JetBlue Airlines 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2004

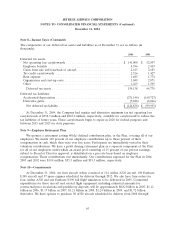

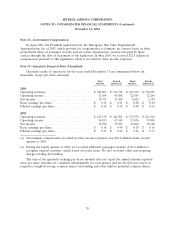

Note 7—Earnings Per Share (Continued)

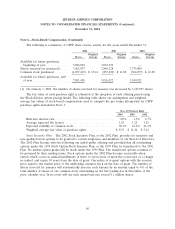

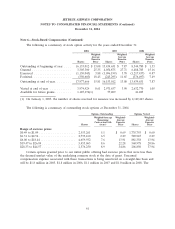

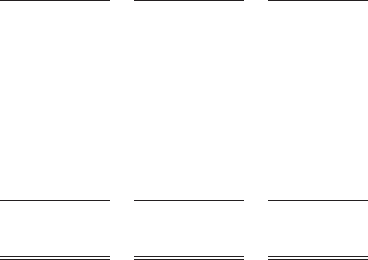

2004 2003 2002

Denominator:

Weighted-average shares outstanding for basic earnings per

share ...................................... 103,179,150 97,274,475 67,045,976

Effect of dilutive securities:

Employee stock options ........................ 7,602,240 8,932,805 7,455,285

Unvested common stock ........................ 27,810 1,333,408 3,096,878

Convertible debt ............................. — 1,962,933 —

Convertible redeemable preferred stock ............. — — 20,055,080

Adjusted weighted-average shares outstanding and

assumed conversions for diluted earnings per share .... 110,809,200 109,503,621 97,653,219

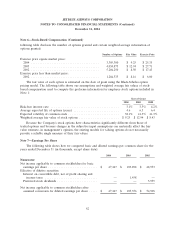

On September 30, 2004, the Emerging Issues Task Force, or EITF, reached consensus on Issue

No. 04-08, The Effect of Contingently Convertible Debt on Diluted Earnings per Share, which changes the

treatment of contingently convertible debt instruments in the calculation of diluted earnings per share.

EITF Issue No. 04-08 provides that these debt instruments be included in the earnings per share

computation, if dilutive, regardless of whether the contingent feature has been met. This change does

not have any effect on net income, but it does affect the related per share amounts. We have adopted

EITF Issue No. 04-08 as of December 31, 2004. We include, if dilutive, the assumed conversion of our

31⁄2% convertible notes issued in July 2003 in our diluted earnings per share calculations. Outstanding

unvested common stock purchased by certain of the Company’s management was subject to repurchase

by the Company and therefore was not included in the calculation of the weighted-average shares

outstanding for basic earnings per share.

For the year ended December 31, 2004, 4.1 million shares issuable upon conversion of our 31⁄2%

convertible notes are excluded from the diluted earnings per share calculation since the assumed

conversion would be anti-dilutive and result in an increase in diluted earnings per share. For the year

ended December 31, 2003, the assumed conversion of the 31⁄2% convertible notes was dilutive and as a

result, the previously reported diluted earnings per share of $0.97 has been restated to $0.96 per

diluted share.

For the years ended December 31, 2004 and 2003, we excluded 5.1 million shares and 0.9 million

shares, respectively, issuable upon exercise of outstanding stock options from the diluted earnings per

share computation, since their exercise price was greater than the average market price of our common

stock and thus anti-dilutive.

63