Kodak 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

EASTMAN BUSINESS PARK SETTLEMENT AGREEMENT

On June 17, 2013, the Company, the New York State Department of Environmental Conservation and the New York State Urban Development Corporation, d/b/a

Empire State Development entered into a settlement agreement, subsequently amended on August 6, 2013 (the “Amended EBP Settlement Agreement”). The

Amended EBP Settlement Agreement was subject to the satisfaction or waiver of certain conditions including a covenant not to sue from the EPA. On May 13,

2014, the Bankruptcy Court approved the U.S. Environmental Settlement, which contained the EPA covenant not to sue, and on May 20, 2014 the Amended EBP

Settlement Agreement was implemented and became effective. The Amended EBP Settlement Agreement included the settlement of certain of the Company’s

historical environmental liabilities at EBP through the establishment of the EBP Trust as follows: (i) the EBP Trust is responsible for investigation and remediation

at EBP arising from the Company’s historical subsurface environmental liabilities in existence prior to the effective date of the Amended EBP Settlement

Agreement, (ii) the Company funded the EBP Trust on the effective date with a $49 million cash payment and transferred certain equipment and fixtures used for

remediation at EBP and (iii) in the event the historical liabilities exceed $99 million, the Company will become liable for 50% of the portion above $99 million.

Prior to the implementation of the Amended EBP Settlement Agreement, $49 million was already held in a separate trust and escrow account.

OTHER POSTEMPLOYMENT BENEFITS

On November 7, 2012, the Bankruptcy Court entered an order approving a settlement agreement between the Debtors and the Official Committee of Retired

Employees appointed by the U.S. Trustee under the chapter 11 proceedings (the “Retiree Committee”). Under the settlement agreement, the Debtors no longer

provide retiree medical, dental, life insurance and survivor income benefits to current and future retirees after December 31, 2012 (other than COBRA continuation

coverage of medical and/or dental benefits or conversion coverage as required by applicable benefit plans or applicable law), and the Retiree Committee established

a trust from which some limited benefits for some retirees may be provided after December 31, 2012. The trust or related account was funded by the following

contributions from the Debtors: $7.5 million in cash paid by the Company in the fourth quarter of 2012, an administrative claim against the Debtors in the amount

of $15 million that was paid on the Effective Date, and a general unsecured claim against the Debtors in the amount of $635 million that was discharged upon

emergence from chapter 11 pursuant to the terms of the Plan.

RETIREES’ SETTLEMENT

The Debtors’ estimated allowed claims for pre-petition obligations for the Kodak Excess Retirement Income Plan (the “KERIP”), the Kodak Unfunded Retirement

Income Plan (the “KURIP”), the Kodak Company Global Pension Plan for International Employees, and individual letter agreements with certain current and

former employees that provided for supplemental non-qualified pension benefits were reported as Liabilities subject to compromise in the accompanying

Consolidated Statement of Financial Position.

On April 30, 2013, Eastman Kodak Retirees Association Ltd. and certain holders of KERIP and KURIP claims (together with the Debtors, the “Settlement Parties”)

filed a motion (the “Motion”) requesting that the Bankruptcy Court appoint a committee pursuant to section 1102(a)(2) of the Bankruptcy Code, to represent the

interests of the holders of the KERIP and KURIP claims, and asserted that they and certain other holders of the KERIP and KURIP claims disagreed with the

underlying discount rates and mortality tables used by the Debtors to calculate the KERIP and KURIP estimated allowed claim amounts. Subsequent to the filing of

the Motion, the Settlement Parties entered into a stipulation (the “Stipulation”) approved by an order of the Bankruptcy Court, which became effective on July 18,

2013, for a total allowed claim of approximately $244 million. During August 2013 a provision for expected allowed claims of approximately $27 million was

reflected in Reorganization Items, net in the accompanying Consolidated Statement of Operations to increase the recorded liability to what was ultimately agreed to

in the Stipulation.

On the Effective Date, the claim was discharged upon emergence pursuant to the terms of the Plan.

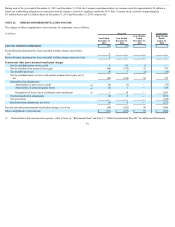

NOTE 25: FRESH START ACCOUNTING

In connection with the Company’s emergence from chapter 11, Kodak applied the provisions of fresh start accounting to its financial statements as (i) the holders

of existing voting shares of the Predecessor Company received less than 50% of the voting shares of the emerging entity and (ii) the reorganization value of

Kodak’s assets immediately prior to confirmation was less than the post-petition liabilities and allowed claims. Kodak applied fresh start accounting as of

September 1, 2013.

Upon the application of fresh start accounting, Kodak allocated the reorganization value to its individual assets based on their estimated fair values. Reorganization

value represents the fair value of the Successor Company’s assets before considering liabilities. The excess reorganization value over the fair value of identified

tangible and intangible assets is reported as goodwill.

Reorganization Value

In support of the Plan, the enterprise value of the Successor Company was estimated to be in the range of $875 million to $1.4 billion. As part of determining the

reorganization value, Kodak estimated the enterprise value of the Successor Company to be $1 billion utilizing the guideline public company method and

discounted cash flow method.

62