Kodak 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

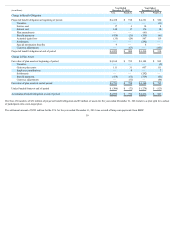

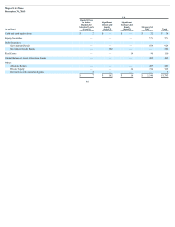

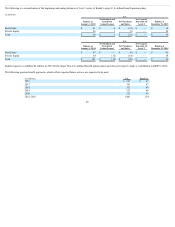

Major Non-U.S. Plans

December 31, 2014

Non - U.S.

(in millions)

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Measured at

NAV Total

Cash and cash equivalents $ 4 $ — $ — $ 32 $ 36

Equity Securities — 8 — 38 46

Debt Securities:

Government Bonds — 39 — 114 153

Inflation-Linked Bonds — — — 9 9

Investment Grade Bonds — 37 — — 37

Global High Yield & Emerging Market Debt — — — 11 11

Real Estate — 2 — — 2

Global Balanced Asset Allocation Funds — 1 — 90 91

Other:

Absolute Return — 4 — 7 11

Private Equity — — — 56 56

Insurance Contracts — 340 — — 340

Derivatives with unrealized gains 5 — — — 5

Derivatives with unrealized losses (2) — — — (2)

$ 7 $ 431 $ — $ 357 $795

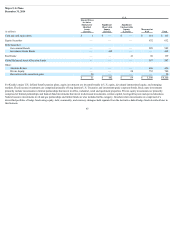

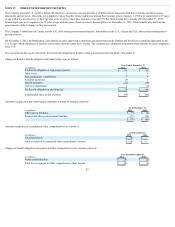

For Kodak’s major non-U.S. defined benefit pension plans, equity investments are invested broadly in local equity, developed international and emerging markets.

Fixed income investments are comprised primarily of government and investment grade corporate bonds. Real estate investments primarily include investments in

limited partnerships that invest in office, industrial, and retail properties. Private equity investments are comprised of limited partnerships and fund-of-fund

investments that invest in distressed investments, venture capital and leveraged buyouts. Absolute return investments are comprised of a diversified portfolio of

hedge funds using equity, debt, commodity, and currency strategies held separate from the derivative-linked hedge funds described later in this footnote.

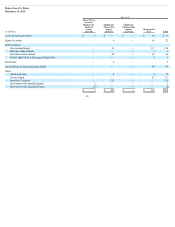

For Kodak’s major defined benefit pension plans, certain investment managers are authorized to invest in derivatives such as futures, swaps, and currency forward

contracts. Investments in derivatives are used to obtain desired exposure to a particular asset, index or bond duration and require only a portion of the total exposure

to be invested as cash collateral. In instances where exposures are obtained via derivatives, the majority of the exposure value is available to be invested, and is

typically invested, in a diversified portfolio of hedge fund strategies that generate returns in addition to the return generated by the derivatives. Of the December 31,

2015 investments shown in the major U.S. plans table above, 10% of the total pension assets represented equity securities exposure obtained via derivatives and are

reported in equity securities, and 24% of the total pension assets represented U.S. government bond exposure, at 18 years target duration, obtained via derivatives

and are reported in government bonds. Of the December 31, 2014 major U.S. plans investments, 9% and 25% of the total pension assets represented exposures to

equity securities and U.S. government bonds (at 18 years target duration), respectively, obtained from the use of derivatives, and are reported in those respective

classes.

Of the December 31, 2015 investments shown in the major Non-U.S. plans table above, 0% and 12% of the total pension assets represented derivatives exposures

to equity securities and government bonds (at 13 years target duration), respectively, and are reported in those respective classes. Of the December 31, 2014 major

Non-U.S. total pension investments, 1% and 9% of the total pension assets represented exposures to equity securities and government bonds (at 25 years target

duration), respectively, obtained from the use of derivatives, and are reported in those respective classes.

47