Kia 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

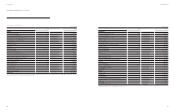

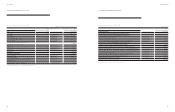

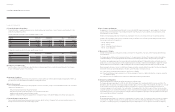

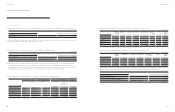

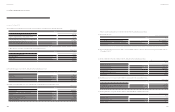

(b) The following tables provide information of sales by geographic locations based on the location of customers and non-current assets as of and for

the year ended December 31, 2013:

Domestic North

America

Europe Other region Consolidation

adjustment

Consolidation

amount

External sales ₩ 17,325,792 17,090,431 12,360,058 821,616 - 47,597,897

Property, plant and

equipment, intangible assets

and other

9,079,840 1,174,659 1,229,526 5,269 53,704 11,542,998

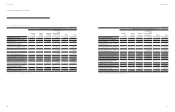

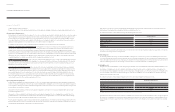

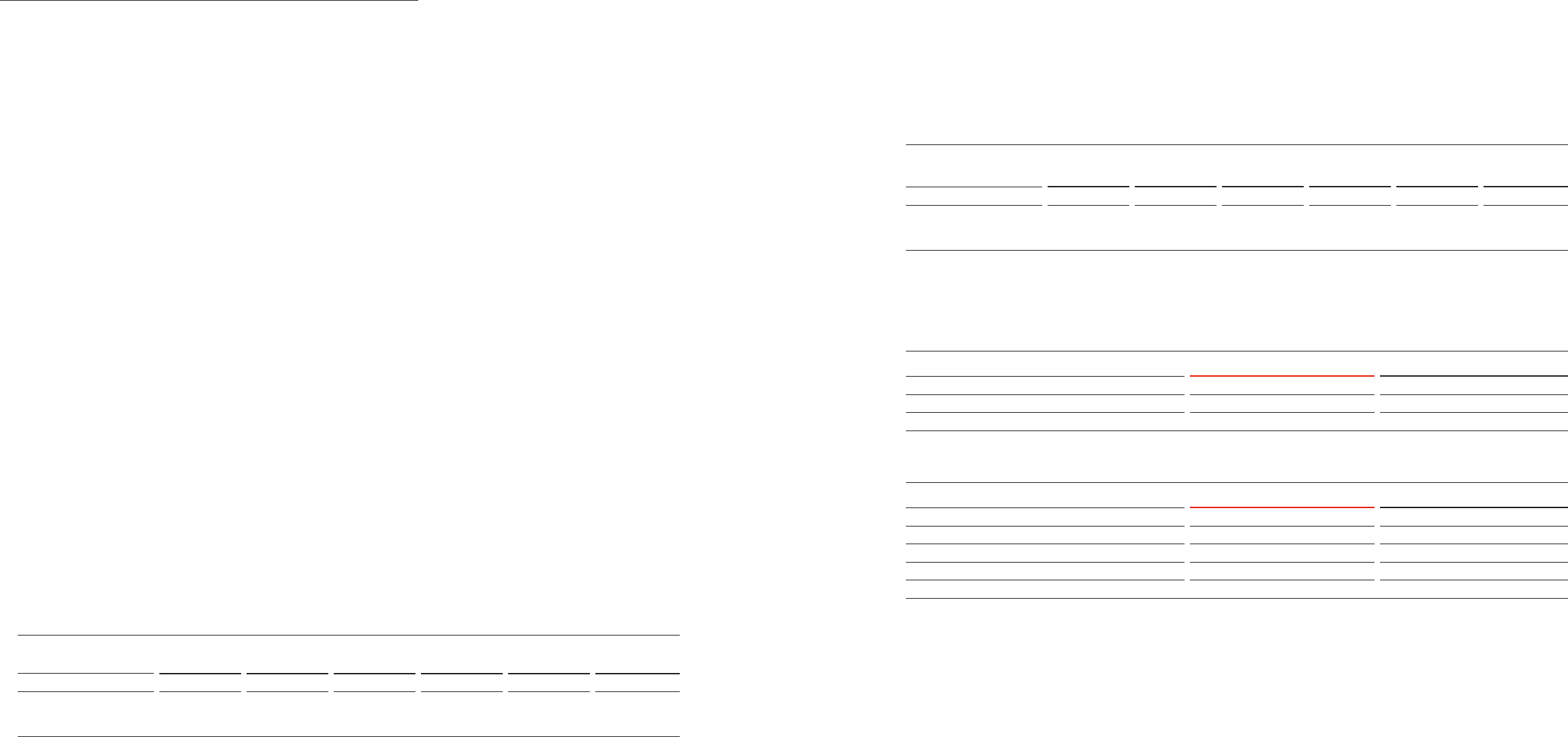

5. Cash, Cash Equivalents and Restricted Financial Instrument

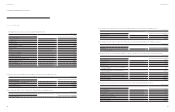

(a) Cash and cash equivalents as of December 31, 2014 and 2013 are summarized as follows:

2014 2013

Cash on hand ₩ 299 477

Deposits with nancial institutions 2,478,171 2,310,787

₩ 2,478,470 2,311,264

(b) Financial instruments which are restricted in use for as of December 31, 2014 and 2013 are summarized as follows:

2014 2013

Win-Win cooperation deposits ₩ 31,000 27,000

Guarantee deposits 10 10

Green mold fund 20,000 20,000

Other deposits 23,143 31,954

₩ 74,153 78,964

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

(KRW in millions)

(KRW in millions)

(KRW in millions)

(KRW in millions)

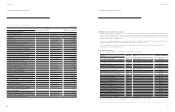

liabilities and deferred tax assets reects the tax consequences that would follow from the manner in which the Company expects, at the end of

the reporting period to recover or settle the carrying amount of its assets and liabilities.

Deferred tax assets and liabilities are offset only if there is a legally enforceable right to offset the related current tax liabilities and assets, and they

relate to income taxes levied by the same tax authority and they intend to settle current tax liabilities and assets on a net basis.

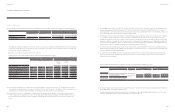

(x) Earnings per share

The Company presents basic and diluted earnings per share (EPS) data for its ordinary shares. Basic EPS is calculated by dividing the prot or loss

