JetBlue Airlines 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2003

Note 1—Summary of Significant Accounting Policies (Continued)

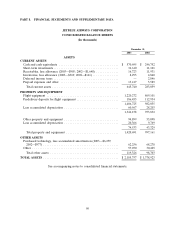

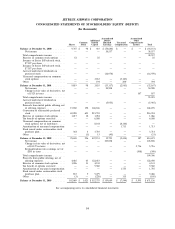

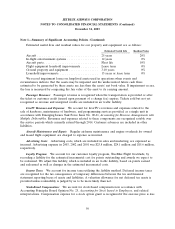

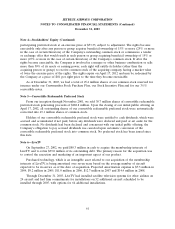

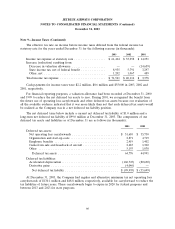

than the fair value of our common stock on the grant date. The following table illustrates the effect on

net income and earnings per common share if we had applied the fair value method to measure stock-

based compensation, which is described more fully in Note 7, as required under the disclosure

provisions of SFAS No. 123, Accounting for Stock-Based Compensation, as amended (in thousands,

except per share amounts):

Year Ended December 31,

2003 2002 2001

Net income, as reported .......................... $ 103,898 $ 54,908 $ 38,537

Add: Stock-based employee compensation expense included

in reported net income, net of tax ................. 1,039 989 115

Deduct: Stock-based employee compensation expense

determined under the fair value method, net of tax:

Crewmember stock purchase plan ................ (2,759) (3,264) —

Employee stock options ....................... (7,652) (2,933) (320)

Proforma net income ............................ $ 94,526 $ 49,700 $ 38,332

Earnings per common share:

Basic—as reported ............................ $ 1.07 $ 0.73 $ 4.39

Basic—proforma .............................. $ 0.97 $ 0.65 $ 4.35

Diluted—as reported ........................... $ 0.97 $ 0.56 $ 0.51

Diluted—proforma ............................ $ 0.88 $ 0.51 $ 0.51

New Accounting Standard: In January 2003, the FASB issued Interpretation No. 46, or FIN 46,

Consolidation of Variable Interest Entities, which requires the consolidation of variable interest entities.

Fifteen of our 24 leased aircraft are owned and leased through trusts whose sole purpose is to

purchase, finance and lease these aircraft to us; therefore, they meet the criteria of a variable interest

entity. However, since these are single owner trusts in which we do not participate, we are not at risk

for losses and are not considered the primary beneficiary. As a result, based on the current rules, we

are not required to consolidate any of these lessors or any other entities in applying FIN 46. Our

maximum exposure under these leases is the remaining lease payments, which are reflected in the

future minimum lease payments table in Note 3.

57