JetBlue Airlines 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

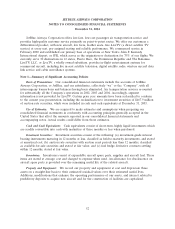

JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2004

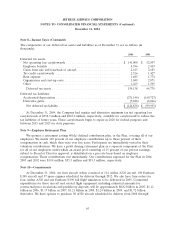

Note 2—Long-term Debt and Short-term Borrowings

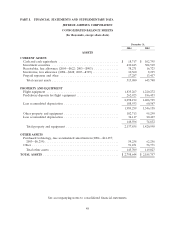

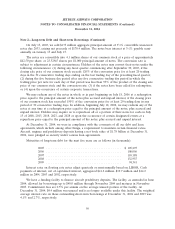

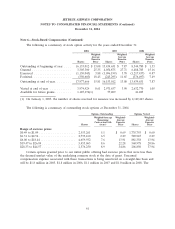

Long-term debt at December 31, 2004 and 2003 consisted of the following (in thousands):

2004 2003

Floating rate equipment notes due through 2016, weighted

average interest rate 4.3% and 3.1%, respectively ........... $ 895,230 $ 903,711

31⁄2% convertible unsecured notes due in 2033 ............... 175,000 175,000

EETC 2004-1 floating rate equipment notes due through 2014,

4.7% weighted average rate ........................... 431,004 —

Total debt ......................................... 1,501,234 1,078,711

Less: current maturities .............................. 105,295 67,101

Long-term debt ..................................... $ 1,395,939 $ 1,011,610

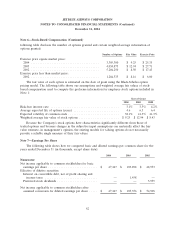

On March 24, 2004, we completed a public offering of $431.0 million of pass-through certificates,

Series 2004-1G-1, 2004-1G-2 and 2004-1C. Separate trusts were established for each class of these

certificates. We issued $431.0 million in equipment notes to these trusts to finance 13 new Airbus A320

aircraft delivered in 2004. The Class G-1 certificates totaling $119.1 million bear interest at three

month London Interbank Offered Rate, or LIBOR, plus 0.375%, the Class G-2 certificates totaling

$187.9 million bear interest at three month LIBOR plus 0.42%, and the Class C certificates totaling

$124.0 million bear interest at three month LIBOR plus 4.25%. Principal payments are required on the

Class G-1 and Class C certificates quarterly commencing on March 15, 2005. The entire principal

amount of the Class G-2 certificates is scheduled to be paid on March 15, 2014. Interest on all

certificates is payable quarterly.

On November 15, 2004, we completed a public offering of $498.2 million of pass-through

certificates, Series 2004-2G-1, 2004-2G-2 and 2004-2C, to finance all of the 15 new Airbus A320 aircraft

scheduled to be delivered in 2005. Separate trusts were established for each class of these certificates.

The Class G-1 certificates totaling $176.8 million bear interest at three month LIBOR plus 0.375%, the

Class G-2 certificates totaling $185.4 million bear interest at three month LIBOR plus 0.45%, and the

Class C certificates totaling $136.0 million bear interest at three month LIBOR plus 3.10%. Principal

payments are required on the Class G-1 and Class C certificates quarterly commencing on February 15,

2006 and November 15, 2005, respectively. The entire principal amount of the Class G-2 certificates is

scheduled to be paid on November 15, 2016. Interest on all certificates is payable quarterly and

commences on February 15, 2005.

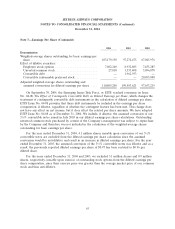

The proceeds from the sale of the 2004-2 certificates are being held in escrow with a depositary.

As aircraft are delivered, the proceeds will be utilized to purchase our secured equipment notes issued

to finance these aircraft. The proceeds held in escrow are not assets of ours, nor are the certificates

obligations of ours or guaranteed by us; therefore, they are not included in our consolidated financial

statements. At December 31, 2004, the entire $498.2 million of proceeds from the sale of the 2004-2

certificates was held in escrow and not recorded as an asset or direct obligation of ours; however,

interest expense on the certificates, net of interest income on the proceeds held in escrow, is included

in interest expense.

55