JetBlue Airlines 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Overview

We are a low-fare, low-cost passenger airline that provides high-quality customer service primarily

on point-to-point routes. We offer our customers a differentiated product, with new aircraft, low fares,

leather seats, free LiveTV (a direct 24-channel satellite TV service) at every seat, pre-assigned seating

and reliable performance.

We were incorporated on August 24, 1998 and we launched our flying operations on February 11,

2000 with two aircraft providing scheduled passenger service between New York’s John F. Kennedy

International Airport, or JFK, and Fort Lauderdale, Florida. Through consistent and controlled growth,

as of December 31, 2003, we operated 222 flights a day with a fleet of 53 single-class Airbus A320

aircraft serving 21 cities throughout the United States and Puerto Rico. On September 27, 2002, we

purchased the membership interests of LiveTV, LLC in order to control the execution and marketing of

an important aspect of our product.

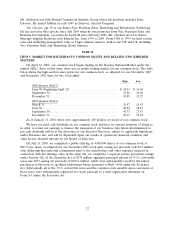

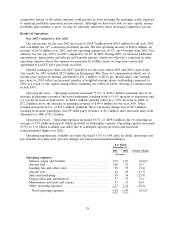

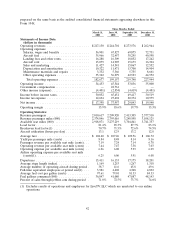

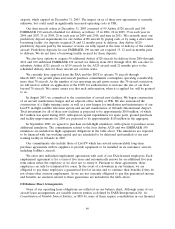

The following chart demonstrates our growth:

Number of

Full and Part- Operating Aircraft

Time

At Period Ended Cities Served Employees Owned Leased Total

December 31, 2000 ......................... 12 1,174 4 6 10

December 31, 2001 ......................... 18 2,361 9 12 21

December 31, 2002 ......................... 20 4,011 21 16 37

March 31, 2003 ............................ 20 4,386 21 20 41

June 30, 2003 ............................. 22 4,764 22 22 44

September 30, 2003 ......................... 22 5,104 25 22 47

December 31, 2003 ......................... 21 5,433 29 24 53

We expect to continue to grow. As of December 31, 2003, our firm aircraft orders consisted of 99

Airbus A320 aircraft and 100 EMBRAER 190 aircraft, plus options for an additional 50 Airbus A320

aircraft and 100 EMBRAER 190 aircraft. Our growth strategy involves increasing the frequency of

flights on our existing routes and entering attractive new markets. During 2003, we initiated service to

San Diego, CA and increased the frequency of service to 13 of our existing markets. In January 2004,

we introduced service from Boston’s Logan International Airport to Fort Lauderdale, Orlando and

Tampa, FL, Long Beach, CA and Denver, CO.

We derive our revenue primarily from transporting passengers on our aircraft. Passenger revenue

was 97% of our operating revenues for the year ended December 31, 2003. Because all of our fares are

nonrefundable, revenue is recognized either when the transportation is provided or after the ticket or

customer credit expires. We measure capacity in terms of available seat miles, which represents the

number of seats available for passengers multiplied by the number of miles the seats are flown. Yield,

or the average amount one passenger pays to fly one mile, is calculated by dividing passenger revenue

by revenue passenger miles.

We strive to increase passenger revenue primarily by increasing our load factor, which is the

percentage of aircraft seating capacity that is actually utilized. Based on published fares at our time of

entry, our advance purchase fares are often 30-40% below those existing in markets prior to our entry,

while our ‘‘walk-up’’ fares are generally 60-70% below major U.S. airlines’ unrestricted ‘‘full coach’’

fares. Our low fares are designed to stimulate demand, particularly from fare-conscious leisure and

business travelers who might otherwise have used alternate forms of transportation or would not have

traveled at all.

36