JetBlue Airlines 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2004

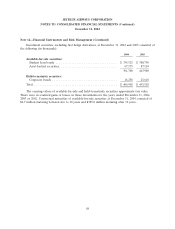

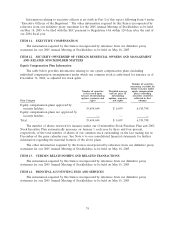

Note 12—Financial Instruments and Risk Management (Continued)

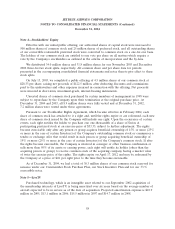

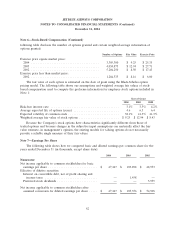

Investment securities, excluding fuel hedge derivatives, at December 31, 2004 and 2003 consisted of

the following (in thousands):

2004 2003

Available-for-sale securities:

Student loan bonds ................................... $ 334,525 $ 380,790

Asset-backed securities ................................. 67,175 87,110

391,700 467,900

Held-to-maturity securities:

Corporate bonds ..................................... 18,258 25,618

Total ............................................... $ 409,958 $ 493,518

The carrying values of available-for-sale and held-to-maturity securities approximate fair value.

There were no realized gains or losses on these investments for the years ended December 31, 2004,

2003 or 2002. Contractual maturities of available-for-sale securities at December 31, 2004 consisted of

$6.7 million maturing between five to 10 years and $385.0 million maturing after 10 years.

68