Kia 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

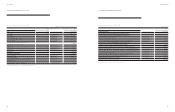

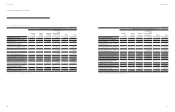

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

(ii) Other derivative nancial instruments

Changes in the fair value of other derivative nancial instrument not designated as a hedging instrument are recognized immediately in prot or loss.

(i) Impairment of nancial assets

A nancial asset not carried at fair value through prot or loss is assessed at each reporting date to determine whether there is objective evidence

that it is impaired. A nancial asset is impaired if objective evidence indicates that a loss event has occurred after the initial recognition of the

asset, and that the loss event had a negative effect on the estimated future cash ows of that asset that can be estimated reliably. However,

losses expected as a result of future events, regardless of likelihood, are not recognized. In addition, for an investment in an equity security, a

signicant or prolonged decline in its fair value below its cost is objective evidence of impairment.

If nancial assets have objective evidence that they are impaired, impairment losses should be measured and recognized.

FINANCIAL ASSETS MEASURED AT AMORTIZED COST An impairment loss in respect of a nancial asset measured at amortized cost is

calculated as the difference between its carrying amount and the present value of its estimated future cash ows discounted at the asset’s

original effective interest rate. If it is not practicable to obtain the instrument’s estimated future cash ows, impairment losses would be

measured by using prices from any observable current market transactions. The Company can recognize impairment losses directly or establish

a provision to cover impairment losses. If, in a subsequent period, the amount of the impairment loss decreases and the decrease can be related

objectively to an event occurring after the impairment was recognized (such as an improvement in the debtor’s credit rating), the previously

recognized impairment loss shall be reversed either directly or by adjusting an allowance account.

FINANCIAL ASSETS CARRIED AT COST If there is objective evidence that an impairment loss has occurred on an unquoted equity instrument

that is not carried at fair value, the amount of the impairment loss is measured as the difference between the carrying amount of the nancial

asset and the present value of estimated future cash ows discounted at the current market rate of return for a similar nancial asset. Such

impairment losses shall not be reversed.

AVAILABLE-FOR-SALE FINANCIAL ASSETS When a decline in the fair value of an available-for-sale nancial asset has been recognized in

other comprehensive income and there is objective evidence that the asset is impaired, the cumulative loss that had been recognized in other

comprehensive income is reclassied from equity to prot or loss as a reclassication adjustment even though the nancial asset has not been

derecognized. Impairment losses recognized in prot or loss for an investment in an equity instrument classied as available-for-sale is not

be reversed through prot or loss. If, in a subsequent period, the fair value of a debt instrument classied as available-for-sale increases and

the increase can be objectively related to an event occurring after the impairment loss was recognized in prot or loss, the impairment loss is

reversed, with the amount of the reversal recognized in prot or loss.

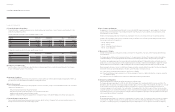

(j) Property, plant and equipment

Property, plant and equipment are initially measured at cost. The cost of property, plant and equipment includes expenditures arising directly

from the construction or acquisition of the asset, any costs directly attributable to bringing the asset to the location and condition necessary for

it to be capable of operating in the manner intended by management and the initial estimate of the costs of dismantling and removing the item

and restoring the site on which it is located.

Subsequent to initial recognition, an item of property, plant and equipment is carried at its cost less any accumulated depreciation and any

accumulated impairment losses.

Subsequent costs are recognized in the carrying amount of property, plant and equipment at cost or, if appropriate, as separate items if it is

probable that future economic benets associated with the item will ow to the Company and the cost of the item can be measured reliably.

The costs of the day-to-day servicing are recognized in prot or loss as incurred.

Property, plant and equipment, except for land, are depreciated on a straight-line basis over estimated useful lives that appropriately reect the

pattern in which the asset’s future economic benets are expected to be consumed. A component that is signicant compared to the total cost

of property, plant and equipment is depreciated over its separate useful life.

Gains and losses on disposal of an item of property, plant and equipment are determined by comparing the proceeds from disposal with the

carrying amount of property, plant and equipment and are recognized in prot or loss.

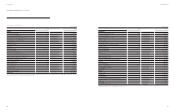

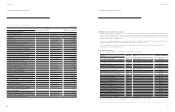

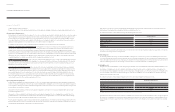

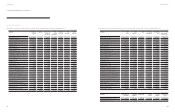

The estimated useful lives of the Company’s property, plant and equipment are as follows:

Useful lives (years)

Buildings and structures 20 – 40

Machinery and equipment 3 – 15

Dies, molds and tools 5

Vehicles 5

Other equipment 3 - 5

Depreciation methods, useful lives and residual values are reviewed at the end of each reporting date and adjusted, if appropriate. The change is

accounted for as a change in an accounting estimate.

(k) Borrowing costs

The Company capitalizes borrowing costs directly attributable to the acquisition, construction or production of a qualifying asset as part of the

cost of that asset. Other borrowing costs are recognized in expense as incurred. A qualifying asset is an asset that requires a substantial period of

time to get ready for its intended use or sale. Financial assets and inventories that are manufactured or otherwise produced over a short period of

time are not qualifying assets. Assets that are ready for their intended use or sale when acquired are not qualifying assets.

(l) Intangible assets

Intangible assets are measured initially at cost and, subsequently, are carried at cost less accumulated amortization and accumulated impairment losses.

Amortization of intangible assets except for goodwill is calculated on a straight-line basis over the estimated useful lives of intangible assets

from the date that they are available for intended use. The residual value of intangible assets is zero. However, as useful lives of intangible assets

are not foreseeable to the periods over which memberships are expected to be available for use, this intangible asset is determined as having

indenite useful lives and not amortized.

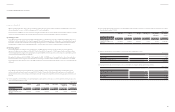

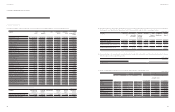

The estimated useful lives of the Company’s intangible assets for the current and comparative periods are as follows:

Estimated useful lives (years)

Industrial property rights 5, 10

Software 2~5

Development costs (*)

Country club membership and golf club membership Indenite

Other 25

(*) Capitalized development costs are amortized over the useful life considering the life cycle of the developed products.

Amortization periods and the amortization methods for intangible assets with nite useful lives are reviewed at the end of each reporting period.

The useful lives of intangible assets that are not being amortized are reviewed at the end of each reporting period to determine whether events

and circumstances continue to support indenite useful life assessments for those assets. Changes are accounted for as changes in accounting

estimates.

76 77

Annual Report 2014Financial Review