JetBlue Airlines 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2004

Note 11—Contingencies (Continued)

broadly defined regulatory changes, including changes in reserve requirements and bank capital

requirements. These indemnities would have the practical effect of increasing the interest rate on our

debt if they were to be triggered. In all cases, the Company has the right to repay the loan and avoid

the increased costs. The term of these indemnities matches the length of the related loan up to

12 years.

Under both aircraft leases with foreign lessors and aircraft and engine mortgages with foreign

lenders, the Company has agreed to customary indemnities concerning withholding tax law changes

under which the Company is responsible, should withholding taxes be imposed, for paying such amount

of additional rent or interest as is necessary to ensure that the lessor or lender still receives, after taxes,

the rent stipulated in the lease or the interest stipulated under the loan. The term of these indemnities

matches the length of the related lease up to 18 years.

The Company has various leases with respect to real property, and various agreements among

airlines relating to fuel consortia or fuel farms at airports, under which the Company has agreed to

standard language indemnifying the lessor against environmental liabilities associated with the real

property covered under the agreement, even if the Company is not the party responsible for the

environmental damage. In the case of fuel consortia at airports, these indemnities are generally joint

and several among the airlines. The Company has not purchased a stand alone environmental liability

insurance policy. The existing aviation hull and liability policy includes some limited environmental

coverage when a clean up is part of an associated covered loss.

Under certain contracts, we indemnify certain parties against legal liability arising out of actions by

other parties. The terms of these contracts range up to 20 years. Generally, the Company has liability

insurance protecting the Company for the obligations it has undertaken relative to these indemnities.

LiveTV provides product warranties to third party airlines to which it sells its products and

services. The Company does not accrue a liability for product warranties upon sale of the hardware

since revenue is recognized over the term of the related service agreements of up to 13 years. Expenses

for warranty repairs are recognized as they occur. In addition, LiveTV has provided indemnities against

any claims which may be brought against its customers related to allegations of patent, trademark,

copyright or license infringement as a result of the use of the LiveTV system.

We are unable to estimate the potential amount of future payments under the foregoing

indemnities and agreements.

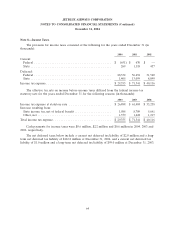

Note 12—Financial Instruments and Risk Management

We maintain cash and cash equivalents with various high-quality financial institutions or in short-

term duration high-quality debt securities. Investments in highly-liquid debt securities are stated at fair

value, which approximates cost. The majority of our receivables result from the sale of tickets to

individuals, mostly through the use of major credit cards. These receivables are short-term, generally

being settled shortly after the sale. As of December 31, 2004, the fair value of our $175 million

31⁄2% convertible notes, based on quoted market prices, was $167 million. The fair value of our other

long-term debt, which approximated its carrying value, was estimated using discounted cash flow

analysis based on our current incremental borrowing rates for instruments with similar terms. The

carrying values of all other financial instruments approximated their fair values.

67