Kia 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

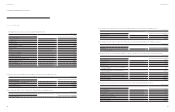

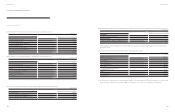

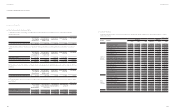

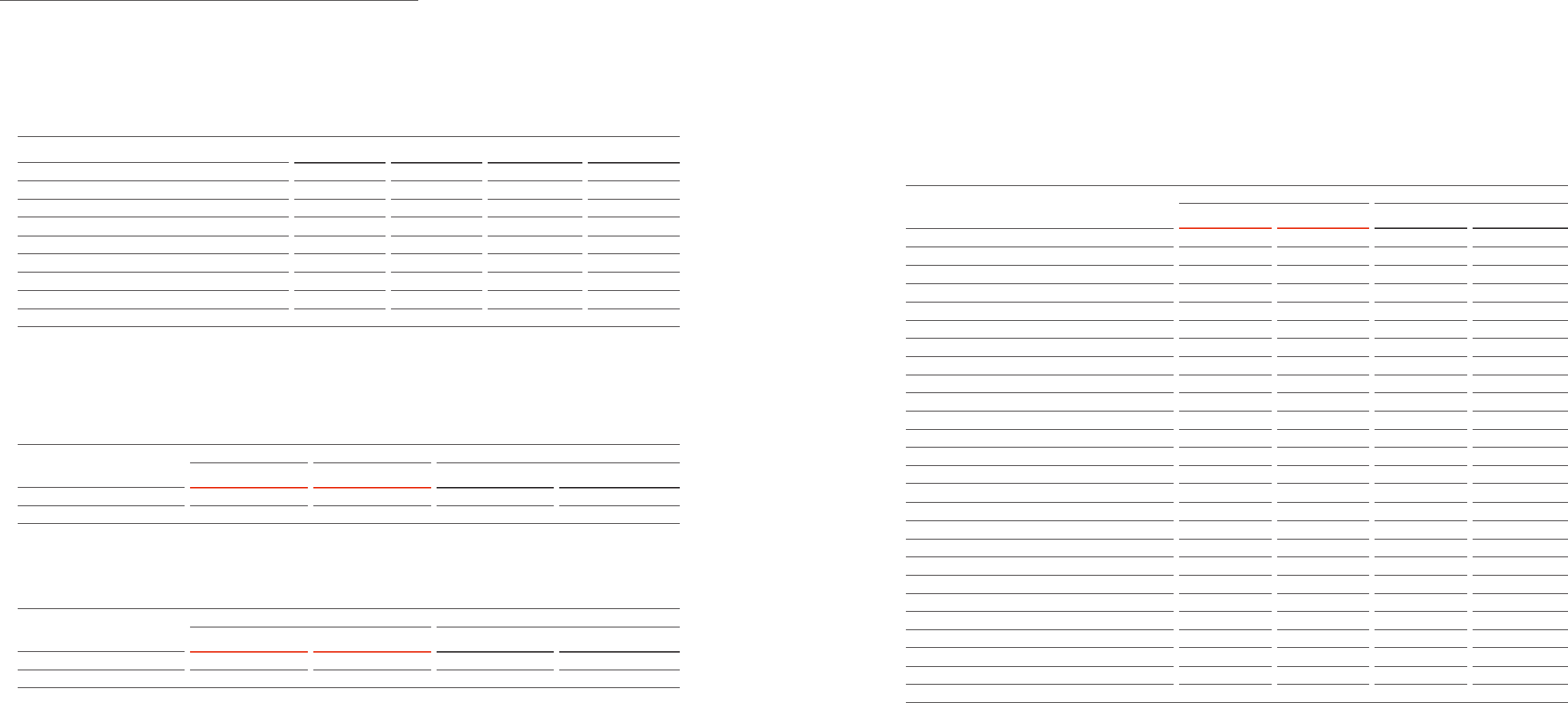

(e) Fair value

(i) Fair value and carrying amount

Details of fair value and carrying amount of nancial assets and liabilities by category as of December 31, 2014 and 2013 are summarized as

follows:

