Kia 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

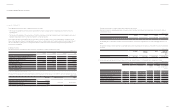

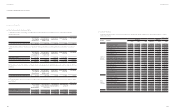

(iii) Financial instruments not measured at fair value, but presented as fair value

Financial instruments recognized by amortized cost, but presented as fair value classied by fair value hierarchy as of December 31, 2014 are

summarized as follows:

Level 1

Level 2 Level 3

Total

Bonds and borrowings ₩ - - 4,681,337 4,681,337

The Company has not disclosed the fair values for nancial instruments, because their carrying amounts are a reasonable approximation of fair

values.

The valuation techniques and the signicant unobservable inputs used in measuring Level 3 fair values as of December 31, 2014 are summarized

as follows:

Fair value

Valuation

methods

Inputs

Signicant

unobservable

input

Bonds and borrowings ₩ 4,681,337 DCF model Discount rate Discount rate

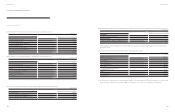

(f) Income and expense by nancial instruments category for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

Finance

income

Finance

costs

Other

comprehensive

income

Finance

income

Finance

costs

Other

comprehensive

income

Loans and receivables ₩ 231,121 52,843 - 206,961 25,078 -

Financial asset at fair value through prot or loss 56 - - - - -

Available-for- sale nancial assets 15,831 557 45,954 223,371 15,356 (143,399)

Held-to-maturity investments - - - 901 196 -

Liabilities recognized by amortized cost 2,358 113,788 - 24,042 98,812 -

Derivative nancial instruments 1,448 2,157 - - - -

₩ 250,814 169,345 45,954 455,275 139,442 (143,399)

(KRW in millions)

(KRW in millions)

(KRW in millions)

The Company measured the fair value of nancial instruments as follows:

- The fair value of available-for-sale nancial assets traded within the market is measured at the closing bid price quoted at the end of the

reporting period.

- The fair value of the derivatives is the present value of the difference between contractual forward price and future forward price discounted

during the remaining period of the contract, from present to contractual maturity.

Except for the nancial assets and liabilities above, the fair value of current receivables is close to their carrying amounts. In addition, the fair

value of other nancial instruments is determined as the present value of estimated future cash ows discounted at the current market interest

rate. As of December 31, 2014, there isn’t any signicant business climate and economic environment changes affecting the fair value of

nancial assets and liabilities.

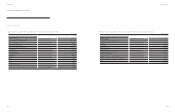

(ii) Fair value hierarchy

Fair value measurement classied by fair value hierarchy as of December 31, 2014 are summarized as follows:

Level 1

Level 2 Level 3

Total

Financial asset at fair value through prot or loss:

Financial asset at fair value through prot or loss ₩ - 200,056 - 200,056

Available-for-sale nancial assets:

Marketable securities 917,322 832,017 - 917,322

Financial derivatives assets:

Currency swap (risk hedge) - 1,448 - 1,448

Financial derivatives assets:

Currency swap (risk hedge) - 2,157 -2,157

(*)There were no signicant transfers between levels 1, 2, and 3.

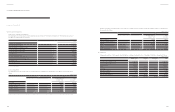

The valuation techniques and the unobservable inputs used in measuring Level 2 fair values as of December 31, 2014 are summarized as follows:

Fair value

Valuation methods Inputs

Financial assets at fair value through prot or loss ₩ 200,056

DCF model Discount rate(*)

Hedging derivative nancial assets 1,448

Hedging derivative nancial liabilities 2,157

(*)The expected net cash ows are discounted using a risk-adjusted discount rate based on government bonds

(KRW in millions)

(KRW in millions)

118 119

Annual Report 2014Financial Review