Kia 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

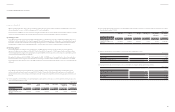

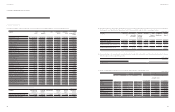

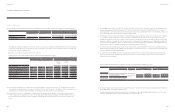

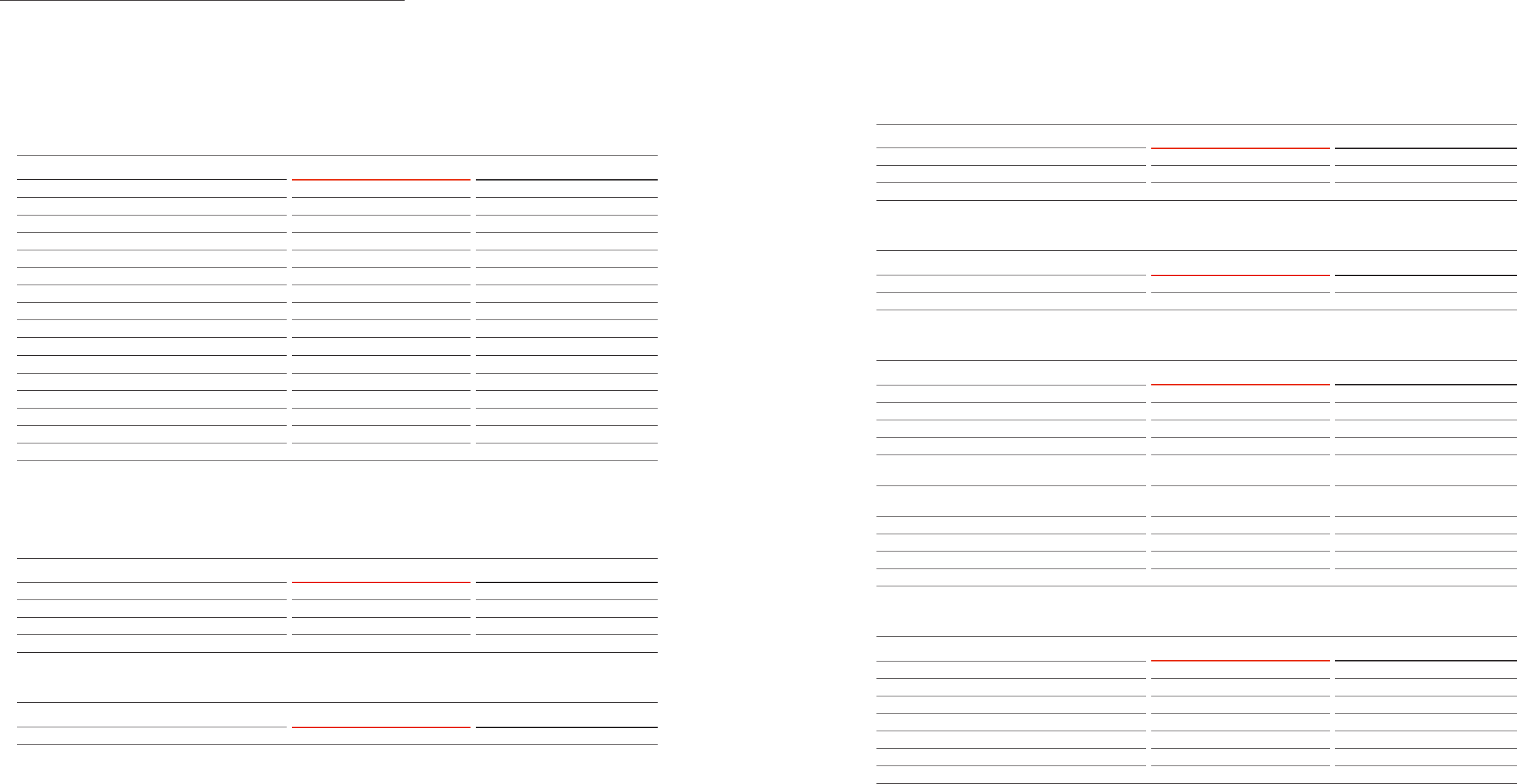

15. Other Liabilities

Other liabilities as of December 31, 2014 and 2013 are summarized as follows:

2014 2013

Other current liabilities:

Unearned income

₩ 7,789

11,207

Dividends payable

24

24

Guarantee received

2,335

2,158

Finance lease liabilities - current

5,278

5,934

Derivatives liability

2,157

-

Others

21,134

18,350

₩ 38,717 37,673

Other non-current liabilities:

Leasehold deposits received

₩ 14,586

18,103

Long-term unearned income

374

403

Long-term accounts and notes payable - other

1,979

5,018

Liability for payment guarantee

856

1,349

Finance lease liabilities

4,575

11,448

Long-term accrued expenses

46,154

61,673

₩ 68,524 97,994

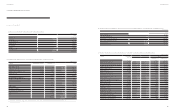

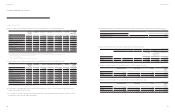

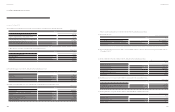

16. Employee Benets

(a) Details of net dened benet liabilities as of December 31, 2014 and 2013 are summarized as follows:

2014 2013

Dened benet plan:

Present value of dened benet obligations

₩ 1,603,218

1,154,866

Fair value of plan assets

(1,271,212)

(982,952)

Net dened benet liabilities

₩ 332,006

171,914

(b) The components of plan assets as of December 31, 2014 and 2013 are summarized as follows:

2014 2013

Time deposits and others

₩ 1,271,212

982,952

(c) The components of retirement benet costs for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

Current service costs

₩ 244,958

251,570

Interest costs, net

7,717

791

₩ 252,675

252,361

(d) The principal actuarial assumptions used related to plans in Korea as of December 31, 2014 and 2013 are summarized as follows:

2014 2013

Discount rate

3.53%

4.50%

Rate of future salary growth

5.00%

5.00%

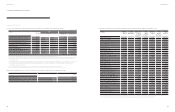

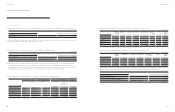

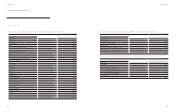

(e) Changes in present value of dened benet obligations for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

Balance at January 1

₩ 1,154,866 961,535

Current service costs

244,958

251,570

Interest costs

51,721

37,588

Remeasurements of:

Net actuarial gains(losses) of the effect of demographic

assumptions change 402

(770)

Net actuarial gains(losses) of the effect of nancial

assumptions change 192,814

(82,013)

Other

(11,719)

3,902

Increase (decrease) due to transference between afliates

2,111

(1,999)

Benet paid by the plan

(31,935) (14,947)

Balance at December 31

₩ 1,603,218

1,154,866

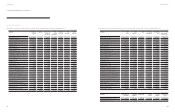

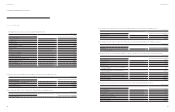

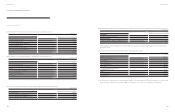

(f) Changes in fair value of plan assets for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

Balance at January 1

₩ 982,952

940,084

Return on plan assets

44,004

36,797

Remeasurements

(14,424)

(2,774)

Contribution paid into the plan

280,000

17,000

Transference between afliates, net

810

114

Benet paid by the plan

(22,130)

(8,269)

Balance at December 31

₩ 1,271,212

982,952

(KRW in millions)

(KRW in millions)

(KRW in millions)

(KRW in millions)

(KRW in millions)

(KRW in millions)

(KRW in millions)

98 99

Annual Report 2014Financial Review