Kia 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

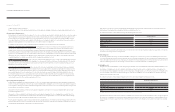

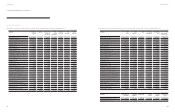

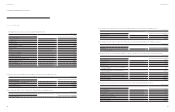

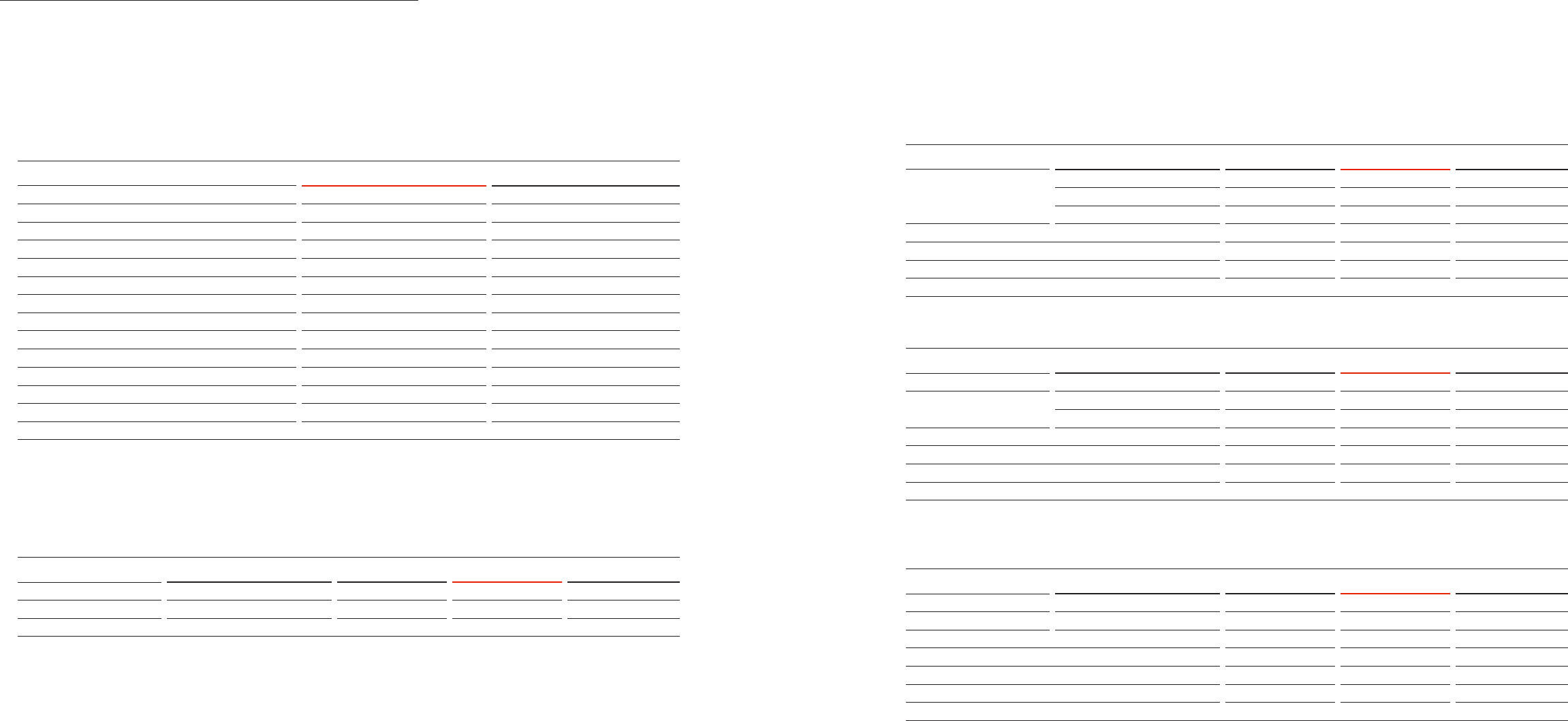

13. Other Assets

Other assets as of December 31, 2014 and 2013 are summarized as follows:

2014 2013

Other current assets:

Financial asset at fair value through prot or loss

₩ 200,056

-

Accrued income

87,904

73,758

Prepaid expenses

79,192

71,580

Derivatives asset

1,448

-

Deposits provided

2,162

2,163

Other

10,294

14,875

₩ 381,056 162,376

Other non-current assets:

Long-term accounts and notes receivable - other

₩ 98,816

77,588

Long-term prepaid expenses

500

1,601

Long-term advanced payments

9,406

7,822

Finance lease receivables

3,876

15,566

₩ 112,598 102,577

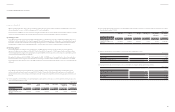

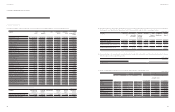

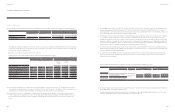

14. Borrowings

(a) Short-term borrowings

Short-term borrowings as of December 31, 2014 and 2013 are summarized as follows:

Lender Annual interest rate 2014 2013

Usance bills Woori Bank and others 0.39%~0.70%

₩ 117,158

133,941

Trade bills(*) Korea Development Bank and others 0.12%~4.05%

1,272,675

742,435

₩ 1,389,833 876,376

(*) The Company did not derecognize outstanding trade accounts and notes receivable transferred to the nancial institutions and recognized the transactions as borrowings from nancial

institutions.

(b) Long-term debt

Long-term debt in local currency as of December 31, 2014 and 2013 are summarized as follows:

Lender Annual interest rate 2014 2013

Facility loans

Korea Development Bank 2.83%

₩ 230,000

130,000

Nong Hyup Bank 2.78%~3.50%

180,000

70,000

Woori Bank 2.90%

200,000

-

General loans Kookmin Bank 3.13%

150,000

-

760,000

200,000

Less : current portion of long-term borrowing

-

-

₩ 760,000 200,000

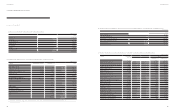

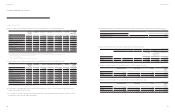

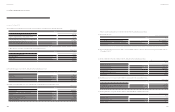

Long-term debt in foreign currency as of December 31, 2014 and 2013 are summarized as follows:

Lender Annual interest rate 2014 2013

General loans Citi Bank and others 1.01%~1.78%

₩ 763,259

270,830

Facility loans and others Deutsche Bank and others 0.32%~2.11%

348,359

270,293

Citi Bank Korea -

-

196,087

Overseas investment loans Korea Development Bank and others 1.56%

317,669

-

1,429,287

737,210

Less : current portion of long-term borrowing

(119,387)

(332,242)

₩ 1,309,900 404,968

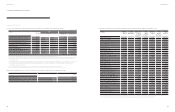

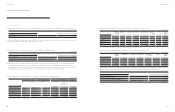

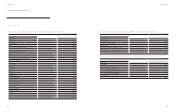

(c) Bonds

Bonds as of December 31, 2014 and 2013 are summarized as follows:

Due Annual interest rate 2014 2013

Unsecured public debentures 2015.8.24~ 2017.11.24 4.02%~4.69%

₩ 400,000

510,000

Unsecured foreign debentures 2016.2.25 2.13%

164,880

474,885

Foreign public debentures 2016.6.14 3.63%

549,600

527,650

1,114,480

1,512,535

Less : discounts on debentures

(2,407)

(4,351)

Less : current portion of long-term borrowing

(299,710)

(426,406)

₩ 812,363 1,081,778

(KRW in millions)

(KRW in millions)

(KRW in millions)

(KRW in millions)

(KRW in millions)

96 97

Annual Report 2014Financial Review