JetBlue Airlines 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2004

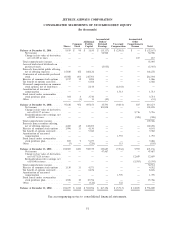

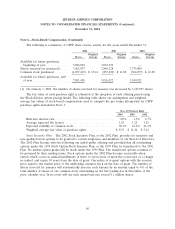

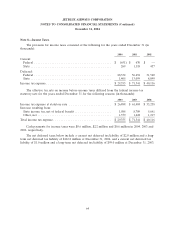

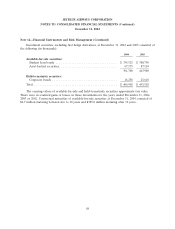

Note 4—Stockholders’ Equity

Effective with our initial public offering, our authorized shares of capital stock were increased to

500 million shares of common stock and 25 million shares of preferred stock, and all outstanding shares

of our convertible redeemable preferred stock were converted to common stock on a one-for-one basis.

The holders of our common stock are entitled to one vote per share on all matters which require a

vote by the Company’s stockholders as outlined in the articles of incorporation and the by-laws.

We distributed 34.0 million shares and 31.8 million shares for our November 2003 and December

2002 three-for-two stock splits, respectively. All common share and per share data for periods

presented in the accompanying consolidated financial statements and notes thereto give effect to these

stock splits.

On July 15, 2003, we completed a public offering of 4.5 million shares of our common stock at

$28.33 per share, raising net proceeds of $122.5 million, after deducting discounts and commissions

paid to the underwriters and other expenses incurred in connection with the offering. Net proceeds

were invested in short-term, investment-grade, interest-bearing instruments.

Unvested shares of common stock purchased by certain members of management in 1998 were

subject to repurchase by the Company upon their termination at the original purchase price. At

December 31, 2004 and 2003, all 8.9 million shares were fully vested and at December 31, 2002,

7.2 million shares were vested under these agreements.

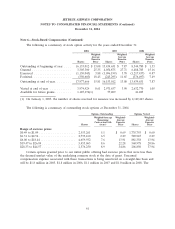

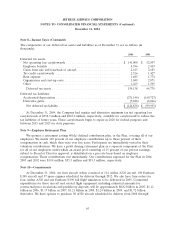

Pursuant to our Stockholder Rights Agreement, which became effective in February 2002, each

share of common stock has attached to it a right and, until the rights expire or are redeemed, each new

share of common stock issued by the Company will include one right. Upon the occurrence of certain

events, each right entitles the holder to purchase one one-thousandth of a share of Series A

participating preferred stock at an exercise price of $53.33, subject to further adjustment. The rights

become exercisable only after any person or group acquires beneficial ownership of 15% or more (25%

or more in the case of certain Investors) of the Company’s outstanding common stock or commences a

tender or exchange offer that would result in such person or group acquiring beneficial ownership of

15% or more (25% or more in the case of certain Investors) of the Company’s common stock. If after

the rights become exercisable, the Company is involved in a merger or other business combination or

sells more than 50% of its assets or earning power, each right will entitle its holder (other than the

acquiring person or group) to receive common stock of the acquiring company having a market value

of twice the exercise price of the rights. The rights expire on April 17, 2012 and may be redeemed by

the Company at a price of $.01 per right prior to the time they become exercisable.

As of December 31, 2004, we had a total of 30.3 million shares of our common stock reserved for

issuance under our Crewmember Stock Purchase Plan, our Stock Incentive Plan and for our 31⁄2%

convertible notes.

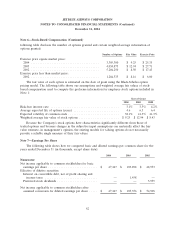

Note 5—LiveTV

Purchased technology, which is an intangible asset related to our September 2002 acquisition of

the membership interests of LiveTV, is being amortized over six years based on the average number of

aircraft expected to be in service as of the date of acquisition. Projected amortization expense is $10.9

million in 2005, $13.1 million in 2006, $15.5 million in 2007 and $14.7 million in 2008.

58