JetBlue Airlines 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2004

Note 1—Summary of Significant Accounting Policies (Continued)

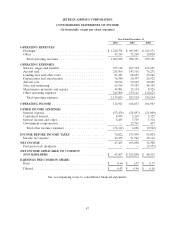

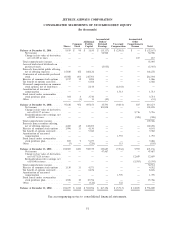

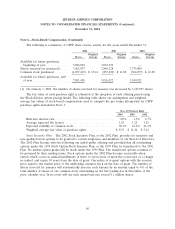

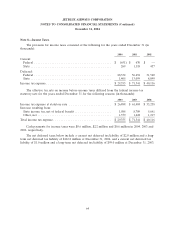

than the fair value of our common stock on the grant date. The following table illustrates the effect on

net income and earnings per common share if we had applied the fair value method to measure stock-

based compensation, which is described more fully in Note 7, as required under the disclosure

provisions of SFAS No. 123, Accounting for Stock-Based Compensation, as amended (in thousands,

except per share amounts):

Year Ended December 31,

2004 2003 2002

Net income, as reported .......................... $47,467 $ 103,898 $ 54,908

Add: Stock-based compensation expense included in

reported net income, net of tax .................... 1,056 1,039 989

Deduct: Stock-based compensation expense determined

under the fair value method, net of tax ..............

Crewmember stock purchase plan ................ (7,400) (2,759) (3,264)

Employee stock options ....................... (12,672) (7,652) (2,933)

Pro forma net income ............................ $28,451 $ 94,526 $ 49,700

Earnings per common share:

Basic—as reported ............................. $ 0.46 $ 1.07 $ 0.73

Basic—pro forma .............................. $ 0.28 $ 0.97 $ 0.65

Diluted—as reported ........................... $ 0.43 $ 0.96 $ 0.56

Diluted—pro forma ............................ $ 0.26 $ 0.88 $ 0.51

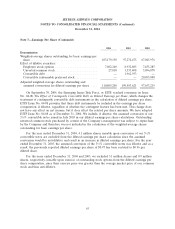

New Accounting Standard. In December 2004, the Financial Accounting Standards Board, or

FASB, issued SFAS No. 123 (revised 2004), Share-Based Payment. SFAS No. 123(R) requires that the

compensation cost relating to share-based payment transactions be recognized in financial statements.

The cost will be measured based on the fair value of the instruments issued. SFAS No. 123(R) covers a

wide range of share-based compensation arrangements including share options, restricted share plans,

performance-based awards, share appreciation rights and employee share purchase plans. SFAS No.

123(R) replaces SFAS No. 123 and supersedes APB Opinion No. 25. As originally issued in 1995, SFAS

No. 123 established as preferable the fair-value-based method of accounting for share-based payment

transactions with employees. However, that Statement permitted entities the option of continuing to

apply the guidance in Opinion 25, as long as the footnotes to financial statements disclosed what net

income would have been had the preferable fair-value-based method been used. We will be required to

apply SFAS No. 123(R) as of the first interim reporting period that begins after June 15, 2005, and we

plan to adopt it using the modified-prospective method, effective July 1, 2005. We are currently

evaluating the impact SFAS No. 123(R) will have on us and, based on our preliminarily analysis, expect

to incur approximately $20 million in additional compensation expense during the period July 1, 2005

to December 31, 2005 as a result of this new accounting standard.

54