JetBlue Airlines 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

December 31, 2003

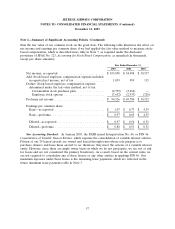

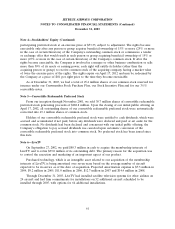

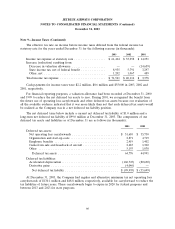

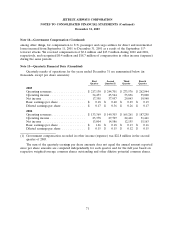

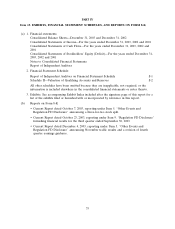

Note 8—Earnings Per Share

The following table shows how we computed basic and diluted earnings per common share for the

years ended December 31 (in thousands, except share data):

2003 2002 2001

Numerator:

Net income applicable to common stockholders for

basic earnings per share ..................... $ 103,898 $ 48,953 $ 21,567

Effect of dilutive securities—preferred stock dividends — 5,955 16,970

Net income applicable to common stockholder after

assumed conversion for diluted earnings per share . . $ 103,898 $ 54,908 $ 38,537

Denominator:

Weighted-average shares outstanding for basic

earnings per share ......................... 97,274,475 67,045,976 4,911,195

Effect of dilutive securities:

Convertible redeemable preferred stock ......... — 20,055,080 61,807,596

Unvested common stock .................... 1,333,408 3,096,878 4,882,671

Employee stock options ..................... 8,932,805 7,455,285 4,320,644

Adjusted weighted-average shares outstanding and

assumed conversions for diluted earnings per share . . 107,540,688 97,653,219 75,922,106

Shares issuable upon conversion of our 31⁄2% convertible notes are excluded from the diluted

earnings per share calculation for the year ended December 31, 2003 since the contingent conditions

for their conversion have not yet been met. Outstanding unvested common stock purchased by certain

of the Company’s management was subject to repurchase by the Company and therefore was not

included in the calculation of the weighted-average shares outstanding for basic earnings per share.

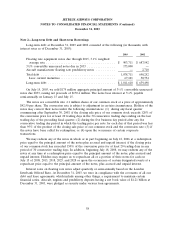

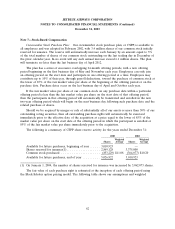

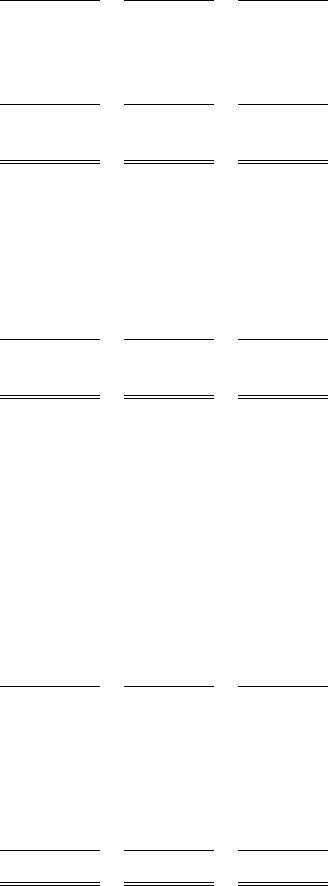

Note 9—Income Taxes

The provision for income taxes consisted of the following for the years ended December 31 (in

thousands):

2003 2002 2001

Current:

Federal ................................. $ 670 $ — $ 5

State .................................. 1,118 457 —

Deferred:

Federal ................................. 56,694 31,560 2,349

State .................................. 13,059 8,099 1,024

Income tax expense ......................... $ 71,541 $ 40,116 $ 3,378

65