JetBlue Airlines 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2004

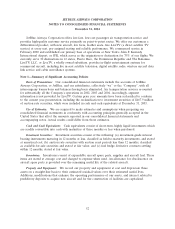

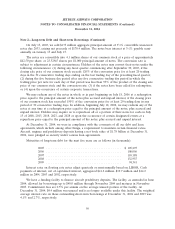

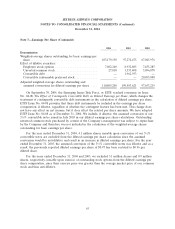

Note 2—Long-term Debt and Short-term Borrowings (Continued)

On July 15, 2003, we sold $175 million aggregate principal amount of 31⁄2% convertible unsecured

notes due 2033, raising net proceeds of $170.4 million. The notes bear interest at 31⁄2% payable semi-

annually on January 15 and July 15.

The notes are convertible into 4.1 million shares of our common stock at a price of approximately

$42.50 per share, or 23.52945 shares per $1,000 principal amount of notes. The conversion rate is

subject to adjustment in certain circumstances. Holders of the notes may convert their notes under the

following circumstances: (1) during any fiscal quarter commencing after September 30, 2003, if the

closing sale price of our common stock exceeds 120% of the conversion price for at least 20 trading

days in the 30 consecutive trading days ending on the last trading day of the preceding fiscal quarter;

(2) during the five business day period after any five consecutive trading day period in which the

trading price per note for each day of that period was less than 95% of the product of the closing sale

price of our common stock and the conversion rate; (3) if the notes have been called for redemption;

or (4) upon the occurrence of certain corporate transactions.

We may redeem any of the notes in whole or in part beginning on July 18, 2006 at a redemption

price equal to the principal amount of the notes plus accrued and unpaid interest, if the closing price

of our common stock has exceeded 150% of the conversion price for at least 20 trading days in any

period of 30 consecutive trading days. In addition, beginning July 18, 2008, we may redeem any of the

notes at any time at a redemption price equal to the principal amount of the notes, plus accrued and

unpaid interest. Holders may require us to repurchase all or a portion of their notes for cash on July

15 of 2008, 2013, 2018, 2023, and 2028 or upon the occurrence of certain designated events at a

repurchase price equal to the principal amount of the notes, plus accrued and unpaid interest.

At December 31, 2004, we were in compliance with the covenants of all our debt and lease

agreements, which include among other things, a requirement to maintain certain financial ratios.

Aircraft, engines and predelivery deposits having a net book value of $1.78 billion at December 31,

2004, were pledged as security under various loan agreements.

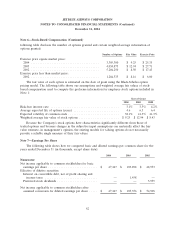

Maturities of long-term debt for the next five years are as follows (in thousands):

2005 ........................................... $ 105,295

2006 ........................................... 108,006

2007 ........................................... 110,188

2008 ........................................... 132,955

2009 ........................................... 94,341

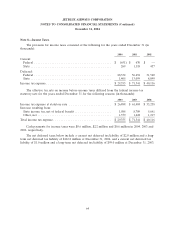

Interest rates on floating rate notes adjust quarterly or semi-annually based on LIBOR. Cash

payments of interest, net of capitalized interest, aggregated $41.2 million, $19.7 million and $14.2

million in 2004, 2003 and 2002, respectively.

We have a funding facility to finance aircraft predelivery deposits. The facility, as amended in June

2004, allowed for borrowings up to $48.0 million through November 2004 and matures in November

2005. Commitment fees are 0.5% per annum on the average unused portion of the facility. At

December 31, 2004, $4.4 million was unused and is no longer available under this facility. The weighted

average interest rate on these outstanding short-term borrowings at December 31, 2004 and 2003 was

4.1% and 2.7%, respectively.

56