attributable to ordinary shareholders of the Parent Company by the weighted average number of ordinary shares outstanding during the period,

adjusted for own shares held. Diluted EPS is determined by adjusting the prot or loss attributable to ordinary shareholders and the weighted

average number of ordinary shares outstanding, adjusted for own shares held, for the effects of all potential dilutive ordinary shares.

(y) Operating segments

An operating segment is a component of the Company that: 1) engages in business activities from which it may earn revenues and incur

expenses, including revenues and expenses that relate to transactions with other components of the Company, 2) whose operating results are

reviewed regularly by the Company’s chief operating decision maker (’CODM’) in order to allocate resources and assess its performance, and 3)

for which discrete nancial information is available.

Management has determined that the CODM of the Company is the CEO. The CODM does not receive and therefore does not review discrete

nancial information for any component of the Company. Consequently, no operating segment information is included in these consolidated

nancial statements. Entity-wide disclosures of geographic and product revenue information are provided in note 4 to the consolidated nancial

statements.

4. Geographic and Other Information

The Company is engaged in manufacturing and sales of vehicles and parts, leasing of vehicles and rendering vehicle maintenance services.

Leasing income and maintenance services are insignicant to total sales. Revenue information by products and services is not available and

management believes the cost to develop such information would be excessive. Consequently revenue amounts by products and services is not

disclosed.

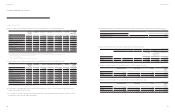

(a) The following tables provide information of sales by geographic locations based on the location of customers and non-current assets as of and

for the year ended December 31, 2014:

Domestic North

America

Europe Other region Consolidation

adjustment

Consolidation

amount

External sales ₩ 17,695,609 16,865,983 11,892,172 643,285 - 47,097,049

Property, plant and

equipment, intangible assets

and other

9,650,614 1,285,600 1,059,052 4,544 54,584 12,054,394

82 83

Annual Report 2014Financial Review