JetBlue Airlines 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.offer sale fares with shorter advance purchase requirements in most of the markets we serve and match

the sale fares offered by other airlines. Other revenue consists primarily of the $20 or $25 fee charged

to change a customer’s reservation through our website or our reservation agents, respectively, and

revenues earned by our subsidiary, LiveTV, LLC, for the sale of, and on-going programming services

provided for, in-flight entertainment systems sold to other airlines. Other components include

concession sales at our terminal at JFK, excess baggage charges, mail revenue, commissions from

website travel sales and revenue from the sale of liquor in-flight.

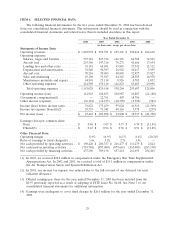

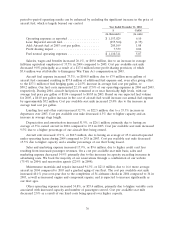

We have low operating expenses because we operate a single type of aircraft, with high utilization

and a single class of service, have a productive workforce and use advanced technologies. The largest

components of our operating expenses are salaries, wages and benefits provided to our employees,

including provisions for our profit sharing plan, and aircraft fuel. The price and availability of aircraft

fuel are extremely volatile due to many global economic and geopolitical factors that we can neither

control nor accurately predict. Sales and marketing expenses include advertising and fees paid to credit

card companies. Our distribution costs tend to be lower than those of most other airlines on a per unit

basis because almost all of our customers book through our website or our reservation agents.

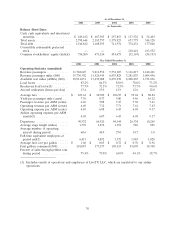

Maintenance materials and repairs are expensed when incurred. Because the average age of our aircraft

is 2.2 years, all of our aircraft require less maintenance now than they will in the future. Our

maintenance costs will increase significantly, both on an absolute basis and as a percentage of our unit

costs, as our fleet ages. Other operating expenses consist of purchased services (including expenses

related to fueling, ground handling, skycap, security and janitorial services), insurance, personnel

expenses, taxes other than payroll taxes, professional fees, passenger refreshments, supplies, bad debts

and communication costs.

The airline industry is one of the most heavily taxed in the U.S., with taxes and fees accounting for

approximately 20% of the total fare charged to a customer. Airlines are obligated to fund all of these

taxes and fees regardless of their ability to pass these charges on to the customer. Should the TSA’s

$2.50 per enplanement ticket tax be increased to $5.50, as has been proposed in President Bush’s 2005

budget, our revenues could be lower. Additionally, if the TSA changes the way the Aviation Security

Infrastructure Fee is assessed, our security costs may be higher.

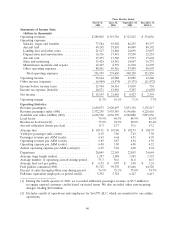

Our operating margin, which measures operating income as a percentage of operating revenues,

was 8.9% in 2004 and 16.9% in 2003, both of which were higher than most other major U.S. airlines,

according to reports by these airlines.

The highest levels of traffic and revenue on our routes to and from Florida are generally realized

from October through April, and on our routes to and from the western United States in the summer.

Many of our areas of operations in the Northeast experience bad weather conditions in the winter,

causing increased costs associated with deicing aircraft, cancelled flights and accommodating displaced

passengers. Our Florida routes experience bad weather conditions in the summer and fall due to

thunderstorms and hurricanes. As we enter new markets, we could be subject to additional seasonal

variations along with competitive responses to our entry by other airlines. Given our high proportion of

fixed costs, this seasonality may cause our results of operations to vary from quarter to quarter.

Most major airlines have reported losses in 2004 and some have either filed bankruptcy or are

using the threat of bankruptcy to reduce their costs in an attempt to improve their ability to compete

with low-fare airlines. Additionally, our competitors have chosen to add service, reduce their fares

and/or offer special promotions in the markets that we service in an attempt to maintain market share,

which has resulted in intense price competition. We expect the airline industry to remain intensely

competitive, especially if adverse economic conditions and capacity additions persist. Our capability to

meet these competitive responses depends on, among other things, our ability to operate at costs equal

to or lower than our competitors. Although we have been able to raise capital, remain profitable and

33