JetBlue Airlines 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2004

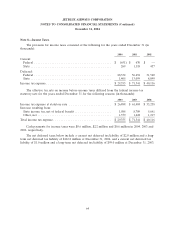

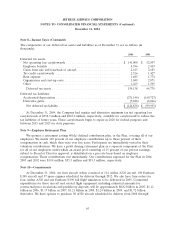

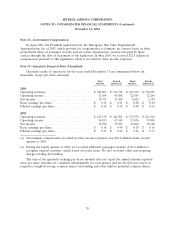

Note 8—Income Taxes

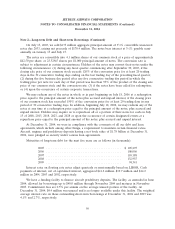

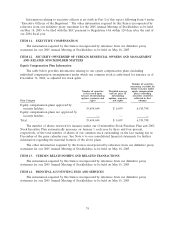

The provision for income taxes consisted of the following for the years ended December 31 (in

thousands):

2004 2003 2002

Current:

Federal ............................................ $ (651) $ 670 $ —

State .............................................. 269 1,118 457

Deferred:

Federal ............................................ 28,332 56,694 31,560

State .............................................. 1,405 13,059 8,099

Income tax expense ..................................... $ 29,355 $ 71,541 $ 40,116

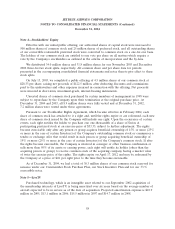

The effective tax rate on income before income taxes differed from the federal income tax

statutory rate for the years ended December 31 for the following reasons (in thousands):

2004 2003 2002

Income tax expense at statutory rate ........................ $ 26,888 $ 61,404 $ 33,258

Increase resulting from:

State income tax, net of federal benefit ..................... 1,088 8,709 5,641

Other, net .......................................... 1,379 1,428 1,217

Total income tax expense ................................. $ 29,355 $ 71,541 $ 40,116

Cash payments for income taxes were $0.6 million, $2.2 million and $0.6 million in 2004, 2003 and

2002, respectively.

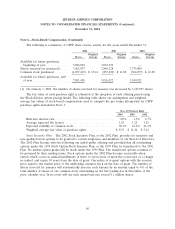

The net deferred taxes below include a current net deferred tax liability of $2.0 million and a long-

term net deferred tax liability of $122.8 million at December 31, 2004, and a current net deferred tax

liability of $1.0 million and a long-term net deferred tax liability of $99.0 million at December 31, 2003.

64