Kodak 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

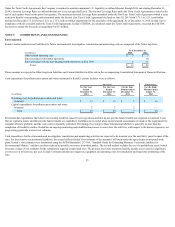

Under the Term Credit Agreements, the Company is required to maintain minimum U.S. Liquidity (as defined therein) through 2014 and starting December 31,

2014, a Secured Leverage Ratio (as defined therein) not to exceed specified levels. The Secured Leverage Ratio under the Term Credit Agreements is tested at the

end of each quarter based on the prior four quarters, The maximum Secured Leverage Ratio permitted under the First Lien Term Credit Agreement (which is more

restrictive than the corresponding ratio permitted under the Second Lien Term Credit Agreement) declined on June 30, 2015 from 3.75:1 to 3.25:1 and further

declined on December 31, 2015 from 3.25:1 to 2.75:1, with no further adjustments for the remainder of the agreement. As of December 31, 2015, Kodak was in

compliance with all covenants under the Term Credit Agreements. Kodak’s EBITDA, as calculated under the Term Credit Agreements, exceeded the EBITDA

necessary to satisfy the Secured Leverage Ratio by $33 million.

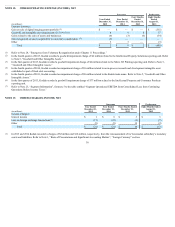

NOTE 9: COMMITMENTS AND CONTINGENCIES

Environmental

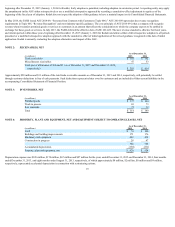

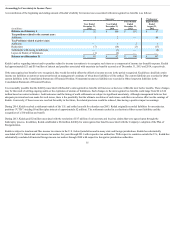

Kodak’s undiscounted accrued liabilities for future environmental investigation, remediation and monitoring costs are composed of the following items:

As of December 31,

(in millions) 2015 2014

Other current operating sites $ 7 $ 7

Sites associated with former operations — 10

Sites associated with the non-imaging health businesses sold in 1994 6 11

Total $ 13 $ 28

These amounts are reported in Other long-term liabilities and Current liabilities held for sale in the accompanying Consolidated Statement of Financial Position.

Cash expenditures for pollution prevention and waste treatment for Kodak’s current facilities were as follows:

Successor Predecessor

(in millions)

For the Year

Ended

December 31,

2015

For the Year

Ended

December 31,

2014

For the Four

Months Ended

December 31,

2013

For the Eight

Months Ended

August 31,

2013

Recurring costs for pollution prevention and waste

treatment $ 13 $ 13 $ 5 $ 16

Capital expenditures for pollution prevention and waste

treatment 2 2 2 —

Total $ 15 $ 15 $ 7 $ 16

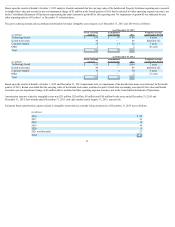

Environmental expenditures that relate to an existing condition caused by past operations and that do not provide future benefits are expensed as incurred. Costs

that are capital in nature and that provide future benefits are capitalized. Liabilities are recorded when environmental assessments are made or the requirement for

remedial efforts is probable, and the costs can be reasonably estimated. The timing of accruing for these remediation liabilities is generally no later than the

completion of feasibility studies. Kodak has an ongoing monitoring and identification process to assess how the activities, with respect to the known exposures, are

progressing against the accrued cost estimates.

Cash expenditures for the aforementioned investigation, remediation and monitoring activities are expected to be incurred over the next thirty years for most of the

sites. For these known environmental liabilities, the accrual reflects Kodak’s best estimate of the amount it will incur under the agreed-upon or proposed work

plans. Kodak’s cost estimates were determined using the ASTM Standard E 2137-06, “Standard Guide for Estimating Monetary Costs and Liabilities for

Environmental Matters,” and have not been reduced by possible recoveries from third parties. The overall method includes the use of a probabilistic model which

forecasts a range of cost estimates for the remediation required at individual sites. The projects are closely monitored and the models are reviewed as significant

events occur or at least once per year. Kodak’s estimate includes investigations, equipment and operating costs for remediation and long-term monitoring of the

sites.

25