Kia 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

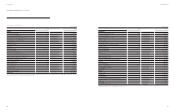

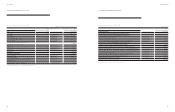

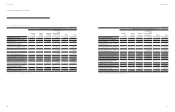

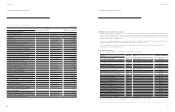

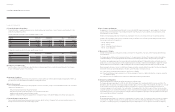

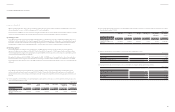

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

RESEARCH AND DEVELOPMENT Expenditures on research activities, undertaken with the prospect of gaining new scientic or technical

knowledge and understanding, is recognized in prot or loss as incurred. Development expenditures are capitalized only if development costs

can be measured reliably, the product or process is technically and commercially feasible, future economic benets are probable, and the

Company intends to and has sufcient resources to complete development and to use or sell the asset. Other development expenditures are

recognized in prot or loss as incurred.

SUBSEQUENT EXPENDITURES Subsequent expenditures are capitalized only when they increase the future economic benets embodied in the

specic asset to which it relates. All other expenditures, including expenditures on internally generated goodwill and brands, are recognized in

prot or loss as incurred.

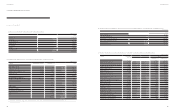

(m) Investment property

Property held for the purpose of earning rentals or beneting from capital appreciation is classied as investment property. Investment property

is measured initially at its cost. Transaction costs are included in the initial measurement. Subsequently, investment property is carried at

depreciated cost less any accumulated impairment losses.

(n) Impairment of non-nancial assets

The carrying amounts of the Company’s non-nancial assets, other than assets arising from employee benets, inventories and deferred tax assets, are

reviewed at the end of the reporting period to determine whether there is any indication of impairment. If any such indication exists, then the asset’s

recoverable amount is estimated. Goodwill and intangible assets that have indenite useful lives or that are not yet available for use, irrespective of

whether there is any indication of impairment, are tested for impairment annually by comparing their recoverable amount to their carrying amount.

The Company estimates the recoverable amount of an individual asset. If it is impossible to measure the individual recoverable amount of an

asset, then the Company estimates the recoverable amount of cash-generating unit (“CGU”). The recoverable amount of an asset or a CGU

is the greater of its value in use and its fair value less costs to sell. The value in use is estimated by applying an pre-tax discount rate that reect

current market assessments of the time value of money and the risks specic to the asset or CGU for which estimated future cash ows have not

been adjusted, to the estimated future cash ows expected to be generated by the asset or a CGU.

An impairment loss is recognized if the carrying amount of an asset or a CGU exceeds its recoverable amount. Impairment losses are recognized

in prot or loss.

An impairment loss is reversed if there has been a change in the estimates used to determine the recoverable amount. An impairment loss is

reversed only to the extent that the asset’s carrying amount does not exceed the carrying amount that would have been determined, net of

depreciation or amortization, if no impairment loss had been recognized.

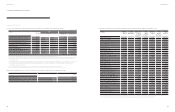

(o) Leases

The Company classies and accounts for leases as either a nance or operating lease, depending on the terms. Leases where the Company

assumes substantially all of the risks and rewards of ownership are classied as nance leases. All other leases are classied as operating leases.

In case of nancial leases, at the commencement of the lease term, the Company recognizes as nance assets and nance liabilities in its

consolidated statements of nancial position, the lower amount of the fair value of the leased property and the present value of the minimum

lease payments, each determined at the inception of the lease. Any initial direct costs are added to the amount recognized as an asset. Also,

minimum lease payments are apportioned between the nance charge and the reduction of the outstanding liability. The nance charge is

allocated to each period during the lease term so as to produce a constant periodic rate of interest on the remaining balance of the liability.

The depreciable amount of a leased asset is allocated to each accounting period during the period of expected use on a systematic basis

consistent with the depreciation policy the lessee adopts for depreciable assets that are owned. If there is no reasonable certainty that the

lessee will obtain ownership by the end of the lease term, the asset is fully depreciated over the shorter of the lease term and its useful life. The

Company reviews to determine whether the leased asset may be impaired.

(p) Government grants

Government grants are not recognized unless there is reasonable assurance that the Company will comply with the grant’s conditions and that

the grant will be received. Government grants whose primary condition is that the Company purchase, construct or otherwise acquire long-term

assets are deducted in calculating the carrying amount of the asset. The grant is recognized in prot or loss over the life of a depreciable asset as

a reduction to depreciation expense.

Other government grants which are intended to compensate the Company for expenses incurred are deducted from related costs over the

periods in which the Company recognizes the related costs as expenses. Government grants which are intended to give immediate nancial

support to the Company with no future related costs are recognized as government grant income in prot or loss.

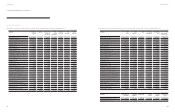

(q) Employee benets

SHORT-TERM EMPLOYEE BENEFITS Short-term employee benets are employee benets that are due to be settled within 12 months after the

end of the period in which the employees render the related service. When an employee has rendered service to the Company during an accounting

period, the Company recognizes the undiscounted amount of short-term employee benets expected to be paid in exchange for that service.

OTHER LONG-TERM EMPLOYEE BENEFITS Other long-term employee benets include employee benets that are settled beyond 12 months

after the end of the period in which the employees render the related service, and are calculated at the present value of the amount of future

benet that employees have earned in return for their service in the current and prior periods, less the fair value of any related assets. The present

value is determined by discounting the expected future cash ows using the interest rate of high-quality corporate bonds that have maturity

dates approximating the terms of the Company’s obligations and that are denominated in the same currency in which the benets are expected

to be paid. Any actuarial gains and losses are recognized in prot or loss in the period in which they arise.

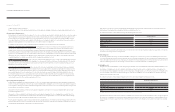

RETIREMENT BENEFITS: DEFINED BENEFIT PLANS The Company’s net obligation in respect of dened benet plans is calculated separately

for each plan by estimating the amount of future benet that employees have earned in the current and prior periods, discounting that amount

and deducting the fair value of any plan assets.

The calculation of dened benet obligations is performed annually by a qualied actuary using the projected unit credit method. When the

calculation results in a potential asset for the Company, the recognized asset is limited to the present value of economic benets available in the

form of any future refunds from the plan or reductions in future contributions to the plan. To calculate the present value of economic benets,

consideration is given to any applicable minimum funding requirements.

Remeasurements of the net dened benet liability, which comprise actuarial gains and losses, the return on plan assets (excluding interest) and

the effect of the asset ceiling (if any, excluding interest), are recognized immediately in OCI. The Company determines the net interest expense

(income) on the net dened benet liability (asset) for the period by applying the discount rate used to measure the dened benet obligation

at the beginning of the annual period to the then-net dened benet liability (asset), taking into account any changes in the net dened benet

liability (asset) during the period as a result of contributions and benet payments. Net interest expense and other expenses related to dened

benet plans are recognized in prot or loss.

When the benets of a plan are changed or when a plan is curtailed, the resulting change in benet that relates to past service or the gain or loss

on curtailment is recognized immediately in prot or loss. The Company recognizes gains and losses on the settlement of a dened benet plan

when the settlement occurs.

In addition, employees of KMA are eligible to participate, upon meeting certain service requirement, in the prot sharing retirement plan and

dened benet pension plan under the Internal Revenue Code 401(k) in the United States. KMA and employees of KMA paid each contributions

during the period in which the employees render the related service.

78 79

Annual Report 2014Financial Review