Kodak 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

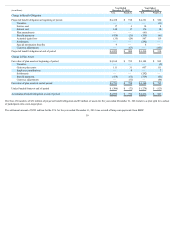

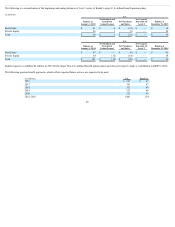

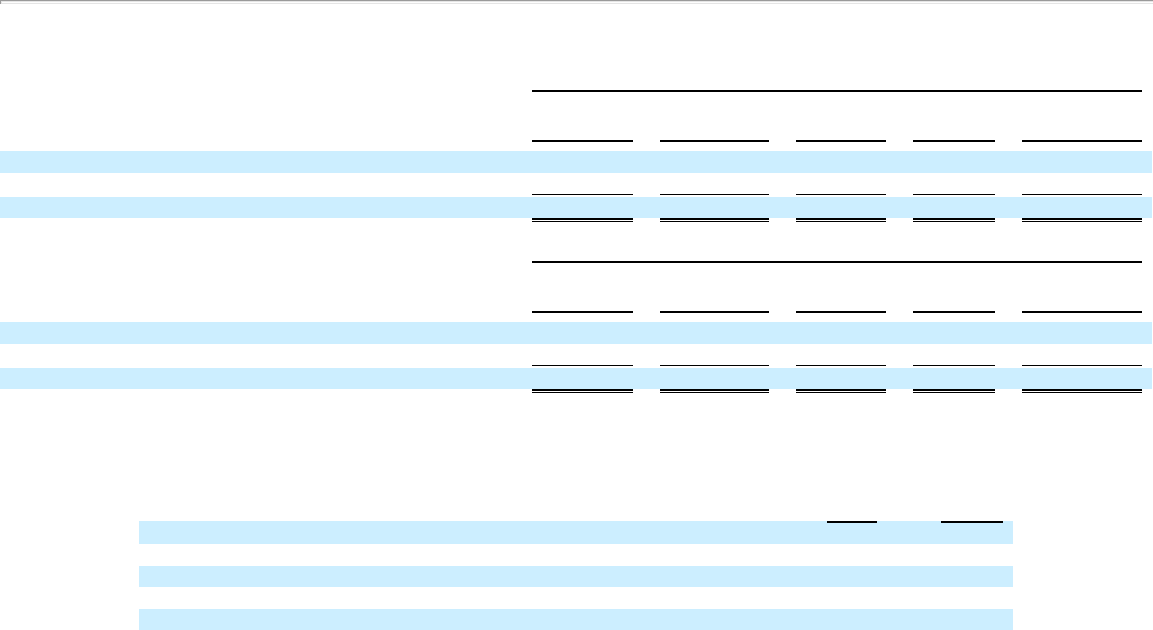

The following is a reconciliation of the beginning and ending balances of level 3 assets of Kodak’s major U.S. defined benefit pension plans:

(in millions)

U.S.

Balance at

January 1, 2015

Net Realized and

Unrealized

Gains/(Losses)

Net Purchases

and Sales

Net Transfer

Into/(Out of)

Level 3

Balance at

December 31, 2015

Real Estate $ 41 $ 6 $ (13) $ — $ 34

Private Equity 28 1 (5) — 24

Total $ 69 $ 7 $ (18) $ — $ 58

U.S.

Balance at

January 1, 2014

Net Realized and

Unrealized

Gains/(Losses)

Net Purchases

and Sales

Net Transfer

Into/(Out of)

Level 3

Balance at

December 31, 2014

Real Estate $ 47 $ — $ (6) $ — $ 41

Private Equity 54 (12) (14) — 28

Total $ 101 $ (12) $ (20) $ — $ 69

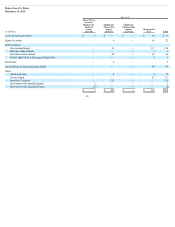

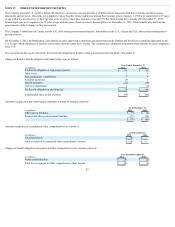

Kodak expects to contribute $4 million in 2016 for the major Non-U.S. defined benefit pension plans and does not expect to make a contribution to KRIP in 2016.

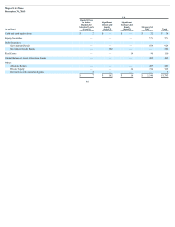

The following pension benefit payments, which reflect expected future service, are expected to be paid:

(in millions) U.S. Non-U.S.

2016 $ 357 $ 47

2017 341 47

2018 331 46

2019 321 46

2020 311 45

2021-2025 1,401 214

48