Kodak 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

EASTMAN KODAK CO

FORM 10-K/A

(Amended Annual Report)

Filed 04/01/16 for the Period Ending 12/31/15

Address 343 STATE ST

ROCHESTER, NY 14650-0910

Telephone 7167244000

CIK 0000031235

Symbol KODK

SIC Code 3861 - Photographic Equipment and Supplies

Industry Printing Services

Sector Services

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2016, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

EASTMAN KODAK CO FORM 10-K/A (Amended Annual Report) Filed 04/01/16 for the Period Ending 12/31/15 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 343 STATE ST ROCHESTER, NY 14650-0910 7167244000 0000031235 KODK 3861 - Photographic Equipment and Supplies Printing Services ... -

Page 2

... Exchange Act of 1934 For the year ended December 31, 2015 or ¨ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from to Commission File Number 1-87 EASTMAN KODAK COMPANY (Exact name of registrant as specified in its charter) NEW... -

Page 3

...price at which the common equity was last sold, as of the last business day of the registrant's most recently completed second fiscal quarter, June 30, 2015 was approximately $302 million. The registrant has no nonvoting common stock. The number of shares outstanding of the registrant's common stock... -

Page 4

... Note Eastman Kodak Company (the "Company") is filing this Amendment No. 2 on Form 10-K/A to its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the Securities and Exchange Commission on March 15, 2016 and amended by Amendment No. 1 thereto filed with... -

Page 5

...loss) income, of equity (deficit) and of cash flows for the years ended December 31, 2015 and 2014, and for the four months ended December 31, 2013 present fairly, in all material respects, the financial position of Eastman Kodak Company and its subsidiaries (Successor) at December 31, 2015 and 2014... -

Page 6

... comprehensive (loss) income, of equity (deficit) and of cash flows for the eight months ended August 31, 2013 present fairly, in all material respects, the results of operations and cash flows of Eastman Kodak Company and its subsidiaries (Predecessor) for the eight months ended August 31, 2013 in... -

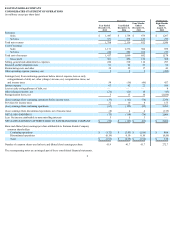

Page 7

EASTMAN KODAK COMPANY CONSOLIDATED STATEMENT OF OPERATIONS (in millions, except per share data) Successor Year Ended December 31, 2015 Year Ended December 31, 2014 Four Months Ended December 31, 2013 Predecessor Eight Months Ended August 31, 2013 Revenues Sales Services Total net revenues Cost of ... -

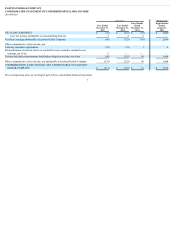

Page 8

... 31, 2015 Year Ended December 31, 2014 Four Months Ended December 31, 2013 Predecessor Eight Months Ended August 31, 2013 NET (LOSS) EARNINGS Less: net income attributable to noncontrolling interests Net (loss) earnings attributable to Eastman Kodak Company Other comprehensive (loss) income, net... -

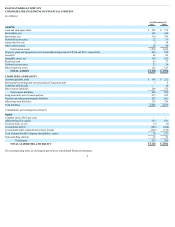

Page 9

EASTMAN KODAK COMPANY CONSOLIDATED STATEMENT OF FINANCIAL POSITION (in millions) As of December 31, 2015 2014 ASSETS Cash and cash equivalents Receivables, net Inventories, net Deferred income taxes Assets held for sale Other current assets Total current assets Property, plant and equipment, net of... -

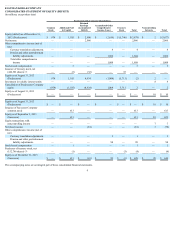

Page 10

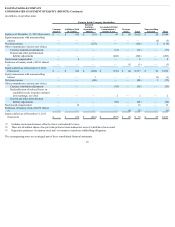

... share data) Eastman Kodak Company Shareholders Retained Earnings Accumulated Other (Accumulated Comprehensive Additional Paid Deficit) Income (Loss) in Capital Common Stock Treasury Stock Total Noncontrolling Interests Total Equity (deficit) as of December 31, 2012 (Predecessor) Net income... -

