JetBlue Airlines 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I

ITEM 1. BUSINESS

Overview

JetBlue Airways Corporation, or JetBlue, is a low-fare, low-cost passenger airline that provides

high-quality customer service primarily on point-to-point routes between 22 destinations in 11 states

and Puerto Rico. We focus on serving underserved markets and/or large metropolitan areas that have

high average fares. We have a geographically diversified flight schedule that includes both short-haul

and long-haul routes. We intend to maintain a disciplined growth strategy by increasing frequency on

our existing routes and entering new markets.

We commenced service in February 2000 and established our primary base of operations at New

York’s John F. Kennedy International Airport, or JFK. On August 28, 2001, we began service at our

West Coast base of operations, Long Beach Municipal Airport, which serves the Los Angeles area. As

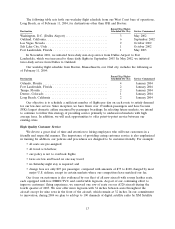

of February 11, 2004, we operated 222 weekday flights, including 108 weekday flights between the

Northeast and Florida, 66 weekday flights between the East Coast and western United States, and 48

weekday short-haul flights. We have flown over 19 million passengers since commencing operations.

JetBlue is the 11th largest passenger carrier in the United States based on revenue passenger miles for

the year ended December 31, 2003.

To date, we have raised $467 million of equity capital, which has enabled us, among other things,

to acquire a fleet of new, single-class Airbus A320 aircraft. We are scheduled to add 98 new Airbus

A320 aircraft and 100 EMBRAER 190 aircraft to our current operating fleet of 55 Airbus A320

aircraft by the end of 2011. We have an experienced management team and a strong company culture

with a productive and incentivized workforce that strives to offer high-quality customer service, while at

the same time operating efficiently and keeping costs low. We also have low operating costs, in part

because of our high daily aircraft utilization and low distribution costs. Our widely available low fares

are designed to stimulate demand, and we have demonstrated our ability to increase passenger traffic

in the markets we serve. In addition, we offer our customers a differentiated product, including new

aircraft, low fares, leather seats, free LiveTV (a 24-channel satellite TV service with programming

provided by DIRECTV) at every seat, pre-assigned seating and reliable operating performance. In

2004, we plan to increase our commitment to customer service with the addition of free digital satellite

radio by XM Satellite Radio and movie channel offerings from News Corporation’s Fox Entertainment

Group.

While the airline industry suffered losses in 2003 and 2002, we had net income of $103.9 million

and $54.9 million for the years ended December 31, 2003 and 2002, respectively. We generated an

operating margin of 16.9% and 16.5% in 2003 and 2002, respectively, which were higher than all of the

major U.S. airlines, according to reports by those airlines. Due to our low fares, our yields (the average

amount one passenger pays to fly one mile) during 2003 were lower than all of the major U.S. airlines.

However, our low fares together with our high quality service offering enabled us to generate a load

factor (the percentage of aircraft seating capacity actually utilized) of 84.5%, higher than that reported

by any of the major U.S. airlines, which had domestic load factors ranging from 65.1% to 76.4%, with a

weighted average of 72.8% for the year ended December 31, 2003. In addition, we have maintained our

high level of operating performance. For the year ended December 31, 2003, we completed 99.5% of

our scheduled flights, which was better than any of the major U.S. airlines, and our on-time

performance of 84.3% exceeded all but one major U.S. airline.

We expect the airline industry to remain intensely competitive, especially if adverse economic

conditions persist. In response to the growing number of price-sensitive travelers and the corresponding

growth in the domestic market share of low-fare airlines, several airlines are seeking to emulate the

low-cost business model by creating their own low-fare operations. Our competitors have chosen to add

5