2014 2013

Carrying amount Fair value Carrying amount Fair value

Financial instruments at fair value through prot or loss:

Financial instruments at fair value through prot or loss

₩ 200,056 200,056 - -

Loans and receivables:

Cash and cash equivalents

₩ 2,478,470 2,478,470 2,311,264 2,311,264

Short-term nancial instruments

3,458,889 3,458,889 4,035,379 4,035,379

Account and notes receivable – trade

2,419,265 2,419,265 2,072,818 2,072,818

Account and note receivable – other

514,366 514,366 468,210 468,210

Long-term account and notes receivable – trade

3,836 3,836 1,662 1,662

Other nancial assets

456,330 456,330 640,517 640,517

₩ 9,331,156 9,331,156 9,529,850 9,529,850

Available-for-sale nancial assets:

Short-term available-for-sale nancial assets

1,176,362 1,176,362 8,000 8,000

Long-term available-for-sale nancial assets

1,245,287 1,245,287 1,237,107 1,237,107

₩ 2,421,649 2,421,649 1,245,107 1,245,107

Financial derivatives assets:

Currency swap (risk hedge)

₩ 1,448 1,448 - -

Liabilities recognized by amortized cost:

Accounts and notes payable - trade

₩ 5,888,191 5,888,191 5,192,589 5,192,589

Accounts and notes payable - other

1,959,339 1,959,339 1,763,692 1,763,692

Bonds

1,112,073 1,133,989 1,508,184 1,450,395

Borrowings

3,579,120 3,547,348 1,813,586 1,839,613

Financial lease liabilities

9,853 9,853 17,382 17,382

Other nancial liabilities

1,424,263 1,424,263 1,206,895 1,206,895

₩ 13,972,839 13,962,983 11,502,328 11,470,566

Financial derivatives liabilities:

Currency swap (risk hedge)

₩ 2,157 2,157 - -

(KRW in millions)

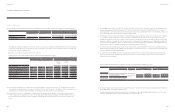

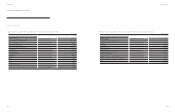

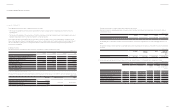

(ii) Aggregate maturities of the Company’s nancial liabilities, including estimated interest, as of December 31, 2013 are summarized as follows:

Within 1 year

1~5 years Over 5 years

Total

Accounts and notes payable - trade ₩ 5,192,589 - - 5,192,589

Accounts and notes payable - other 1,763,692 - - 1,763,692

Accrued expenses 1,119,919 - - 1,119,919

Bonds 471,904 1,140,048 - 1,611,952

Borrowings 1,265,176 675,399 23,717 1,964,292

Financial lease liabilities 6,567 16,266 - 22,833

Other current liabilities 2,182 - - 2,182

Other non-current liabilities - 86,143 -86,143

₩ 9,822,029 1,917,856 23,717 11,763,602

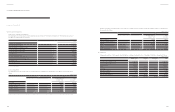

(c) Foreign exchange risk

The Company’s capital and income (loss) would have been increased or decreased, if the foreign exchange rate against USD and EUR were

higher. The Company assumes that interest rate uctuates 10% at year ended period. Also, the Company assumes that others variables such as

interest rate are not changed by sensitive analysis. The Company analyzed by the same method as used for last period and details for the effect

on income before taxes are summarized as follows:

2014 2013

10% Up 10% Down 10% Up 10% Down

USD

₩ (186,042) 186,042

(131,830) 131,830

EUR

(14,403) 14,403 16,016 (16,016)

(d) Interest rate risk

Sensitivity analysis of interest expenses and interests income from changes of interests rate for the years ended December 31, 2014 and 2013 are

as summarized as follows:

2014 2013

10% Up 10% Down 10% Up 10% Down

Interest income

₩ 24,785 (24,785)

23,110 (23,110)

Interest expense

12,900 (12,900) 10,762 (10,762)

(KRW in millions)

(KRW in millions)

(KRW in millions)

116 117

Annual Report 2014Financial Review