Page 11

...realized losses on available-for-sale securities included in net earnings, net of tax Pension and other postretirement liability adjustments Stock-based compensation Purchases of treasury stock, (84,678 shares) Equity (deficit) as of December 31, 2015 (Successor) (1) (2) (3) (3) (3) $ Common Stock... -

Page 12

EASTMAN KODAK COMPANY CONSOLIDATED STATEMENT OF CASH FLOWS (in millions) Successor Year Ended December 31, 2015 Year Ended December 31, 2014 Four Months Ended December 31, 2013 Predecessor Eight Months Ended August 31, 2013 Cash flows from operating activities: Net (loss) earnings Adjustments to ... -

Page 13

EASTMAN KODAK COMPANY CONSOLIDATED STATEMENT OF CASH FLOWS (Continued) SUPPLEMENTAL CASH FLOW INFORMATION (in millions) Successor Year Ended December 31, 2015 Year Ended December 31, 2014 Four Months Ended December 31, 2013 Predecessor Eight Months Ended August 31, 2013 Cash paid for interest and ... -

Page 14

... January 19, 2012 (the "Petition Date"), Eastman Kodak Company ("EKC" or the "Company") and its U.S. subsidiaries (collectively, the "Debtors") filed voluntary petitions for relief under chapter 11 of the United States Bankruptcy Code (the "Bankruptcy Code") in the United States Bankruptcy Court for... -

Page 15

... and cash equivalents, receivables, and derivative instruments. Kodak places its cash and cash equivalents with high-quality financial institutions and limits the amount of credit exposure to any one institution. With respect to receivables, such receivables arise from sales to numerous customers in... -

Page 16

... Start Accounting." Kodak calculates depreciation expense using the straight-line method over the assets' estimated useful lives, which are as follows: Successor Company As of September 1, 2013 Buildings and building improvements Land improvements Leasehold improvements Equipment Tooling Furniture... -

Page 17

...product warranties, based on historical experience at the time Kodak recognizes revenue. For product sales, the revenue recognition criteria are generally met when title and risk of loss have transferred from Kodak to the buyer, which may be upon shipment or upon delivery to the customer site, based... -

Page 18

... years ended December 31, 2015 and December 31, 2014, four months ended December 31, 2013, and for the eight months ended August 31, 2013, respectively. SHIPPING AND HANDLING COSTS Amounts charged to customers and costs incurred by Kodak related to shipping and handling are included in net sales and... -

Page 19

... tax assets and liabilities to be classified as non-current on the consolidated balance sheet. ASU 2015-17 is effective for fiscal years and interim reporting periods within those years beginning after December 15, 2016 (January 1, 2017 for Kodak), with early adoption permitted in any annual or... -

Page 20

... SUBJECT TO OPERATING LEASES, NET (in millions) As of December 31, 2015 2014 Land Buildings and building improvements Machinery and equipment Construction in progress $ Accumulated depreciation Property, plant and equipment, net 74 171 483 28 756 (330) $ 426 $ 100 176 432 47 755 (231) $ 524... -

Page 21

... at emergence. As a result of the change in segments that became effective as of January 1, 2015, Kodak's goodwill reporting units changed. Refer to Note 23, "Segment Information" for additional information on the change to Kodak's organizational structure. The Print Systems segment has two goodwill... -

Page 22

...December 31, 2014, four months ended December 31, 2013, and eight months ended August 31, 2013, respectively. Estimated future amortization expense related to intangible assets that are currently being amortized as of December 31, 2015 was as follows: (in millions) 2016 2017 2018 2019 2020 2021 and... -

Page 23

... the Consolidated Statement of Financial Position, and therefore, have been aggregated in accordance with Regulation S-X. NOTE 7: OTHER LONG-TERM LIABILITIES (in millions) As of December 31, 2015 2014 Workers compensation Environmental liabilities Asset retirement obligations Other Total $ 113... -

Page 24

... AND LONG-TERM DEBT Debt and related maturities and interest rates were as follows at December 31, 2015 and 2014: (in millions) Type Maturity As of December 31, 2015 2014 Carrying Value Carrying Value Weighted-Average Effective Interest Rate Current portion: Term note Credit line Other 2016... -

