JetBlue Airlines 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.JETBLUE AIRWAYS CORPORATION

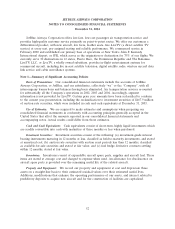

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2004

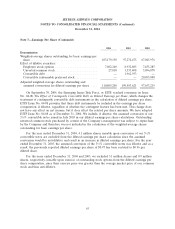

Note 5—LiveTV (Continued)

Through December 31, 2004, LiveTV had installed satellite television systems for other airlines on

55 aircraft and had firm commitments for installations on 47 additional aircraft scheduled to be

installed through 2006, with options for 38 additional installations through 2009. Deferred profit on

hardware sales and advance deposits for future hardware sales included in the accompanying

consolidated balance sheets in non-current other liabilities at December 31, 2004 and 2003 is $20.8

million and $12.2 million, respectively. Deferred profit to be recognized as income on installations

completed through December 31, 2004 will be approximately $1.6 million per year through 2009 and

$4.7 million thereafter.

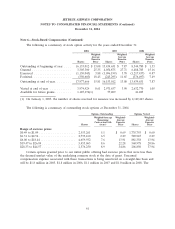

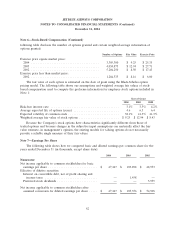

Note 6—Stock-Based Compensation

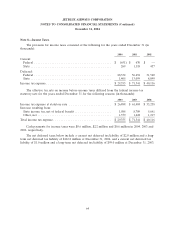

Crewmember Stock Purchase Plan: Our Crewmember Stock Purchase Plan, or CSPP, is available

to all employees and was adopted in February 2002, with 3.4 million shares of our common stock

initially reserved for issuance. The reserve automatically increases each January by an amount equal to

3% of the total number of shares of our common stock outstanding on the last trading day in

December of the prior calendar year. In no event will any such annual increase exceed 6.1 million

shares. The plan will terminate no later than the last business day of April 2012.

The plan has a series of successive overlapping 24-month offering periods, with a new offering

period beginning on the first business day of May and November each year. Employees can only join

an offering period on the start date and participate in one offering period at a time. Employees may

contribute up to 10% of their pay, through payroll deductions, toward the purchase of common stock at

the lower of 85% of the fair market value per share at the beginning of the offering period or on the

purchase date. Purchase dates occur on the last business day of April and October each year.

If the fair market value per share of our common stock on any purchase date within a particular

offering period is less than the fair market value per share on the start date of that offering period,

then the participants in that offering period will automatically be transferred and enrolled in the new

two-year offering period which will begin on the next business day following such purchase date and the

related purchase of shares. On May 1 and November 1, 2004, certain participants were automatically

transferred and enrolled in a new offering period due to a decrease in our stock price.

Should we be acquired by merger or sale of substantially all of our assets or more than 50% of our

outstanding voting securities, then all outstanding purchase rights will automatically be exercised

immediately prior to the effective date of the acquisition at a price equal to the lower of 85% of the

market value per share on the start date of the offering period in which the participant is enrolled or

85% of the fair market value per share immediately prior to the acquisition.

59