Kia 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

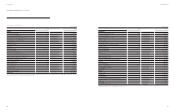

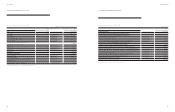

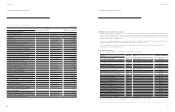

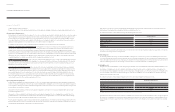

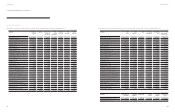

Note 2014 2013

Cash ows from operating activities

Cash generated from operations 29 ₩ 2,679,387 5,051,324

Interest received 231,950 189,032

Interest paid (90,707) (106,408)

Dividends received 467,969 430,336

Income tax paid (924,774) (787,691)

Net cash provided by operating activities 2,363,825 4,776,593

Cash ows from investing activities

Proceeds from sale of long-term nancial instruments 211,881 -

Proceeds from sale of investments in associates -7,266

Proceeds from sale of property, plant and equipment 41,275 157,714

Proceeds from sale of intangible assets 468 610

Proceeds from sale of short-term nancial instruments 900,953 -

Purchase of short-term nancial instruments, net (320,614) (1,548,149)

Purchase of long-term nancial instruments, net (3,080) (355,387)

Acquisition of investments in associates (156,098) (89,200)

Acquisition of available-for-sale nancial assets (1,440,341) (24)

Acquisition of property, plant and equipment (1,429,596) (1,192,372)

Acquisition of intangible assets (589,855) (551,550)

Cash ows from other investing activities (198,399) 57,152

Net cash used in investing activities (2,983,406) (3,513,940)

Cash ows from nancing activities

Cash ows from short-term borrowings and long-term debt 2,231,693 -

Dividends paid (283,489) (263,240)

Repayment of short-term borrowings and long-term debt (460,184) (421,251)

Repayment of bonds (426,590) (100,000)

Repayment of current portion of nancial lease liabilities (6,962) (5,860)

Acquisition of treasury stock (64,495) -

Cash ows from other nancing activities (3,482) (856)

Net cash provided by (used in) nancing activities 986,491 (791,207)

Impact on foreign currency exchange rates on

cash and cash equivalents (199,704) (63,491)

Net increase (decrease) in cash and cash equivalents 167,206 407,955

Cash and cash equivalents at January 1 2,311,264 1,903,309

Cash and cash equivalents at December 31 ₩ 2,478,470 2,311,264

See accompanying notes to the consolidated nancial statements.

For the years ended December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

Consolidated Statements of

Cash Flows

KIA MOTORS CORPORATION AND SUBSIDIARIESKIA MOTORS CORPORATION AND SUBSIDIARIES

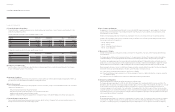

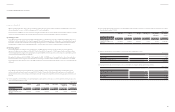

1. General Description of Parent Company and Subsidiaries

(a) Organization and description of the Company

Kia Motors Corporation (the “Parent Company”), one of the leading motor vehicle manufacturers in Korea, was established in December 1944

under the laws of the Republic of Korea to manufacture and sell a range of passenger cars, recreational vehicles and other commercial vehicles in

the domestic and international markets. The Parent Company owns and operates three principal automobile production sites: the Sohari factory,

the Hwasung factory and the Kwangju factory.

The shares of the Parent Company have been listed on the Korea Exchange since 1973. As of December 31, 2014, the Parent Company’s largest

shareholder is Hyundai Motor Company, which holds 33.88 percent of the Parent Company’s stock.

The consolidated nancial statements comprise the Parent Company and its subsidiaries (together referred to as the “Company”) and the

Company’s interest in associates and joint ventures.

