Kia 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2014 and 2013

Notes to the Consolidated

Financial Statements

KIA MOTORS CORPORATION AND SUBSIDIARIES

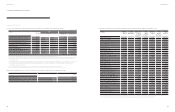

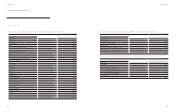

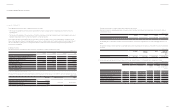

26. Other Income and Expense

(a) Other income for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

Rent ₩ 11,770

13,422

Foreign exchange transaction gain

258,080

179,020

Foreign exchange translation gain

31,839

22,609

Gain on sale of property, plant and equipment

10,323

10,990

Gain on sale of intangible assets

36

-

Reversal of allowance for doubtful accounts

338

1,359

Reversal of impairment loss on intangible assets

3,040

-

Other income

144,258

149,788

₩ 459,684

377,188

(b) Other expense for the years ended December 31, 2014 and 2013 are summarized as follows:

2014 2013

Foreign exchange transaction loss ₩ 284,582

208,381

Foreign exchange translation loss

253,136

18,491

Loss on disposal of accounts and notes receivable - trade

686

1,142

Donation

26,224

27,138

Loss on sale of property, plant and equipment

41,995

49,100

Loss on sale of intangible assets

138

110

Impairment loss of intangible assets

1,337

2,672

Other expenses

83,440

54,096

₩ 691,538

361,130

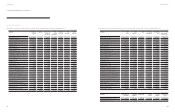

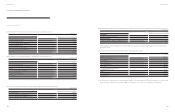

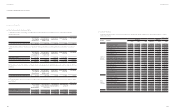

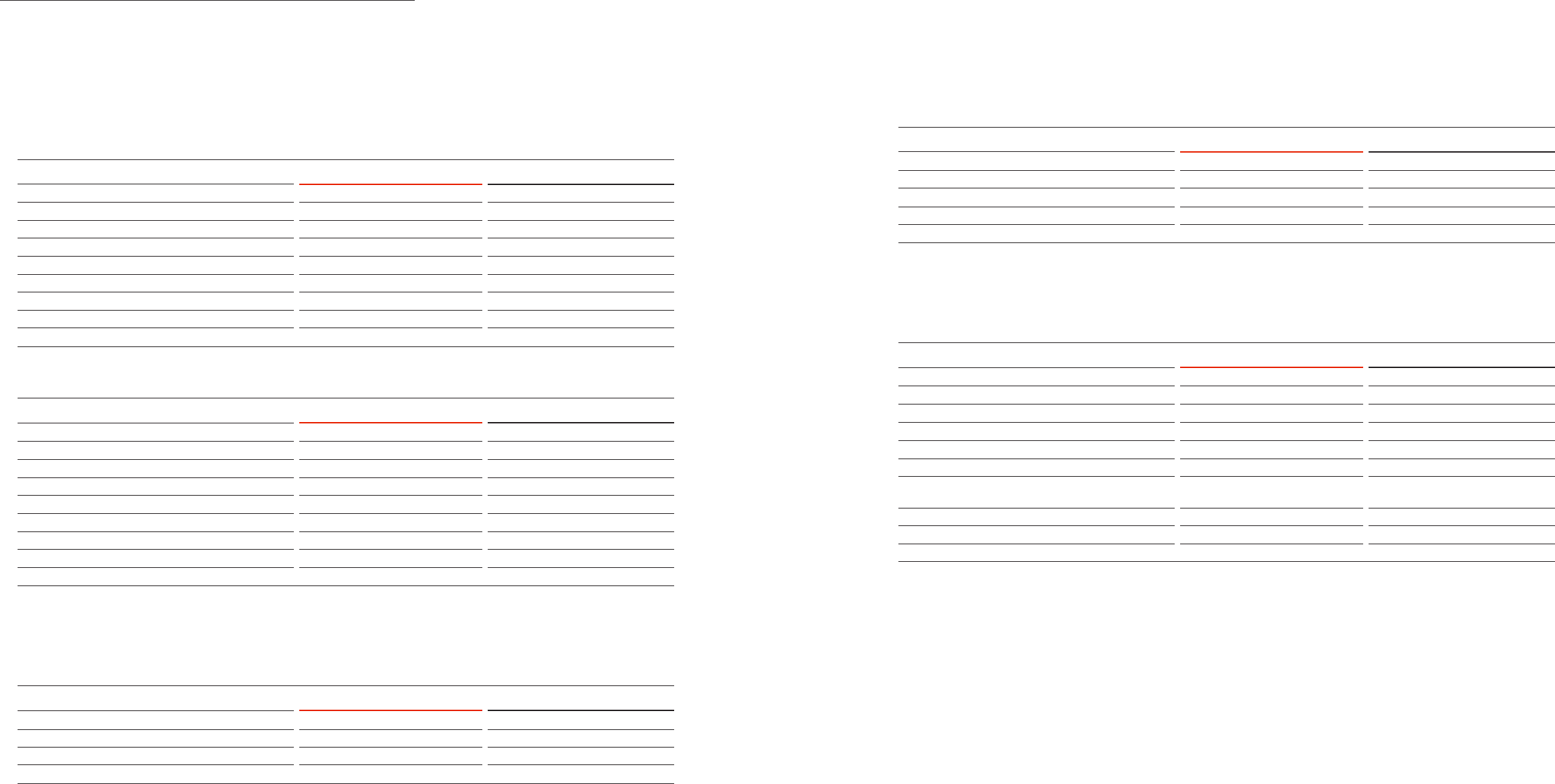

27. Income Tax Expense

(a) The component of income tax expense for the years ended December 31, 2014 and 2013 are as follows:

2014 2013

Current tax expense ₩ 725,166

932,809

Origination and reversal of temporary differences

60,471

56,641

Income tax recognized in other comprehensive income

37,086

22,067

₩ 822,723

1,011,517

