JetBlue Airlines 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

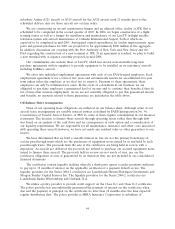

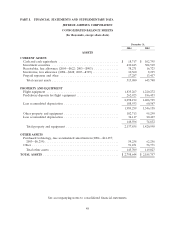

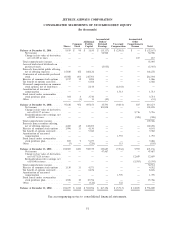

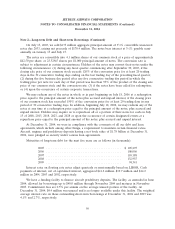

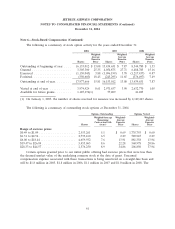

JETBLUE AIRWAYS CORPORATION

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands)

Accumulated Accumulated

Additional Deficit/ Other

Common Paid-In Retained Unearned Comprehensive

Shares Stock Capital Earnings Compensation Income Total

Balance at December 31, 2001 ...... 9,819 $ 98 $ 3,835 $ (33,117) $ (2,983) $ — $ (32,167)

Net income ............... — — — 54,908 — — 54,908

Change in fair value of derivatives,

net of $125 in taxes ........ — — — — — 187 187

Total comprehensive income ...... 55,095

Accrued undeclared dividends on

preferred stock ............. — — — (5,955) — — (5,955)

Proceeds from initial public offering,

net of offering expenses ....... 15,180 152 168,126 — — — 168,278

Conversion of redeemable preferred

stock ................... 69,058 691 215,703 — — — 216,394

Exercise of common stock options . . 1,217 12 1,054 — — — 1,066

Tax benefit of options exercised .... — — 6,568 — — — 6,568

Unearned compensation on common

stock options, net of forfeitures . . — — 8,144 — (8,144) — —

Amortization of unearned

compensation .............. — — — — 1,713 — 1,713

Stock issued under crewmember

stock purchase plan .......... 364 4 3,710 — — — 3,714

Other .................... — (1) 13 (45) — — (33)

Balance at December 31, 2002 ...... 95,638 956 407,153 15,791 (9,414) 187 414,673

Net income ............... — — — 103,898 — — 103,898

Change in fair value of derivatives,

net of $4,127 in taxes ....... — — — — — 5,716 5,716

Reclassifications into earnings, net

of $205 in taxes ........... — — — — — (308) (308)

Total comprehensive income ...... 109,306

Proceeds from secondary offering,

net of offering expenses ....... 4,485 45 122,453 — — — 122,498

Exercise of common stock options . . 1,096 11 4,130 — — — 4,141

Tax benefit of options exercised .... — — 9,380 — — — 9,380

Amortization of unearned

compensation .............. — — — — 1,755 — 1,755

Stock issued under crewmember

stock purchase plan .......... 853 9 9,479 — — — 9,488

Other .................... (3) — (220) — 115 — (105)

Balance at December 31, 2003 ...... 102,069 1,021 552,375 119,689 (7,544) 5,595 671,136

Net income ............... — — — 47,467 — — 47,467

Change in fair value of derivatives,

net of $7,828 in taxes ....... — — — — — 12,659 12,659

Reclassifications into earnings, net

of $4,046 in taxes .......... — — — — — (5,595) (5,595)

Total comprehensive income ...... 54,531

Exercise of common stock options . . 1,130 11 4,371 — — — 4,382

Tax benefit of options exercised .... — — 8,676 — — — 8,676

Amortization of unearned

compensation .............. — — — — 1,709 — 1,709

Stock issued under crewmember

stock purchase plan .......... 1,038 10 15,756 — — — 15,766

Other .................... — — (122) — 122 — —

Balance at December 31, 2004 ...... 104,237 $ 1,042 $ 581,056 $ 167,156 $ (5,713) $ 12,659 $ 756,200

See accompanying notes to consolidated financial statements.

51