Kia 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

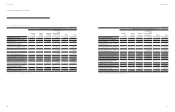

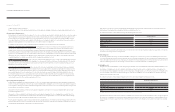

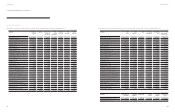

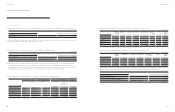

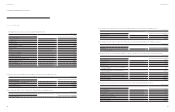

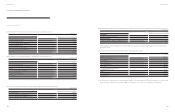

(a) Details of investments in associates and joint ventures as of December 31, 2014 and 2013 are summarized as follows:

Company Percentage of

ownership

2014 2013

Acquisition cost Carrying amount Acquisition cost Carrying amount

Hyundai Powertech (Shangdong) Co., Ltd. 25.00% ₩ 28,894 36,734 28,894 41,981

Dongfeng Yueda Kia Motors Co., Ltd.(*3) 50.00% 348,522 958,400 348,522 888,208

Hyundai Motor Manufacturing Russia LLC 30.00% 129,229 117,029 129,229 220,314

Innocean Worldwide Americas, LLC(*6) 20.00% 371 1,853 557 4,818

Hyundai Information System North America 30.00% 1,911 3,154 1,911 2,554

Sewon America, Inc. 40.00% 15,090 11,663 15,090 8,092

Hyundai Capital America(*5) 20.00% 453,093 503,842 - -

Hyundai Capital Services UK Ltd.(*3) 10.00% 6,080 9,407 7,814 7,561

Hyundai Capital Canada Inc. 40.00% 21,096 15,405 - -

₩ 3,381,425 10,470,634 2,704,375 9,197,720

(*1) Though the Company’s ownership is below 20%, the Company has signicant inuence on the nancial and operating policy decisions.

(*2) Though the Company has 100% of the ownership, equity method is applied because management believes that the difference between consolidation and applying equity method is immaterial.

(*3) The Company classied Dongfeng Yueda Kia motors Co., Ltd. and Hyundai Capital Services UK Ltd. as joint ventures since the Company has the right to the net assets established by

contractual agreement.

(*4) Hyundai AMCO Co., Ltd. was merged into Hyundai Engineering Co,. Ltd., which is an associate of the Company, during the period ended December 31, 2014. The difference between fair value

of the shares Hyundai Engineering Co., Ltd received and existing book value of Hyundai AMCO Co., Ltd. of ₩ 78,572 million was recognized as a gain on sale of investment in associates.

(*5) The Company was able to exercise signicant inuence on the entity by acquisition of shares in 2014, therefore reclassied the investment from available-for-sale nancial assets to

investments in associates and joint ventures.

(*6) The Company sells the part of its investment in the entity and recognized prot on investments in associates and joint ventures of ₩ 4,809 million.

(*7) In 2014, Hyundai CNI Co., Ltd. merge into Hyundai Autoever Systems Co., Ltd. and by the result the Company’s ownership decreased from 20.00% to 19.37%.

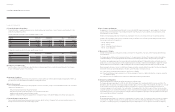

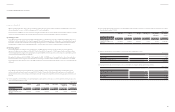

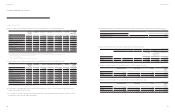

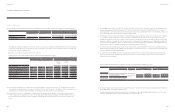

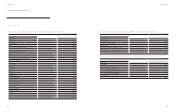

(b) Fair value of marketable securities of associates companies as of December 31, 2014 and 2013 are summarized as follows:

2014 2013

Hyundai Mobis Co., Ltd. ₩ 3,876,789 4,821,346

Hyundai Steel Company 1,463,622 1,989,142

Hyundai Engineering & Construction Co., Ltd. 245,521 353,993

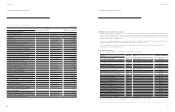

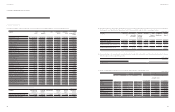

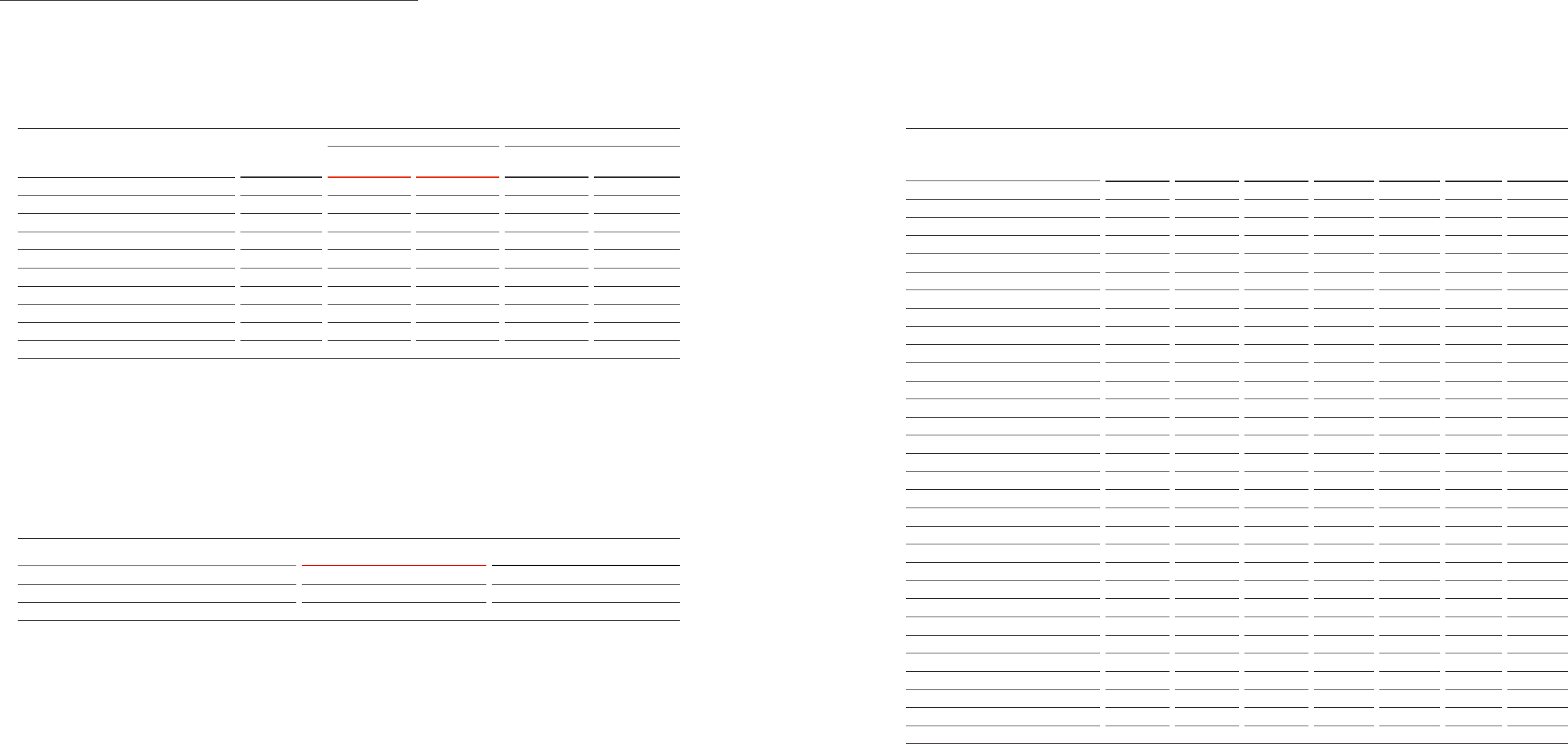

(c) Changes in investment in associates and joint ventures for the year ended December 31, 2014 are summarized as follows:

Company Beginning

balance

Acquisition

(Disposition)

Equity prot

or loss on

investment

Other

capital

movement

Dividends

received

Other

increase

(decrease)

Ending

balance

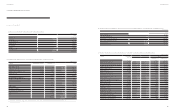

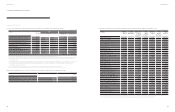

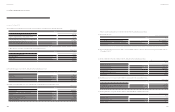

Hyundai Mobis Co., Ltd. ₩ 3,288,988 - 547,082 (33,315) (32,033) - 3,770,722

Hyundai Steel Company 2,566,364 - 149,354 (54,301) (11,525) - 2,649,892

Hyundai Engineering & Construction Co., Ltd. 762,700 - 12,671 10,266 (2,916) - 782,721

Hyundai Powertech Co., Ltd. 344,798 - 41,526 (149) - - 386,175

Hyundai Card Co., Ltd. 271,642 - 34,426 (5,392) - - 300,676

Hyundai Dymos Inc. 261,013 - 20,022 (2,416) - - 278,619

EUKOR Car Carriers Inc. 99,070 - 15,538 3,919 (5,280) - 113,247

Hyundai AMCO Co., Ltd. 129,764 (133,213) 2,632 817 - - -

Hyundai Engineering Co., Ltd. - 214,848 16,649 (7,987) (7,810) - 215,700

Hyundai Partecs Co., Ltd. 20,576 - 827 - - - 21,403

Hyundai Autoever Systems Co., Ltd. 44,487 - 10,206 693 (1,600) - 53,786

Donghee Auto Co., Ltd. 14,556 - 1,622 - - - 16,178

TRW Steering Co., Ltd. 1,124 - (362) 8 - - 770

Kia Tigers Co., Ltd. (*1) - - - - - - -

Hyundai NGV Co., Ltd. 1,653 - 513 - (20) - 2,146

Haevichi Resort Co., Ltd. 22,962 - (976) (330) - - 21,656

Hyundai Autron Co., Ltd. 19,212 - 682 (315) - - 19,579

Beijing Dymos Transmission Co., Ltd. 58,113 - 8,117 426 (9,201) - 57,455

China Millennium Corporations 21,852 - 3,305 849 - - 26,006

Hyundai Motor Company China Ltd. 93,526 - 13,854 2,461 (15,217) - 94,624

Yanji Kia Motors A/S and Repair(*2) 1,792 - - - - - 1,792

Hyundai Powertech (Shangdong) Co., Ltd. 41,981 - 16,852 (22,099) - - 36,734

Dongfeng Yueda Kia Motors Co., Ltd. 888,208 - 373,909 14,950 (318,667) - 958,400

Hyundai Motor Manufacturing Russia LLC 220,314 - 6,818 (64,651) (45,452) - 117,029

Innocean Worldwide Americas, LLC 4,818 (1,034) 2,180 - (3,928) (183) 1,853

Hyundai Information System North America 2,554 - 798 - (330) 132 3,154

Sewon America, Inc. 8,092 - 2,565 191 - 815 11,663

Hyundai Capital America - 453,093 35,147 - - 15,602 503,842

Hyundai Capital Services UK Ltd. 7,561 1,728 273 - - (155) 9,407

Hyundai Capital Canada Inc. - 21,096 (5,459) (232) - - 15,405

₩ 9,197,720 556,518 1,310,771 (156,607) (453,979) 16,211 10,470,634

(*1) The Company discontinued the application of the equity method for investment in associates of Kia Tigers Co., Ltd. due to the carrying amount of Company’s share being reduced to zero as of December 31, 2014.

(*2) These investments in associates are recorded at cost as management believe that the effect of applying the equity method of accounting for the investments is immaterial.

(KRW in millions)(KRW in millions)

(KRW in millions)

86 87

Annual Report 2014Financial Review