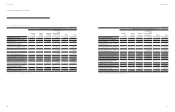

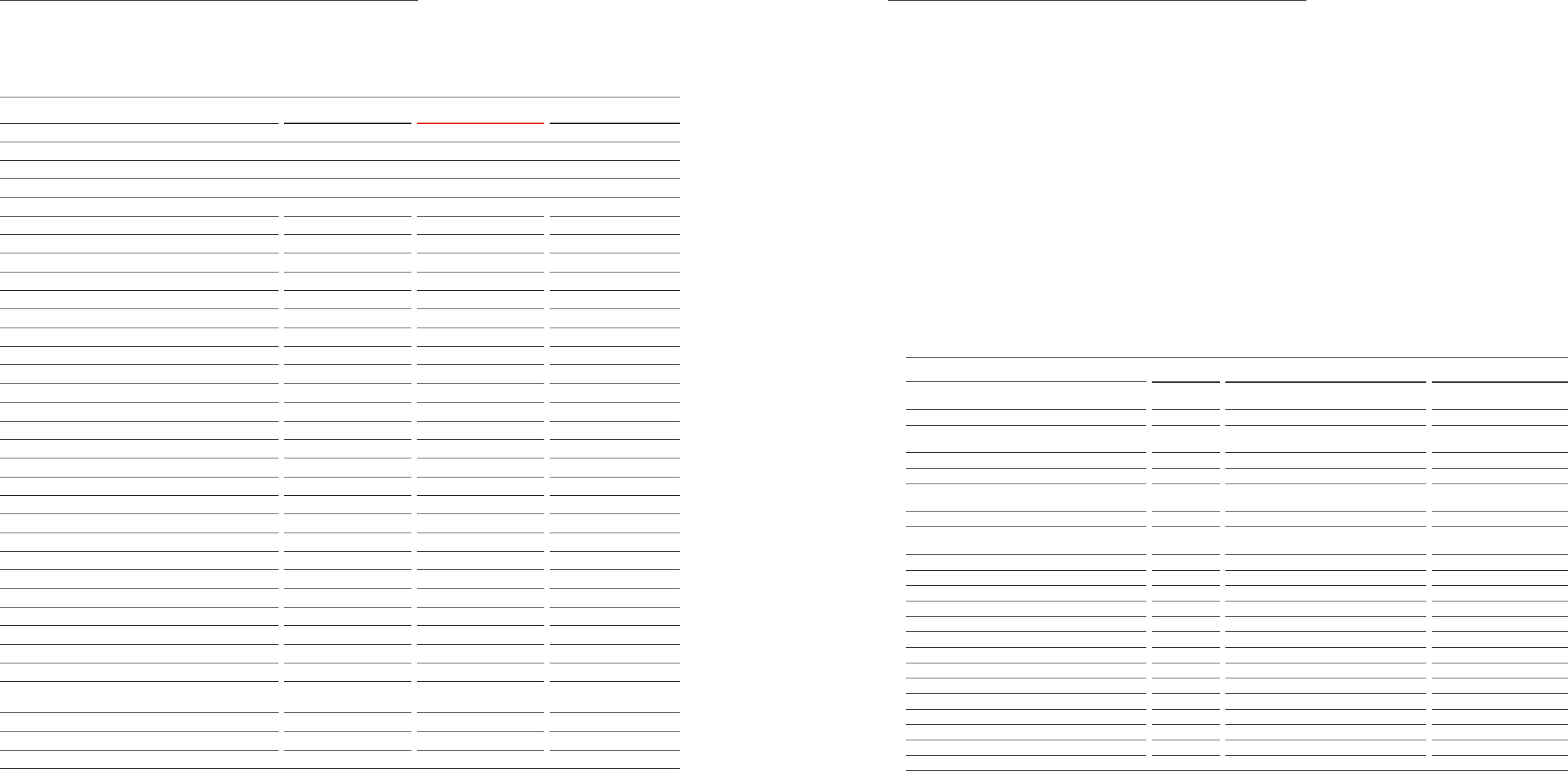

(b) Consolidated subsidiaries

Details of consolidated subsidiaries as of December 31, 2014 are summarized as follows:

Subsidiary Location Business Percentage of ownership

Kia Motors America, Inc. (KMA) U.S.A. Exclusive importer and distributor of motor

vehicles and parts 100.00%

Kia Motors Manufacturing Georgia, Inc. (KMMG) (*1) U.S.A. Manufacturing and sale of vehicles and parts 100.00%

Kia Canada Inc. (KCI) (*2) Canada Exclusive importer and distributor of motor

vehicles and parts 100.00%

Kia Motors Deutschland GmbH (KMD) Germany ” 100.00%

Kia Motors Europe GmbH (KME) Germany Holding company 100.00%

Kia Motors Polska Sp.z.o.o. (KMP) (*3) Poland Exclusive importer and distributor of motor

vehicles and parts 100.00%

Kia Motors Slovakia s.r.o. (KMS) Slovakia Manufacturing and sale of vehicles and parts 100.00%

Kia Motors Sales Slovensko s.r.o. (KMSs) (*4) Slovakia Exclusive importer and distributor of motor

vehicles and parts 100.00%

Kia Motors Belgium (KMB) (*4) Belgium ” 100.00%

Kia Motors Czech s.r.o. (KMCZ) (*4) Czech ” 100.00%

Kia Motors UK Ltd. (KMUK) (*4) England ” 100.00%

Kia Motors Austria GmbH (KMAS) (*4) Austria ” 100.00%

Kia Motors Hungary K.f.t (KMH) (*4) Hungary ” 100.00%

Kia Motors Iberia (KMIB) (*4) Spain ” 100.00%

Kia Motors Sweden AB (KMSW) (*4) Sweden ” 100.00%

Kia Motors France SAS (KMF) (*4) France ” 100.00%

Kia Motors Nederland BV (KMNL) (*4) Netherlands ” 100.00%

Kia Motors Company Italy S.r.l (KMIT) (*4) Italy ” 100.00%

Kia Motors Russia LLC (KMR) (*5) Russia ” 100.00%

Kia Motors Australia Pty Ltd. (KMAU) Australia ” 100.00%

Kia Motors New Zealand Pty Ltd. (KMNZ) (*6) New Zealand ” 100.00%

Kia Motors Mexico S.A de C.V. (KMM) (*7) Mexico Manufacturing and sale of vehicles and parts 100.00%

(*1) 100.00% owned by KMA, (*2) 17.47% owned by KMA, (*3) 100.00% owned by KMD, (*4) 100.00% owned by KME,

(*5) 80.00% owned by KME and 20.00% owned by KMD, (*6) 100.00% owned by KMAU, (*7) 0.01% owned by KMA

Thirty-fourth of investment trusts other than stated in the note above are separate entities and the entities are consolidated as they are under control of KMC.

(KRW in millions)

68 69

Annual Report 2014Financial Review