Kia 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

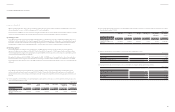

(b) Accumulated other comprehensive income and loss as of December 31, 2014 and 2013 are summarized as follows:

2014 2013

Gain on valuation of available-for-sale nancial assets

₩ 456,148

410,194

Change in capital adjustments - increase in gain of equity

method accounted investments, net of tax of nil

98,543

111,759

Change in capital adjustments - increase in loss of equity method

accounted investments, net of tax of nil

(278,178)

(171,983)

Foreign currency translation difference, net of tax of nil

(394,814)

(247,994)

₩ (118,301)

101,976

(c) Other equity as of December 31, 2014 and 2013 are summarized as follows:

2014 2013

Gain on retirement of capital stock

₩ 119,859

119,859

Other capital surplus

55,613

55,613

Treasury shares

(88,927)

(24,432)

₩ 86,545

151,040

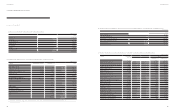

21. Retained Earnings

(a) Retained Earnings as of December 31, 2014 and 2013 are summarized as follows:

2014 2013

Legal reserve

₩ 152,400

123,900

Voluntary reserve

12,439,140

10,042,411

Unappropriated retained earnings

6,224,114

6,135,501

₩ 18,815,654

16,301,812

(b) Changes in retained earnings for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

Balance at January 1

₩ 16,301,812

12,663,024

Prot attributable to owners of the Parent Company

2,993,593

3,817,059

Dividends

(283,489)

(263,240)

Dened benet plan remeasurements

(162,118)

74,281

Change in remeasurements of associates

(34,144)

10,688

Balance at December 31

₩ 18,815,654

16,301,812

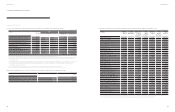

22. Earnings per Share

Details of calculating earnings per share for the years ended December 31, 2014 and 2013 are as follows:

(a) Basic earnings per share

2014 2013

Prot attributable to owners of the Parent Company

₩ 2,993,593,266,805

3,817,059,084,178

Weighted-average number of common shares outstanding(*)

404,922,715

404,985,231

Earnings per share

₩ 7,393

9,425

(*) The weighted-average number of common equivalent shares are calculated by average outstanding period, and treasury shares are not included in the number of common equivalent shares.

(b) Basic and diluted earnings per share are the same for the year ended December 31, 2014 since there are no dilutive potential ordinary shares as

of December 31, 2014.

23. Dividends

(a) Details of dividends for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

Number of shares issued

405,363,347

405,363,347

Number of treasury shares

(1,305,122)

(378,116)

Number of dividend shares

404,058,225

404,985,231

Par value per share

₩ 5,000

5,000

Dividends as a percentage of par value

20%

14%

Dividend amount

₩ 404,058

283,489

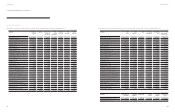

(b) Dividends payout ratio for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

Dividend amount

₩ 404,058

283,489

Prot attributable to owners of the Parent Company

2,993,593

3,817,059

Dividend payout ratio

13.50%

7.43%

(c) Dividend yield ratio for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

Dividend per share

₩ 1,000

700

Market price as of year end

52,300

56,100

Dividend yield ratio

1.91%

1.25%

(KRW in millions)

(KRW in millions)

(KRW in millions)

(KRW in millions)

(In won, except number of shares)

(In won, except for ratio)

(KRW in millions)

(KRW in millions, except shares and par value)

102 103

Annual Report 2014Financial Review