Page 25

..., in the case of net proceeds received from asset sales or recovery events, reinvestment rights by the Company in assets used or usable by the business within certain time limits. On an annual basis, starting with the fiscal year ending on December 31, 2014, the Company will prepay on June 30 of the... -

Page 26

...held for sale in the accompanying Consolidated Statement of Financial Position. Cash expenditures for pollution prevention and waste treatment for Kodak's current facilities were as follows: For the Year Ended December 31, 2015 Successor For the Year Ended December 31, 2014 For the Four Months Ended... -

Page 27

... 2014, the $2 million net book value of the Middleway property was classified in Current assets held for sale and the environmental liability of approximately $9 million was classified as Current liabilities held for sale. The Company released the environmental liability associated with the site and... -

Page 28

...2014, four months ending December 31, 2013, and eight months ending August 31, 2013, respectively. As of December 31, 2015, the Company had outstanding letters of credit of $118 million issued under the ABL Credit Agreement as well as bank guarantees and letters of credit of $4 million, surety bonds... -

Page 29

...of December 31, 2015 $ 13 (16) 8 5 (8) 7 $ 4 Kodak also offers its customers extended warranty arrangements that are generally one year, but may range from three months to five years after the original warranty period. Kodak provides repair services and routine maintenance under these arrangements... -

Page 30

...31, 2014, four months ended December 31, 2013 or eight months ended August 31, 2013. Kodak's financial instrument counterparties are high-quality investment or commercial banks with significant experience with such instruments. Kodak manages exposure to counterparty credit risk by requiring specific... -

Page 31

... OPERATING EXPENSE (INCOME), NET Successor Year Ended December 31, 2015 Year Ended December 31, 2014 Four Months Ended December 31, 2013 Predecessor Eight Months Ended August 31, 2013 Expense (income) : Gain on sale of digital imaging patent portfolio (1) Goodwill and intangible asset impairments... -

Page 32

... 2015 Year Ended December 31, 2014 Four Months Ended December 31, 2013 Predecessor Eight Months Ended August 31, 2013 (in millions) (Loss) earnings from continuing operations before income taxes: U.S. Outside the U.S. Total U.S. income taxes: Current provision (benefit) Deferred provision (benefit... -

Page 33

... resulting from the KPP Global Settlement and the related sale of the Business. As a result, Kodak recorded a tax provision of $100 million associated with the establishment of a valuation allowance on those deferred tax assets. Additionally, during the eight months ended August 31, 2013, Kodak... -

Page 34

... 1,127 $ 42 Deferred tax assets (liabilities) are reported in the following components within the Consolidated Statement of Financial Position: (in millions) As of December 31, 2015 2014 Deferred income taxes (current) Deferred income taxes (non-current) Other current liabilities Other long-term... -

Page 35

...approximately $27 million and $42 million as of December 31, 2015 and December 31, 2014, respectively, relate primarily to net operating loss carry-forwards, certain tax credits, and pension related tax benefits for which Kodak believes it is more likely than not that the assets will be realized. 34 -

Page 36

...the beginning and ending amount of Kodak's liability for income taxes associated with unrecognized tax benefits is as follows: Successor Year Ended December 31, 2015 Year Ended December 31, 2014 Four Months Ended December 31, 2013 Predecessor Eight Months Ended August 31, 2013 Balance as of January... -

Page 37

...months utilization/cash payments Four months other adjustments & reclasses (2) Balance as of December 31, 2013 (Successor): 2014 charges 2014 utilization/cash payments 2014 other adjustments & reclasses (3) Balance as of December 31, 2014 (Successor): 2015 charges 2015 utilization/cash payments 2015... -

Page 38

... in 2015 were initiated to reduce Kodak's cost structure as part of its commitment to drive sustainable profitability and included continued progress toward the Leeds plate manufacturing facility exit, a Kodak Technology Center workforce reduction, and various targeted reductions in service, sales... -

Page 39

... by employee benefit and tax laws plus any additional amounts the Company determines to be appropriate. Assets in the trust fund are held for the sole benefit of participating employees and retirees. They are composed of corporate equity and debt securities, U.S. government securities, partnership... -