(b) Income tax benet recognized directly in other equity and other comprehensive income for the years ended December 31, 2014 and 2013 are as follows:

2014 2013

Current tax:

Dened benet plan remeasurements

₩ 51,757

(23,715)

Deferred income tax:

Loss (gain) on valuation of available-for-sale nancial assets

(14,671)

45,782

Income tax recognized directly in other comprehensive income

₩ 37,086

22,067

Income tax related to dened benet plan remeasurements and gains/losses on valuation of available-for-sale nancial assets were recognized in other

comprehensive income.

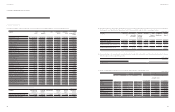

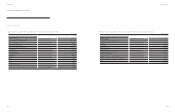

(c) Reconciliation of effective tax rate for the years ended December 31, 2014 and 2013 are as follows:

2014 2013

Prot before income taxes ₩ 3,816,316 4,828,576

Income tax using statutory tax rates(*) 1,036,084 1,356,277

Adjustment for:

Non-taxable income (74,293) (170,302)

Non-deductible expense 115,636 101,371

Tax credits (324,700) (401,376)

Tax effect for gains/losses on investment

in subsidiaries and associates 151,040 204,000

Others (81,044) (78,453)

Income tax expenses ₩ 822,723 1,011,517

Effective tax rate 21.56% 20.95%

(*) Calculated by multiplying each nation’s statutory tax rate and prot before income taxes on each separate nancial statements.

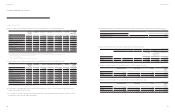

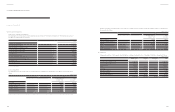

(d) The Company set off a deferred tax asset against a deferred tax liability of the same taxable entity if, and only if, they relate to income taxes levied

by the same taxation authority and the entity has a legally enforceable right to set off current tax assets against current tax liabilities.

(KRW in millions)

(KRW in millions)

(KRW in millions)

(KRW in millions)

(KRW in millions)

106 107

Annual Report 2014Financial Review