Kodak 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

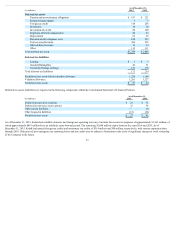

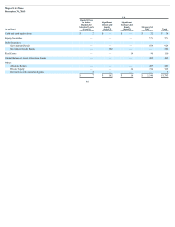

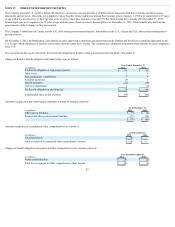

The Company’s weighted-average asset allocations for its major Non-U.S. defined benefit pension plans by asset category, are as follows:

As of December 31,

2015 2014 2015 Target

Asset Category

Equity securities 3% 6% 0-10%

Debt securities 35% 27% 28-38%

Real estate 0% 1% 0-5%

Cash and cash equivalents 3% 4% 0-10%

Global balanced asset allocation funds 6% 11% 0-10%

Other 53% 51% 50-60%

Total 100% 100%

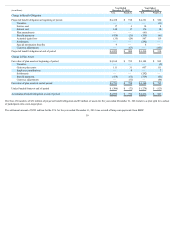

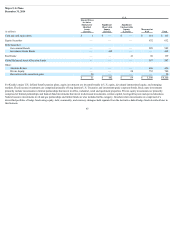

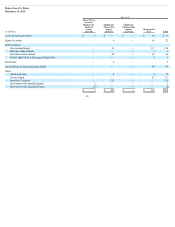

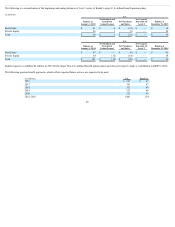

Fair Value Measurements

Kodak’s asset allocations by level within the fair value hierarchy at December 31, 2015 and 2014 are presented in the tables below for Kodak’s major defined

benefit plans. Kodak’s plan assets are accounted for at fair value and are classified within the fair value hierarchy based on the lowest level of input that is

significant to the fair value measurement, with the exception of investments for which fair value is measured using the net asset value per share expedient. Kodak’s

assessment of the significance of a particular input to the fair value measurement requires judgment, and may affect the valuation of fair value of assets and their

placement within the fair value hierarchy levels.

Assets not utilizing the net asset value per share expedient are valued as follows: Equity and debt securities traded on an active market are valued using a market

approach based on the closing price on the last business day of the year. Real estate investments are valued primarily based on independent appraisals and

discounted cash flow models, taking into consideration discount rates and local market conditions. Cash and cash equivalents are valued utilizing cost approach

valuation techniques. Other investments are valued using a combination of market, income, and cost approaches, based on the nature of the investment. Private

equity investments are valued primarily based on independent appraisals, discounted cash flow models, cost, and comparable market transactions, which include

inputs such as discount rates and pricing data from the most recent equity financing. Insurance contracts are primarily valued based on contract values, which

approximate fair value. For investments with lagged pricing, Kodak uses the available net asset values, and also considers expected return, subsequent cash flows

and relevant material events.

43