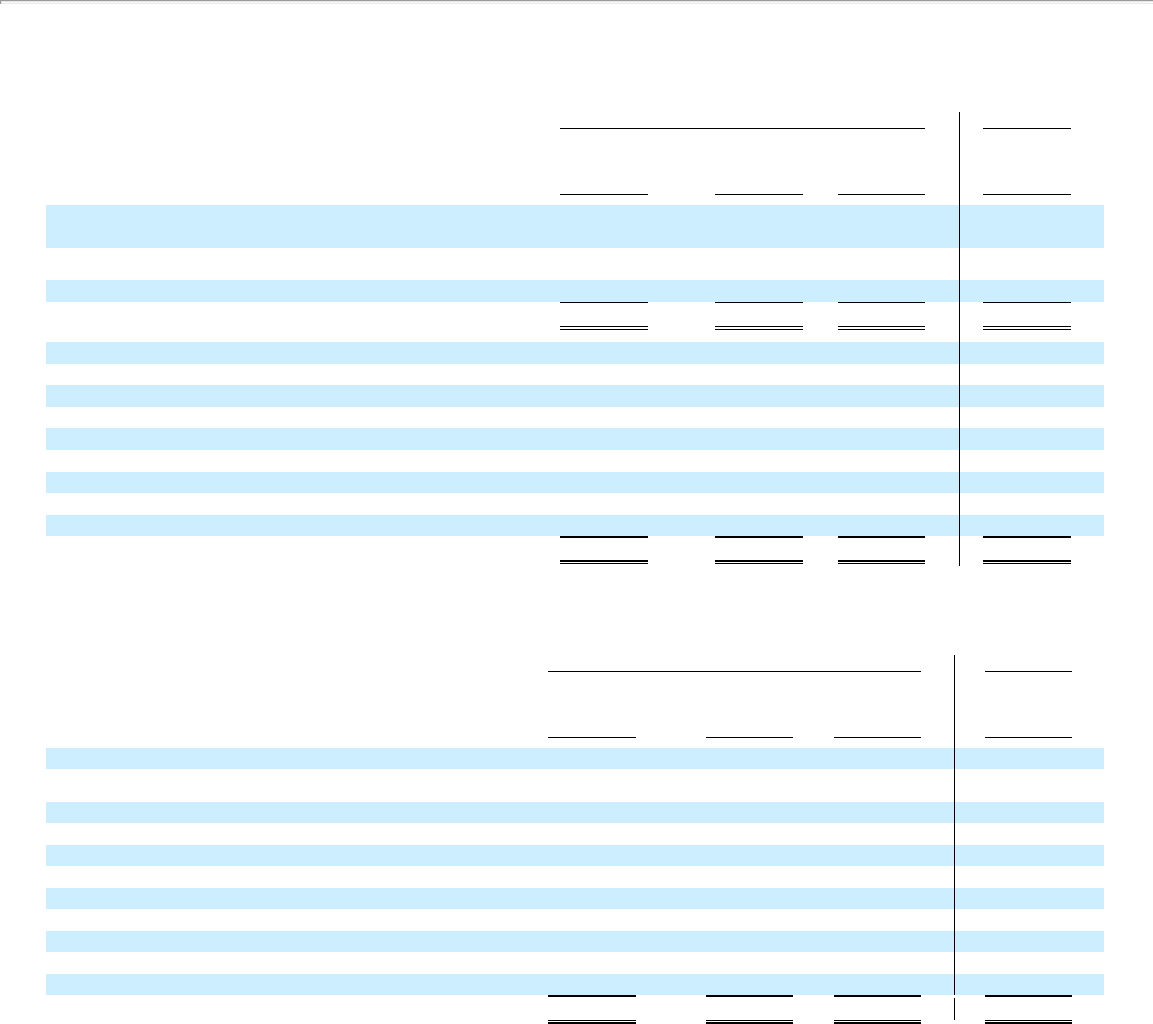

NOTE 14: INCOME TAXES

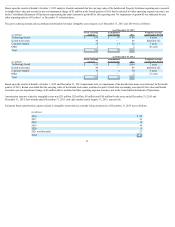

The components of (loss) earnings from continuing operations before income taxes and the related provision (benefit) for U.S. and other income taxes were as

follows:

Successor Predecessor

(in millions)

Year Ended

December 31,

2015

Year Ended

December 31,

2014

Four Months

Ended

December 31,

2013

Eight Months

Ended

August 31,

2013

(Loss) earnings from continuing operations before income

taxes:

U.S. $ (169) $ (208) $ (119) $ 2,243

Outside the U.S. 134 96 45 113

Total $ (35) $ (112) $ (74) $ 2,356

U.S. income taxes:

Current provision (benefit) $ 1 $ (2) $ 3 $ —

Deferred provision (benefit) 9 4 3 (3)

Income taxes outside the U.S.:

Current provision (benefit) 22 (1) 8 52

Deferred provision (benefit) — 7 (8) 105

State and other income taxes:

Current provision — 1 2 1

Deferred provision — 1 — —

Total provision $ 32 $ 10 $ 8 $ 155

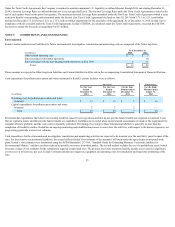

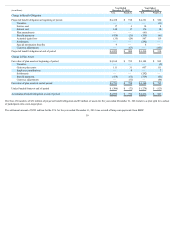

The differences between income taxes computed using the U.S. federal income tax rate and the provision for income taxes for continuing operations were as

follows:

Successor Predecessor

(in millions)

Year Ended

December 31,

2015

Year Ended

December 31,

2014

Four Months

Ended

December 31,

2013

Eight Months

Ended

August 31,

2013

Amount computed using the statutory rate $ (12) $ (39) $ (25) $ 825

Increase (reduction) in taxes resulting from:

State and other income taxes, net of federal — 1 2 —

Unremitted foreign earnings 26 4 36 32

Impact of goodwill and intangible impairments — — (3) (22)

Operations outside the U.S. 28 111 73 (18)

Legislative rate changes — — — 1

Valuation allowance (71) (121) (100) 39

Tax settlements and adjustments, including interest 2 (5) 1 5

Discharge of debt and other reorganization related items 60 57 24 (722)

Other, net (1) 2 — 15

Provision for income taxes $ 32 $ 10 $ 8 $ 155

31