JetBlue Airlines 2003 Annual Report Download - page 46

Download and view the complete annual report

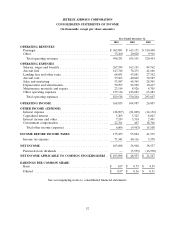

Please find page 46 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Although we have continued to experience significant revenue growth, this trend may not continue.

We expect our expenses to continue to increase significantly as we acquire additional aircraft, as our

fleet ages and as we expand the frequency of flights in existing markets and enter into new markets.

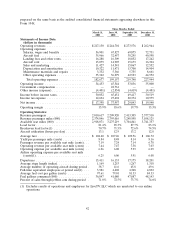

Accordingly, the comparison of the financial data for the quarterly periods presented may not be

meaningful. In addition, we expect our operating results to fluctuate significantly from quarter to

quarter in the future as a result of various factors, many of which are outside our control.

Consequently, we believe that quarter-to-quarter comparisons of our operating results may not

necessarily be meaningful and you should not rely on our results for any one quarter as an indication

of our future performance.

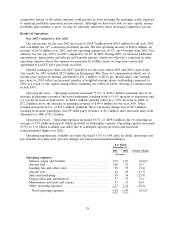

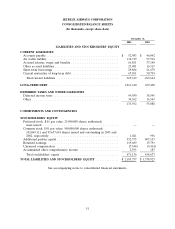

Liquidity and Capital Resources

At December 31, 2003, we had cash and cash equivalents of $570.7 million, compared to

$246.8 million at December 31, 2002. We presently have no lines of credit other than a short-term

borrowing facility for certain aircraft predelivery deposits. This facility allows for borrowings of up to

$34.0 million prior to November 2005, with $29.9 million outstanding at December 31, 2003.

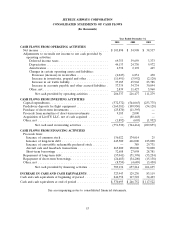

We rely primarily on cash flows from operations to provide working capital for current and future

operations. Cash flows from operating activities totaled $286.3 million in 2003, $216.5 million in 2002

and $111.3 million in 2001. The increase in operating cash flows in 2003 and 2002 was primarily due to

the growth of our business. Cash flows from operations during these periods were also impacted by the

receipt of government compensation, which was $19.6 million higher in 2003 compared to 2002 and

$12.7 million less in 2002 compared to 2001. Net cash from investing and financing activities was

$37.6 million in 2003. Net cash used in investing and financing activities was $87.2 million in 2002 and

$28.2 million in 2001.

Investing Activities. During 2003, capital expenditures related to our purchase of flight equipment

included expenditures of $509.6 million for 15 Airbus aircraft and one spare engine, $160.4 million for

predelivery deposits and $20.1 million for spare part purchases. Capital expenditures for other property

and equipment, including ground equipment purchases and facilities improvements, were $42.9 million.

During 2002, capital expenditures related to our purchase of flight equipment included

expenditures of $490.9 million for 16 Airbus aircraft and two spare engines, $110.0 million for

predelivery deposits and $26.0 million for spare part purchases. Capital expenditures for other property

and equipment, including ground equipment purchases and facilities improvements, were $24.1 million

and for all other assets were $3.0 million. Investing activities also included the acquisition of LiveTV

for $80.5 million on September 27, 2002.

Financing Activities. Financing activities during 2003 consisted primarily of (1) the public offering

of 4,485,000 shares of our common stock at $28.33 per share, raising net proceeds of $122.5 million,

(2) our issuance of $175 million of 31⁄2% convertible notes due 2033, raising net proceeds of

$170.4 million, (3) the sale and leaseback over 20 years of seven aircraft for $265.2 million with a U.S.

leasing institution, (4) the incurrence of $270.5 million of 10- to 12- year floating rate equipment notes

issued to various European banks secured by eight aircraft, (5) net short-term borrowings of

$8.2 million, and (6) the repayment of $57.0 million of debt. Net proceeds from our equity and notes

offerings are being used to fund working capital and capital expenditures, including capital expenditures

related to the purchase of aircraft and construction of facilities on or near airports.

On October 7, 2003, we filed a registration statement on Form S-3 with the SEC which, when

effective, will permit us to offer up to $750 million aggregate amount of common stock, preferred

stock, debt securities and/or pass through certificates. This registration statement is not yet effective

and we have not issued nor offered any securities related to it. Once declared effective, we plan to

finance our remaining 2004 aircraft deliveries with enhanced equipment trust certificates to be issued

under this shelf registration statement.

43