Kodak 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

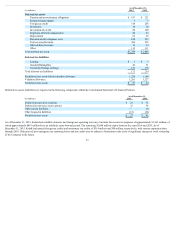

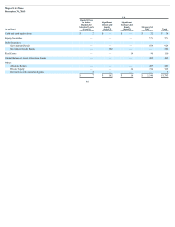

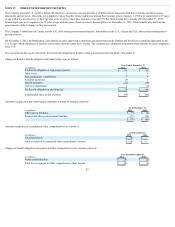

Pension (income) expense for all defined benefit plans included:

Successor Predecessor

(in millions) Year Ended

December 31, 2015

Year Ended

December 31, 2014

Four Months Ended

December 31, 2013

Eight Months Ended

August 31, 2013

U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S.

Major defined benefit plans:

Service cost $ 17 $ 3 $ 18 $ 4 $ 7 $ 2 $ 19 $ 6

Interest cost 148 17 176 30 67 10 120 95

Expected return on plan assets (272) (30) (295) (38) (122) (14) (236) (105)

Amortization of:

Prior service credit (8) — (3) — — — 1 —

Actuarial loss — 2 — — — — 120 55

Pension (income) expense before special termination benefits,

curtailments and settlements (115) (8) (104) (4) (48) (2) 24 51

Special termination benefits 9 — 8 — — — — —

Curtailment (gains) losses — — — — — (1) 1 1

Settlement (gains) losses — — 10 — (11) — — 114

Net pension (income) expense for major defined benefit plans (106) (8) (86) (4) (59) (3) 25 166

Other plans including unfunded plans — 4 — 8 — — 4 19

Net pension (income) expense $(106) $ (4) $ (86) $ 4 $ (59) $ (3) $ 29 $ 185

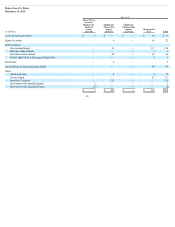

The pension (income) expense before special termination benefits, curtailments, and settlements reported above for the eight months ended August 31, 2013

includes $38 million which was reported as (Loss) earnings from discontinued operations.

The special termination benefits of $9 million and $8 million for the years ended December 31, 2015 and December 31, 2014, respectively, were incurred as a

result of Kodak’s restructuring actions and, therefore, have been included in Restructuring costs and other in the Consolidated Statement of Operations for those

periods.

The $114 million of settlement losses for the eight months ended August 31, 2013 were incurred as a result of the Global Settlement, and have been included in

(Loss) earnings from discontinued operations in the Consolidated Statement of Operations.

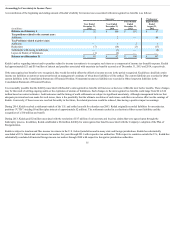

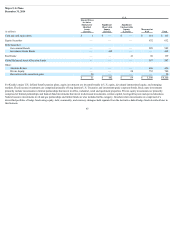

The weighted-average assumptions used to determine the benefit obligation amounts for all major funded and unfunded U.S. and Non-U.S. defined benefit plans

were as follows:

Successor Predecessor

December 31, 2015 December 31, 2014 December 31, 2013 August 31, 2013

U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S.

Discount rate 3.89% 2.50% 3.50% 2.09% 4.50% 3.40% 4.25% 3.33%

Salary increase rate 3.37% 1.91% 3.34% 1.95% 3.37% 2.74% 3.39% 2.77%

The weighted-average assumptions used to determine net pension (income) expense for all the major funded and unfunded U.S. and Non-U.S. defined benefit plans

were as follows:

Successor Predecessor

Year Ended

December 31, 2015

Year Ended

December 31, 2014

Four Months Ended

December 31, 2013

Eight Months Ended

August 31, 2013

U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S.

Discount rate 3.50% 2.09% 4.19% 3.34% 4.25% 3.33% 3.52% 3.63%

Salary increase rate 3.34% 1.95% 3.37% 2.62% 3.39% 2.77% 3.40% 2.79%

Expected long-term rate of return on plan assets 7.40% 4.69% 7.63% 4.93% 8.20% 5.54% 8.12% 6.66%

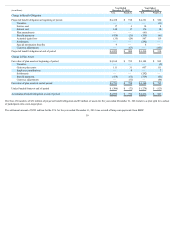

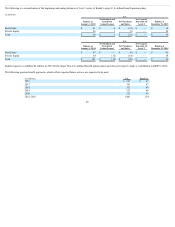

Plan Asset Investment Strategy

The investment strategy underlying the asset allocation for the pension assets is to achieve an optimal return on assets with an acceptable level of risk while

providing for the long-term liabilities, and maintaining sufficient liquidity to pay current benefits and other cash obligations of the plans. This is primarily achieved

by investing in a broad portfolio constructed of various asset classes

41