Kia 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

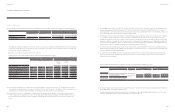

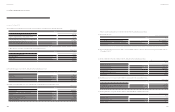

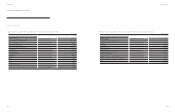

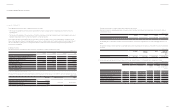

Changes in allowance for doubtful trade accounts and notes receivable and other receivables for the years ended December 31, 2014 and 2013

are summarized as follows:

2014 2013

Accounts and notes

receivable- trade

Other

receivable

Accounts and notes

receivable- trade

Other

receivable

Balance at January 1

₩ 101,033 17,046

119,395 24,603

Collection of written-off amount

8,534 - 146 -

Write-off

(930) (2,760) (18,434) (7,410)

Allowance for doubtful accounts

(8,010) 592 (1,092) (181)

Others

(1,964) (141) 1,018 34

Balance at December 31

₩ 98,663 14,737 101,033 17,046

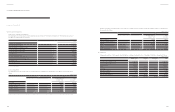

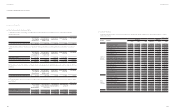

(b) Liquidity risk

(i) Aggregate maturities of the Company’s nancial liabilities, including estimated interest, as of December 31, 2014 are summarized as follows:

Within 1 year

1~5 years Over 5 years

Total

Accounts and notes payable - trade ₩ 5,888,191 - - 5,888,191

Accounts and notes payable - other 1,959,339 - - 1,959,339

Accrued expenses 1,359,185 - - 1,359,185

Bonds 337,880 832,017 - 1,169,897

Borrowings 1,564,586 2,024,040 114,760 3,703,386

Financial lease liabilities 5,598 4,665 - 10,263

Other current liabilities 4,516 - - 4,516

Other non-current liabilities - 63,575 -63,575

₩ 11,119,295 2,924,297 114,760 14,158,352

(KRW in millions)

(KRW in millions)

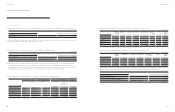

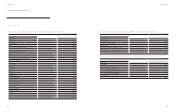

31. Risk Management of Financial Instruments

(a) Credit and counterparty risk

(i) Exposure to credit and counterparty risk

The carrying amount of nancial assets means maximum exposure in respect of credit and counterparty risk. The maximum exposure as of

December 31, 2014 and 2013 are as follows:

2014 2013

Cash and cash equivalents (*)

₩ 2,478,171

2,310,787

Short-term nancial instruments

3,458,889 4,035,379

Short-term available-for-sale nancial assets

1,176,358

8,000

Accounts and notes receivable - trade

2,419,265

2,072,818

Accounts and notes receivable - other

514,366

468,210

Other current assets

301,864

90,796

Long-term nancial instruments

84,349

294,377

Long-term available-for-sale nancial assets

260,324

630

Long-term accounts and notes receivable - trade

3,836

1,662

Guarantee deposits

168,929

162,190

Other non-current assets

102,692

93,154

₩ 10,969,043

9,538,003

(*) Cash on hand is excluded.

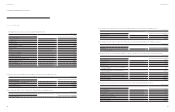

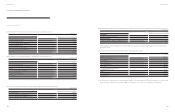

(ii) Loss on impairment

The carrying amount of trade account and notes receivable and other receivable based on by maturity as of December 31, 2014 and 2013 are as

follows:

2014 2013

Accounts and notes

receivable- trade

Other

receivable (*)

Accounts and notes

receivable- trade

Other

receivable (*)

Not overdue

₩ 1,934,720 786,748

1,958,343 691,216

Past due less than 3 month

346,183 20,028 84,981 39,860

Past due 4~ 6 month

139,418 49,826 3,962 21,973

Past due 7~12 month

2,311 1,222 23,296 1,220

Past due over 12 month

99,132 29,089 104,931 47,043

₩ 2,521,764 886,913 2,175,513 801,312

(*) Other receivables are comprised of other accounts and notes receivables, long-term other accounts and notes receivables, accrued income, short-term loans and guarantee deposits.

(KRW in millions)

(KRW in millions)

114 115

Annual Report 2014Financial Review