Page 40

...Transfers Service cost Interest cost Plan amendments Benefit payments Actuarial (gain) loss Settlements Special termination benefits Currency adjustments Projected benefit obligation at end of period Change in Plan Assets Fair value of plan assets at beginning of period Transfers Gain on plan assets... -

Page 41

...changes in plan assets and benefit obligations recognized in Other comprehensive income (expense) are as follows: Year Ended December 31, 2015 U.S. Non-U.S. Successor Year Ended December 31, 2014 U.S. Non-U.S. Four Months Ended December 31, 2013 U.S. Non-U.S. Predecessor Eight Months Ended August 31... -

Page 42

... 31, 2014 U.S. Non-U.S. Four Months Ended December 31, 2013 U.S. Non-U.S. Predecessor Eight Months Ended August 31, 2013 U.S. Non-U.S. Major defined benefit plans: Service cost Interest cost Expected return on plan assets Amortization of: Prior service credit Actuarial loss Pension (income) expense... -

Page 43

... benefit plan assets. The Company's weighted-average asset allocations for its major U.S. defined benefit pension plans by asset category, are as follows: As of December 31, 2015 2014 2015 Target Asset Category Equity securities Debt securities Real estate Cash and cash equivalents Global balanced... -

Page 44

The Company's weighted-average asset allocations for its major Non-U.S. defined benefit pension plans by asset category, are as follows: As of December 31, 2015 2014 2015 Target Asset Category Equity securities Debt securities Real estate Cash and cash equivalents Global balanced asset allocation ... -

Page 45

... (Level 3) (in millions) Measured at NAV Total Cash and cash equivalents Equity Securities Debt Securities: Government Bonds Investment Grade Bonds Real Estate Global Balanced Asset Allocation Funds Other: Absolute Return Private Equity Derivatives with unrealized gains $ - - - 2 $ - - - 382... -

Page 46

... 3) (in millions) Measured at NAV Total Cash and cash equivalents Equity Securities Debt Securities: Government Bonds Investment Grade Bonds Real Estate Global Balanced Asset Allocation Funds Other: Absolute Return Private Equity Derivatives with unrealized gains $ - - - - - 1 $ - - - 442... -

Page 47

...at NAV Total Cash and cash equivalents Equity Securities Debt Securities: Government Bonds Inflation-Linked Bonds Investment Grade Bonds Global High Yield & Emerging Market Debt Real Estate Global Balanced Asset Allocation Funds Other: Absolute Return Private Equity Insurance Contracts Derivatives... -

Page 48

...at NAV Total Cash and cash equivalents Equity Securities Debt Securities: Government Bonds Inflation-Linked Bonds Investment Grade Bonds Global High Yield & Emerging Market Debt Real Estate Global Balanced Asset Allocation Funds Other: Absolute Return Private Equity Insurance Contracts Derivatives... -

Page 49

... and ending balances of level 3 assets of Kodak's major U.S. defined benefit pension plans: (in millions) Balance at January 1, 2015 Net Realized and Unrealized Gains/(Losses) U.S. Net Purchases and Sales Net Transfer Into/(Out of) Level 3 Balance at December 31, 2015 Real Estate Private Equity... -

Page 50

...Company's subsidiaries in Canada and the U.K. offer similar postretirement benefits. Information on the U.S., Canada and U.K. other postretirement plans is presented below. On November 7, 2012, the Bankruptcy Court entered an order approving a settlement agreement between the Debtors and the Retiree... -

Page 51

... Year Ended December 31, 2014 Four Months Ended December 31, 2013 Predecessor Eight Months Ended August 31, 2013 (in millions) Components of net postretirement benefit cost: Service cost Interest cost Amortization of: Prior service credit Actuarial loss Other postretirement benefit cost (income... -

Page 52

... earnings per share using weighted-average basic shares outstanding for those periods. If Kodak had reported earnings from continuing operations for the years ended December 31, 2015 and December 31, 2014 and four months ended December 31, 2013, the following potential shares of its common stock... -

Page 53

... shares of the Company common stock upon vesting. The fair value is based on the closing market price of the Company's stock on the grant date. Compensation cost related to restricted stock units was $7 million for the years ended December 31, 2015 and 2014 and $1 million for the four months ending... -

