Kodak 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(a) On the Effective Date, Kodak completed the sale of substantially all of its assets constituting the Personalized Imaging and Document Imaging businesses to

KPP Holdco Limited. This transaction has been reflected in the Predecessor Company period. Refer to Note 27, “Discontinued Operations” for additional

information.

Reorganization adjustments

(1) Reflects the net cash payments recorded as of the Effective Date from implementation of the Plan:

(in millions)

Sources:

Net proceeds from Emergence Credit Facilities $664

Proceeds from Rights Offerings 406

Total sources $ 1,070

Uses:

Repayment of Junior DIP Term Loans $644

Repayment of Second Lien Notes 375

Claims paid at emergence 94

Funding of escrow accounts 113

Other fees and expenses 16

Total uses 1,242

Net uses $ (172)

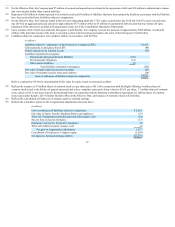

Other fees and expenses represent $7 million payment for accrued and unpaid interest related to the repayment of debt and $9 million payment for

emergence and success fees, which is included in Reorganization items, net in the Consolidated Statement of Operations.

(2) Reflects the funding of $80 million to the professional fee escrow account for professional fees accrued at emergence and $18 million related to the EBP

Settlement Agreement. Refer to Note 24, “Emergence from Voluntary Reorganization under Chapter 11 Proceedings” for additional information regarding

the EBP Settlement Agreement.

(3) Reflects the expiration of tax attributes, which was fully offset by a corresponding decrease in Kodak’s U.S. valuation allowance, as a result of the Debtors’

emergence from chapter 11 bankruptcy proceedings. Refer to Note 14, “Income Taxes” for additional information.

(4) Represents the write-off of unamortized debt issuance costs of $1 million related to the Junior DIP Credit Agreement upon repayment in full of all

outstanding term loans on the Effective Date. This amount has been included in Reorganization items, net in the Consolidated Statement of Operations.

(5) Represents the funding of $15 million in cash collateralization for letters of credit under the ABL Credit Facility.

(6) Represents $8 million of debt issuance costs incurred related to the Emergence Credit Facilities.

(7) Represents the write-off of $5 million of deferred debt issuance costs upon repayment in full of all loans outstanding under the 9.75% senior secured notes

due 2018 and 10.625% senior secured notes due 2019 and the write-off of $3 million of deferred equity issuance costs. These amounts have been included in

Reorganization items, net in the Consolidated Statement of Operations.

(8) Represents $6 million in claims expected to be satisfied in cash that were reclassified from Liabilities subject to compromise.

(9) Represents $3 million of accrued expenses related to the Emergence Credit Facilities that have been deferred and recorded as part of Other Current assets.

(10) Represents $13 million in success fees accrued upon emergence that have been included in Reorganization items, net in the Consolidated Statement of

Operations.

(11) On the Effective Date, the Company repaid in full all term loans outstanding under the Junior DIP Credit Agreement for an aggregate remaining principal

amount of approximately $644 million offset by $3 million of unamortized debt discount that was written off upon repayment of the debt and is included in

Reorganization items, net in the Consolidated Statement of Operations.

(12) Represents $4 million of principal amount recorded as short-term borrowings pursuant to the terms of the Emergence Credit Facility.

66