Kia 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

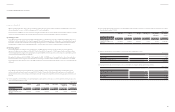

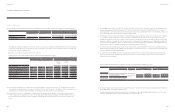

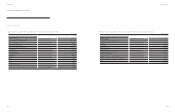

(g) Sensitivity analysis of dened obligations from changes of assumptions for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

1% Up 1% Down 1% Up 1% Down

Discount rate

₩ (198,981) 273,812

(142,639) 170,273

Rate of salary growth

139,455 (123,965) 170,074 (145,033)

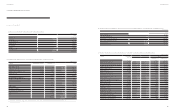

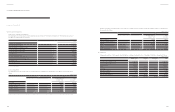

17. Provisions

The Company provides general warranty to the ultimate consumer for each product sold and accrues warranty expense at the time of sale based

on the history of actual claims. Also, the Company accrues potential expenses, which may occur due to replacement of parts or voluntary recalls

pending as of the end of the reporting period.

Other provision are comprised of provision related to loss on lawsuits.

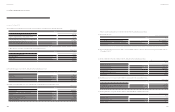

Changes in provisions for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

Provision of

warranty

for sale

Other

provision

Total

Provision of

warranty

for sale

Other

provision

Total

Balance at January 1 ₩ 2,011,256 29,537 2,040,793 1,802,983

31,365

1,834,348

Provisions made (reimbursed) during the year 997,232 (636) 996,596 1,050,494 641 1,051,135

Provisions used during the year (898,615) (19,106) (917,721) (835,862) (383) (836,245)

Other increase (decrease) (*) (72,570) 6,272 (66,298) (6,359) (2,086) (8,445)

Balance at December 31 ₩ 2,037,303 16,067 2,053,370 2,011,256 29,537 2,040,793

Thereof current 654,950 12,704 667,654 612,312 5,657 617,969

Thereof non-current

₩ 1,382,353 3,363 1,385,716 1,398,944 23,880 1,422,824

(*) Other decrease is mainly related to foreign currency translation impact.

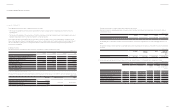

18. Commitments and Contingencies

(a) The Company provides guarantees for certain customers’ nancing relating to long-term installment sales. The oustanding amount for which

the Company has provided guarantees to the respective nancial institutions is ₩ 5,522 million as of December 31, 2014. These guarantees are

covered by insurance contracts in which the Company is the beneciary of the claim amount if the customer defaults.

(b) As of December 31, 2014, one certicate deposit of ₩ 1,415 million has been provided as collateral to Korea Defense Industry Association

(“KDIA”) for a performance guarantee on a contract. The Company has provided 1,500 units (carrying amount: ₩ 612 million) of the Korea

Defense Industry Association (“KDIA”), which are included in long-term available-for-sale nancial assets for a performance guarantee on a

contract.

(c) The Company provides guarantees for employees relating to borrowings to acquire shares of the Parent Company. The outstanding amount for

which the Company has provided collective guarantees to the Korea Securities Finance Corporation is ₩ 296,507 million as of December 31,

2014. Management is of the opinion that afore mentioned guarantees will not have a material adverse effect on the Company’s credit risk since

the Company has pledged its acquired shares as collateral for the borrowings.

(d) The Company is involved in several claims, litigations for alleged damages and product liabilities, which arose in the ordinary course of business,

as of December 31, 2014. Management is of the opinion that foregoing lawsuits and claims will not have a material adverse effect on the

Company’s nancial position and results of operations since the likelihood of unfavorable outcome is not probable nor amounts can be reliably

estimated. In addition, on December 18, 2013, the Supreme Court of Korea made a ruling regarding the scope of Ordinary Wage which could

be the basis for overtime payment, allowance for night work and others. As of December 31, 2014, management cannot reliably estimate the

potential impacts, if any, on the Company’s nancial position, nancial performance and cashows.

(e) In connection with long-term debt guaranteed, amounting to USD 98,333 thousand, by Hyundai Motor America, Inc. and Mobis America, Inc.,

Kia Motors Manufacturing Georgia, Inc. (KMMG) should pay guarantor fees calculated at a rate of 0.15% per annum on the outstanding debt

balance of KMMG which should be paid biannually.

(f) As of December 31, 2014, KMMG entered into an agreement with the West Point Development Authority and Troup Country Development

Authority to issue up to USD 2,700,000 thousand of taxable revenue bonds for a term through December 1, 2022, to fund the purchase of

building, machinery and equipment.

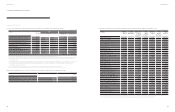

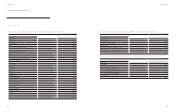

19. Derivative Financial Instruments and Hedge

Details of derivative nancial instruments to avoid risk as of December 31, 2014 and 2013 are summarized as follows:

Contract amount Fair Value

Purpose Derivatives 2014 2013 2014 2013

Cash ow hedge To hedge the variability of exchange

rate for expected export Forward foreign

currency

EUR 30,000 -448 -

USD 130,000 -(2,157) -

Fair value hedge Fair value hedge To hedge the variability

of exchange rate for foreign deposit EUR 120,000 -1,000 -

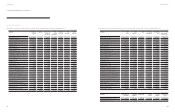

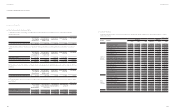

20. Equity

(a) The number of shares to issue, the number of shares issued and the par value of a share of the Parent Company are 820,000,000 shares, 405,363,347

shares and ₩ 5,000 as of December 31, 2014, respectively.

The Parent Company retired 10 million and 12.5 million shares of treasury shares on July 2, 2003 and May 28, 2004, respectively. Due to these stock

retirements, the aggregate par value of issued shares differs from the common stock amount.

(In thousands of foreign currency, KRW in millions)

(KRW in millions)

(KRW in millions)

100 101

Annual Report 2014Financial Review