Page 54

...and outstanding. On the Effective Date, the Company issued, to the holders of general unsecured claims and the retiree settlement unsecured claim, net-share settled warrants to purchase: (i) 2.1 million shares of common stock at an exercise price of $14.93 and (ii) 2.1 million shares of common stock... -

Page 55

... each of the years ended December 31, 2015 and December 31, 2014, the Company repurchased shares of common stock for approximately $1 million to satisfy tax withholding obligations in connection with the issuance of stock to employees under the 2013 Plan. Treasury stock consisted of approximately... -

Page 56

... 2014 Currency translation adjustments Available for sale securities Pension and other postretirement benefit plan changes Ending balance $ (67) 2 (202) $ (267) $ (32) $ - (104) $ (136) NOTE 23: SEGMENT INFORMATION Effective January 1, 2015, Kodak has seven reportable segments: Print Systems... -

Page 57

... 31, 2015 Year Ended December 31, 2014 Four Months Ended December 31, 2013 Predecessor Eight Months Ended August 31, 2013 (in millions) Print Systems Enterprise Inkjet Systems Micro 3D Printing and Packaging Software and Solutions Consumer and Film Intellectual Property Solutions Eastman Business... -

Page 58

... Months Ended August 31, 2013 Print Systems Enterprise Inkjet Systems Micro 3D Printing and Packaging (5) Software & Solutions Consumer & Film Intellectual Property Solutions Eastman Business Park Total of reportable segments All Other Depreciation and amortization Corporate components of pension... -

Page 59

...) Intangible asset amortization expense from continuing operations: Year Ended December 31, 2015 Successor Year Ended Four Months Ended December 31, December 31, 2014 2013 Predecessor Eight Months Ended August 31, 2013 Print Systems Enterprise Inkjet Systems Micro 3D Packaging & Printing Software... -

Page 60

... are reported in the geographic area in which they originate. No non-U.S. country generated more than 10% of net sales in the years ended December 31, 2015 and December 31, 2014, four months ended December 31, 2013 or eight months ended August 31, 2013. (in millions) Property, plant and equipment... -

Page 61

... thereof; or under Section 1145 of the Bankruptcy Code as securities of a debtor issued principally in exchange for claims against a debtor and partly in exchange for cash pursuant to a plan of reorganization. Registration Rights Agreement On the Effective Date, the Company and the Backstop Parties... -

Page 62

... support direction and contribution notice claims. On April 26, 2013, Eastman Kodak Company, the Trustee, Kodak Limited and certain other Kodak entities entered into a global settlement agreement (the "Global Settlement") that resolved all liabilities of Kodak with respect to the U.K. Pension Plan... -

Page 63

... claims for pre-petition obligations for the Kodak Excess Retirement Income Plan (the "KERIP"), the Kodak Unfunded Retirement Income Plan (the "KURIP"), the Kodak Company Global Pension Plan for International Employees, and individual letter agreements with certain current and former employees... -

Page 64

... ("WACC") reflecting the rate of return that would be expected by a market participant. The WACC also takes into consideration a company specific risk premium reflecting the risk associated with the overall uncertainty of the financial projections used to estimate future cash flows. As the valuation... -

Page 65

... Plus: Cash and cash equivalents Less: Other non-operating liabilities Less: Fair value of debt and capitalized lease obligations Less: Fair value of pension and other postretirement obligations Less: Fair value of warrants Fair value of Successor common stock Shares outstanding at September 3, 2013... -

Page 66

... cash Receivables, net Inventories, net Assets held for sale Other current assets Total current assets Property, plant & equipment, net Goodwill Intangible assets, net Deferred income taxes Other long-term assets TOTAL ASSETS LIABILITIES AND EQUITY (DEFICIT) Current Liabilities Accounts payable... -

Page 67

...chapter 11 bankruptcy proceedings. Refer to Note 14, "Income Taxes" for additional information. Represents the write-off of unamortized debt issuance costs of $1 million related to the Junior DIP Credit Agreement upon repayment in full of all outstanding term loans on the Effective Date. This amount... -

Page 68

... with the Backstop Commitment Agreement, 0.1 million shares of common stock issued under Kodak's 2013 Omnibus Incentive Plan on the Effective Date, and issuance of warrants valued at $24 million. Reflects the cancellation of Predecessor Company equity to retained earnings. Reflects the cumulative... -

Page 69

...holding period costs, and a reasonable profit on the remaining manufacturing, selling and disposal effort. Fair value of raw materials was determined based on current replacement costs. Successor As of September 1, 2013 Predecessor As of August 31, 2013 The following table summarizes the components... -

Page 70

... was utilized for land, buildings and building improvements. This approach relies upon recent sales, offerings of similar assets or a specific inflationary adjustment to original purchase price to arrive at a probable selling price. The cost approach was utilized for machinery and equipment. This... -

Page 71

... years. c. Customer related intangibles of $39 million were valued using the income approach, specifically the multi-period excess earnings approach based on the following significant assumptions: i. ii. iii. iv. Forecasted revenues and profit margins attributable to the current customer base for... -

Page 72

... of employee benefit obligations offset by net $4 million increase in fair value adjustment related to asset retirement obligations and other miscellaneous liabilities. Reflects the increase in fair value of the 34 million shares of common stock issued in connection with the Rights Offering from... -

Page 73

... to repayment to KPP which was also received by Kodak on the Effective Date. The pre-tax loss included the recognition of approximately $1.5 billion of unamortized pension losses previously reported in Accumulated other comprehensive income. On March 17, 2014, the KPP Purchasing Parties agreed... -

Page 74

...reported as part of Current assets held for sale and Current liabilities held for sale in the Consolidated Statement of Financial Position: (in millions) As of December 31, 2015 2014 Inventories, net Property, plant and equipment, net Other assets Current assets held for sale Trade payables Current... -

Page 75

...2014 Net revenues from continuing operations Gross profit from continuing operations (Loss) earnings from continuing operations (Loss) earnings from discontinued operations (4) Net (loss) earnings attributable to Eastman Kodak Company Basic net (loss) earnings per share attributable to Eastman Kodak... -

Page 76

PART IV ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES (a) Exhibits required as part of this report are listed in the index appearing on pages 77 through 80. 75 -

Page 77

... of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. EASTMAN KODAK COMPANY (Registrant) By: /s/ John N. McMullen John N. McMullen Chief Financial Officer April 1, 2016 76 -

Page 78

... to Exhibit 2.2 of the Company's Current Report on Form 8-K as filed on August 29, 2013). Amended and Restated Stock and Asset Purchase Agreement between Eastman Kodak Company, Qualex, Inc., Kodak (Near East), Inc., KPP Trustees Limited, as Trustee for the Kodak Pension Plan of the United Kingdom... -

Page 79

*(10.4) Eastman Kodak Company 2013 Omnibus Incentive Plan Form of Nonqualified Stock Option Agreement. (Incorporated by reference to Exhibit 10.1 of the Company's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2015 as filed on May 7, 2015). #(10.5) Credit Agreement dated ... -

Page 80

... Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2013 as filed on March 19, 2014). (10.19) Settlement Agreement between Eastman Kodak Company, Kodak Limited, Kodak International Finance Limited, Kodak Polychrome Graphics Finance UK Limited, and the KPP Trustees Limited... -

Page 81

*(10.24) Eastman Kodak Company Deferred Compensation Plan for Directors dated December 26, 2013. (Incorporated by reference to Exhibit 10.23 of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2013 as filed on March 19, 2014). *(10.25) (12) (21) (23) (31.1) (31.2) (... -

Page 82

... information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report. /s/ Jeffrey J. Clarke Jeffrey J. Clarke Chief Executive Officer Date: April 1, 2016 -

Page 83

... information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report. /s/ John N. McMullen John N. McMullen Chief Financial Officer Date: April 1, 2016 -

Page 84

... PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 In connection with the Annual Report of Eastman Kodak Company (the "Company") on Form 10-K for the period ended December 31, 2015 as filed with the Securities and Exchange Commission (the "SEC") on March 15, 2016 and amended by Amendment No... -

Page 85

... PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 In connection with the Annual Report of Eastman Kodak Company (the "Company") on Form 10-K for the period ended December 31, 2015 as filed with the Securities and Exchange Commission (the "SEC") on March 15, 2016 and amended by Amendment No...